MediaTek's new chipsets pack in features for high-end phones -- but not faster 5G

The Dimensity 1100 and 1200 will first arrive in China in handsets made by Realme, Vivo, Oppo and Xiaomi.

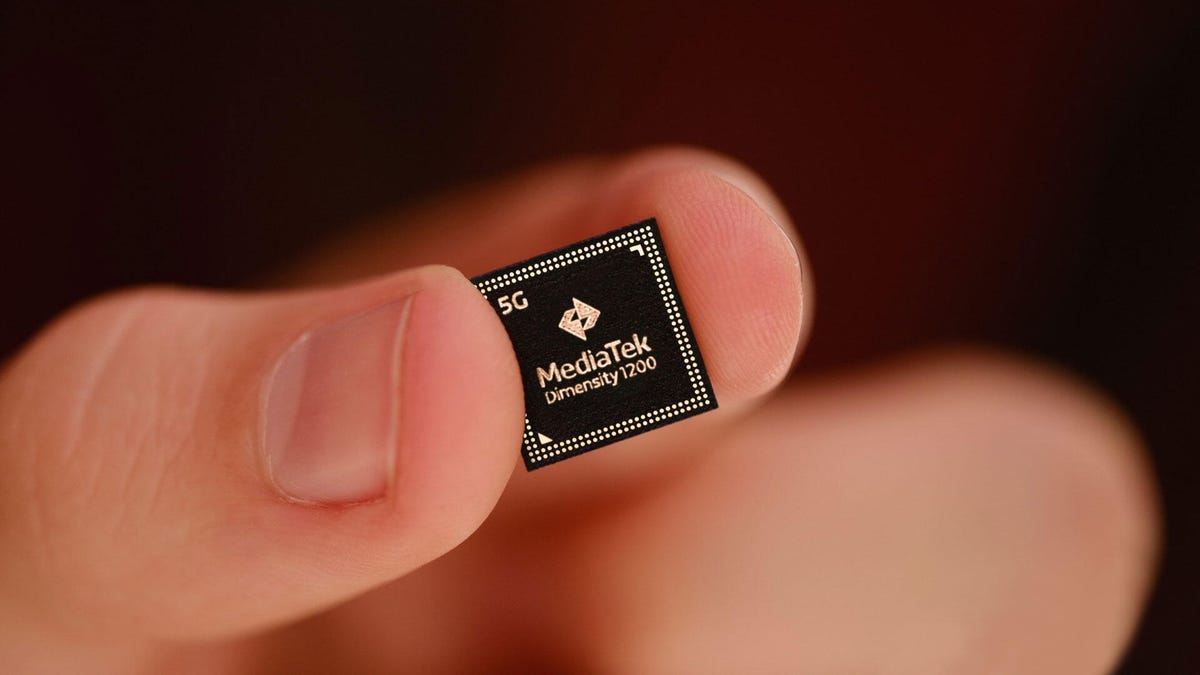

MediaTek's new Dimensity 1200 and Dimensity 1100 5G chipsets will power phones from Xiaomi, Oppo, Vivo, Realme and others.

A week after Qualomm's latest high-end 5G processor arrived in Samsung's new Galaxy S21 lineup, rival MediaTek unveiled new chipsets of its own: the Dimensity 1200 and Dimensity 1100. The new processors from the Taiwanese chipmaker bring improved AI, camera and multimedia capabilities but lack super-fast 5G found in chipsets from Qualcomm and Samsung.

The new Dimensity chipsets are built using TSMC's 6-nanometer technology, versus 7-nanometer for last year's Dimensity 1000. And MediaTek took advantage of Arm's latest A78 core technology. Together, those advances make the Dimensity 1200 22% more powerful and 25% more battery efficient than last year's chipset.

There's also a 13% performance boost for for AI-related tasks like using portrait mode for multiple people in a shot or enabling panorama photos at night. And MediaTek has amped up its gaming features, like adding support for faster refresh displays.

The first phones using the Dimensity 1100 and 1200 will hit the market late in the first quarter. Already Chinese handset vendor Realme said it will be one of the first companies to release a smartphone with the Dimensity 1200. Xiaomi , Vivo and Oppo also have said they'll use the new chipsets.

"The first wave of launches will likely come from China," Finbarr Moynihan, general manager of sales for MediaTek, said in an interview ahead of the news. "That's probably where there's the wider range of 5G devices, and ... the launch time-to-market tends to be quicker."

