Why You Can Trust CNET

Why You Can Trust CNET New FCC Broadband Maps Are Out. Here's What the Data Shows

The FCC data isn't perfect, but it's a good indicator of where internet providers offer service and what technologies they use.

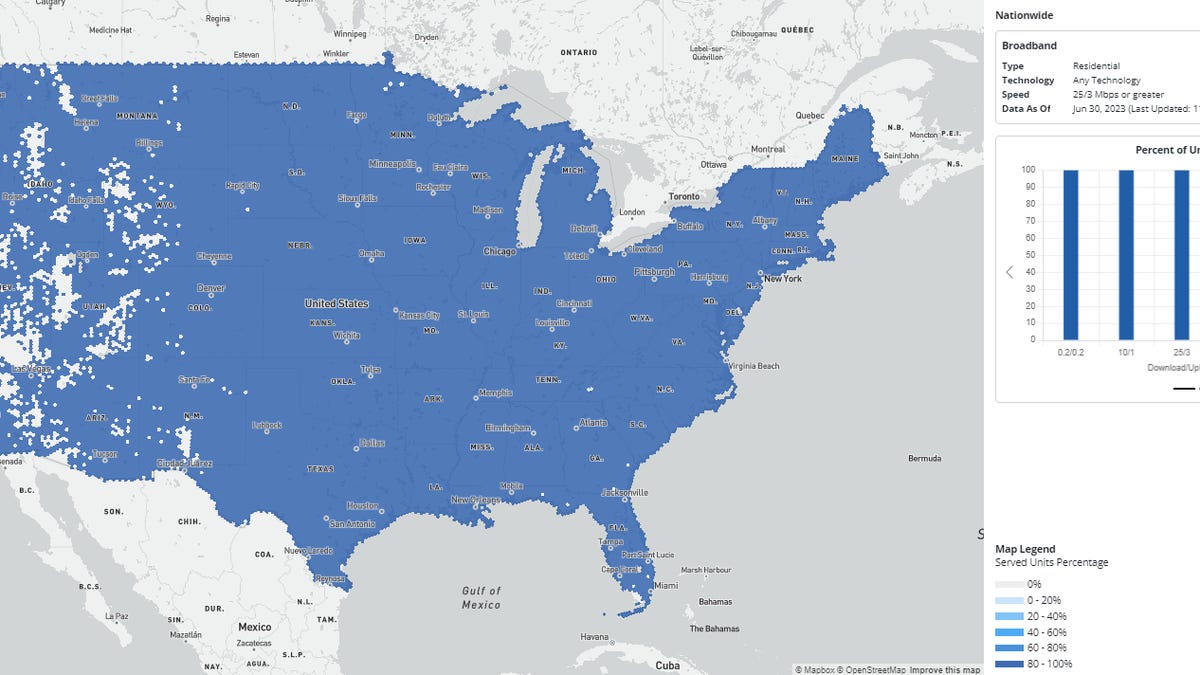

The latest FCC data shows broadband internet is available nationwide, but many still lack access to wired high-speed connections.

Twice a year, the Federal Communications Commission releases updated data on the coverage of every internet provider in the US. That includes coverage maps as well as metrics on the types of technologies being used, the percentage of households that fall into each provider's footprint and insight into the speeds available to those customers, should they choose to sign up. The most recent update went live in mid November 2023 and brings the database up to date with the latest info as of June 2023.

In spite of some notorious shortcomings, the FCC data is of particular interest to us on the CNET Home team. It's often the starting point when evaluating the best internet providers in a particular area, like my hometown of Charlotte, North Carolina, and when we're researching ISPs to create in-depth reviews.

To that end, here's a quick rundown of the major takeaways from the FCC's latest update, and what they tell us about the current state of broadband in America.

Locating local internet providers

Broadband is available everywhere, sort of

Download speeds of 25Mbps and upload speeds of 3Mbps or higher -- the minimum speeds required to qualify as broadband -- are available to 99.99% of US households, according to the recent FCC data. That doesn’t mean we’ve closed the broadband divide, however.

Satellite internet, from HughesNet, Viasat and now Starlink, skews the data a bit as each provider is available virtually everywhere in the US and offers download speeds of 25Mbps or higher (though not by much), in most service areas.

