PayAnywhere is like Square, but more so

PayAnywhere is taking swipes at Square's credit card reader with a strong offering of its own and national distribution.

NEW ORLEANS--If a new player in mobile payment has its way, PayAnywhere will soon be everywhere.

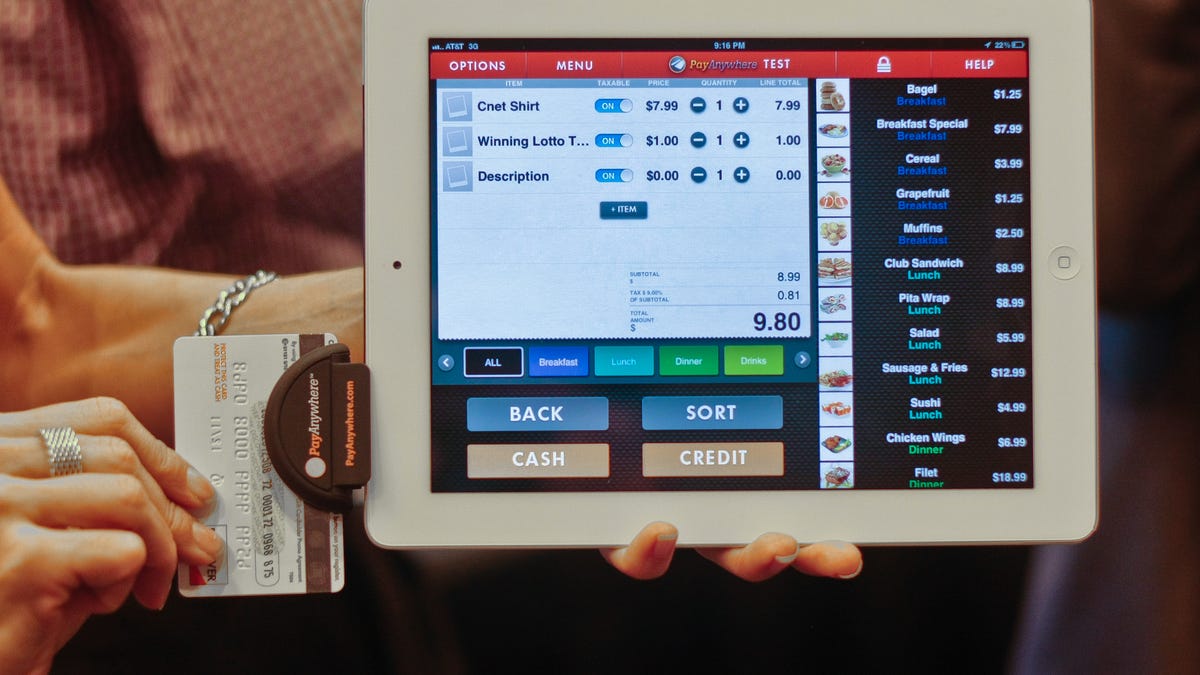

If you've heard of Square, then you pretty much already know everything you need to about PayAnywhere's point-of-sale product for mobile devices, which I saw for the first time at CTIA. The service consists of three parts: a credit card reader you can attach to a mobile device, a mobile app interface for customers and for merchants to manage, and a processing platform to tie it all together and offer analytics.

There are a few differences with Square's headset jack-plug-in cube of a card reader. Physically, it's longer and looks more secure, with a little plastic bumper to keep from slipping off the side of the demo tablet.

The transaction fee is also lower to attract more merchants (like my Square-toting driver in New Orleans) -- 2.69 percent per transaction rather than Square's 2.75 percent. It also offers 24-hour customer support, an agent to assist each merchant, and a set of analytical tools.

It also costs the merchant $10, which they'll receive back as a credit after clearing their first $150 in sales. At the show, PayAnywhere announced that it'll soon start selling the card reader from retailers.The company has a 20-year history processing credit card payments.

If you're not a merchant and don't intend to become one, you'll be happy to know that as a customer, you'll get your receipts e-mailed to you, and that your sensitive information won't be stored on the Android, iOS, or BlackBerry device.

Catch all the latest news from CTIA 2012.