There are really only four companies in the world making 5G chips: Qualcomm, MediaTek, Samsung and Huawei. Samsung and Huawei largely only use their 5G chips in their own devices. Qualcomm supplied 5G modems for the vast majority of high-end phones last year, including Apple's iPhone 12 lineup. MediaTek, for its part, has predominantly provided modems to Asian handset makers, something that helped it become the world's biggest smartphone chipset vendor for the first time ever in the third quarter, according to Counterpoint Research.

"MediaTek's strong performance in the $100-$250 price band and growth in key regions like China and India helped it become the biggest smartphone chipset vendor," the firm said. But Qualcomm still sold more 5G processors than any other company, Counterpoint added.

China's surge

The coronavirus pandemic raised doubts early last year about how widespread 5G would become in 2020. Instead of slowing down 5G, the pandemic in some ways made it easier for carriers to expand their networks faster. In China, the government made 5G's rollout a priority, which helped China drive the global expansion of 5G in 2020. Out of last year's estimated 200 million 5G subscriptions, 175 million were expected to come from China, networking giant Ericsson said in November.

While MediaTek has benefited from soaring phone sales in China, it sees the shift to 5G as a way to break into the US handset market. In August, LG's $600 Velvet became the first smartphone to use MediaTek's processor -- the Dimensity 1000c -- in the US. This year, most phones in the US that use MediaTek chips will be lower priced devices, not flagships like those from Samsung, Moynihan said.

"The expansion of MediaTek in the US in the first half of 2021 is more likely coming from the Dimensity 800 and 700 device platforms," he said. MediaTek introduced the Dimensity 800 a year ago to bring flagship features, power and performance to midrange smartphones. And the Dimensity 700, unveiled in November, will enable 5G phones that cost less than $250 and address an important market: prepaid smartphones in the US.

Phones with the Dimensity 700 or 800 will enable "an expansion ... into the lower price points and broader based access to 5G," Moynihan said.

Still no mmWave

While MediaTek's new Dimensity 1100 and 1200 include features for higher end phones, they're lacking a key characteristic required for Verizon in the US: support for ultra-fast millimeter-wave 5G connectivity. The Dimensity 1100 and 1200 use the same modem as last year's Dimensity 1000, the Helio M70. That modem, unveiled in 2018, enables download speeds of up to 4.7 Gbps.

Qualcomm's Snapdragon 888, with its X60 modem, is capable of downloading data at up to 7.5 Gbps, thanks to its mmWave technology. And Samsung's Exynos 2100, unveiled last week, can handle maximum download speeds of 5.1Gbps over lower-band 5G and download speeds of up to 7.35Gbps over mmWave.

For most of MediaTek's markets, the absence of mmWave doesn't matter. The technology is super fast but can only travel short distances, and it has largely only been installed in dense parts of cities. Instead, China, T-Mobile and most carriers around the world instead have rolled out sub-6Ghz 5G, which doesn't go as fast but is more reliable.

MediaTek has said it's working on bringing mmWave connectivity to customers, and it plans to start giving handset makers samples of mmWave processors this year. mmWave is "clearly an important technology, clearly something we're focused on bringing into the portfolio, but it's going to be more like a sampling in 2021 situation," Moynihan said.

Lack of mmWave in phones available this year could limit MediaTek's opportunities in the US market and some other regions around the world. The only carrier that's largely focusing on lower band 5G is T-Mobile, and Verizon won't sell phones on its network unless they connect to mmWave.

"Using the company's M70 modem means that these chipsets do not yet come packed with mmWave, which may limit device acceptance in other major global markets in the short term, notably the US and Japan," ABI Research analyst David McQueen said.

But MediaTek's ability to combine different types of 5G together to get faster speeds could be attractive to T-Mobile and handset makers that want a second supplier for phone chipsets. It wasn't until the Snapdragon 888 with X60 modem, shipping in phones this year, that Qualcomm's chipsets had the capability of aggregating 5G airwaves. Companies designing lower priced phones specifically for T-Mobile may seek out MediaTek's new chipsets.

With the new Dimensity 1100 and 1200, MediaTek is "hoping to go to the upper-end of the midtier, which we have started to see grow in the US and is increasingly important in other markets around the world," Technalysis Research analyst Bob O'Donnell said. "We could see them start to show up in more US-focused phones in the $500 and less segment, particular on T-Mobile."

Still, MediaTek's chips may power a significant number of Chinese handsets this year -- and even make their way into cheaper US phones -- it's likely that most high-end smartphones in the US and other markets will continue to use Qualcomm's processors.

"The new MediaTek chips primarily improve on the compute, graphics and image processing side and get them closer to Qualcomm and [Samsung's] Exynos but not to the latest top-tier chips from those companies," O'Donnell said.