Locating local internet providers

When you take satellite internet out of the equation, broadband internet is available to only around 94% of US households. That includes wired (cable, DSL, fiber) and wireless internet connections like T-Mobile Home Internet and Verizon 5G Home Internet. Narrowing the scope further to include only cable and fiber service -- the best connection types for fast speeds and plan variety -- further drops the broadband availability to 87%.

Xfinity is available to more homes nationwide than any other wired internet provider.

Xfinity is the largest wired provider nationwide

Available to nearly 35% of US households, Xfinity is the country’s largest wired internet service provider. Much of that coverage is over a cable internet network, though Xfinity does have a small but growing fiber presence in select areas.

Verizon surpassed AT&T in June 2023 as the second largest internet provider in the US. The growth is likely due in part to its relatively new fixed wireless internet service, which can allow for rapid expansion without the costs or hassles of running cable or fiber wires to the home.

T-Mobile Home Internet has arguably made the most out of the flexibility of fixed wireless internet, however, and is now available to approximately 70% of US residences. That’s more than double Xfinity’s availability percentage, and it's the highest of any non-satellite internet service provider nationwide.

Other providers, including Cox Communications, WideOpenWest (aka WOW) and Mediacom, all saw incremental gains while availability of Lumen Technologies (CenturyLink, Quantum Fiber) dropped sharply, reflecting a recent sale of networks in the East.

FCC data indicates fiber expansion continues, but more than half of US residences are still ineligible for fiber internet service.

Fiber internet still has room to grow

With gigabit speeds that far surpass most other internet technologies -- Ziply Fiber, for example, recently released a 50-gig plan -- as well as upload speeds that are just as fast as they are for downloads, fiber-optic internet (fiber, for short) is widely considered to be the ideal mode of connecting to the web. The problem is that it isn't available everywhere -- for the most part, providers have focused on building out fiber networks in population-dense regions around America's major cities, leaving rural internet customers out of the mix.

The recent FCC data shows that fiber internet is only available to around 40% of households in the US. That's up 4% year over year, indicating continued growth in fiber expansion from providers like Google Fiber, but fiber is still the least available internet technology nationwide.

Your best shot of landing a fiber internet connection is in Rhode Island, where fiber internet is available to more than three quarters of the state thanks to major ISPs including Verizon Fios and Cox. Other states that stood out for exceptionally high fiber coverage include New York (60%), North Dakota (61%) and Connecticut (56%). Alaska had the lowest fiber availability at just over 8% of the state's households, followed by Arizona and New Mexico, each with around 15% coverage.

For too long the FCC has not had truly accurate broadband maps. But we're changing that. Starting right here and now. This is the first-of-its-kind wireless coverage map the agency has produced. And we're just getting started. More to come.https://t.co/FhgddIgRfh

— Jessica Rosenworcel (@JRosenworcel) August 6, 2021

Wireless internet coverage declines, but speeds increase

FCC data from December 2020 saw the debut of new coverage maps for mobile carriers. FCC Chairwoman Jessica Rosenworcel called the tool a "first-of-its-kind wireless coverage map" for the agency, and while the data was limited to 4G LTE voice and data service from just four carriers, Rosenworcel promised that more was to come.

Since then, we've kept track of the major players in the fixed wireless internet space and noticed that, despite expansion from providers like T-Mobile and Verizon, coverage dropped by 3% from June 2022 to June 2023. Speeds increased, however, as 39% of US households are now eligible for fixed wireless download speeds of 100Mbps or higher, compared with just 25% a year ago.

Overall, nationwide fixed wireless coverage sits just above 60% and largely includes suburban and rural areas, offering additional options for broadband where the choices are often scarce. A number of carriers, including T-Mobile, Verizon and AT&T already offer both 5G and 4G LTE home internet service in select cities, and with some plans, the upload speeds can be faster than what you'd get with cable.

Along with our broader focus on broadband, expect us to keep an eye on those new cellular home internet options as they continue to roll out (and expect us to test them out as soon as we're able, as we've already done with T-Mobile). With services like those already up and running in select regions, it's a safe bet that we'll learn more about them in future FCC database releases, as well.