Apple Pay Later Makes Its Debut in the US

The "buy now, pay later" service is available to a limited number of people to start, but Apple says it'll roll out more widely in the coming months.

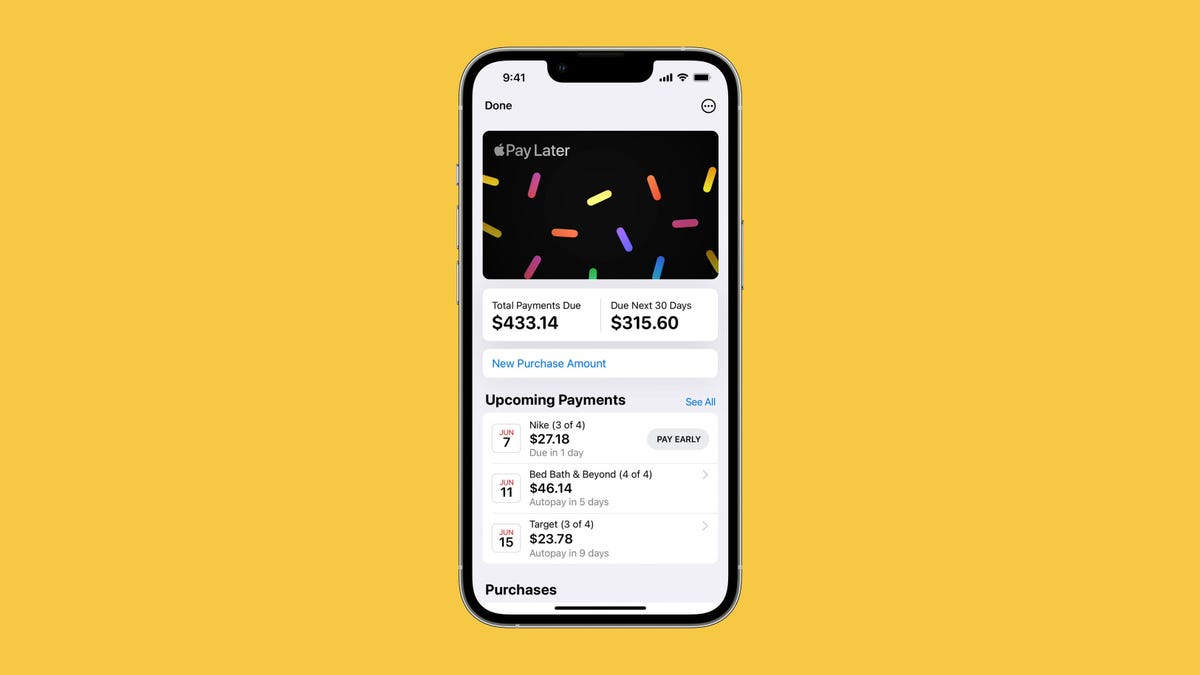

Apple Pay Later will let you spread the cost of a purchase over four payments.

Apple Pay Later, the tech giant's entry into "buy now, pay later" services, is launching in the US starting Tuesday, but only for a limited number of people for now. The service will let iPhone users split Apple Pay purchases into four equal payments spread over six weeks.

Apple Pay Later will be available within Wallet, the iPhone's digital wallet app, alongside other payments features, like Apple Card and Apple Cash. Apple said people will be able to apply for Apple Pay Later loans of $50 to $1,000, which can then be used for online and in-app purchases made on an iPhone or iPad. People can then track and manage Apple Pay Later loans in the Wallet app, and they'll receive notifications and email before their next payment is due.

"Apple Pay Later was designed with our users' financial health in mind, so it has no fees and no interest, and can be used and managed within Wallet, making it easier for consumers to make informed and responsible borrowing decisions," said Jennifer Bailey, Apple's vice president of Apple Pay and Apple Wallet, in a release.

Apple announced Apple Pay Later almost a year ago at its 2022 Worldwide Developers Conference in June, saying it would be available in iOS 16. Though not included in the initial release of iOS 16, the payments feature is available to some people as part of iOS 16.4 and iPadOS 16.4, which came out Monday.

Buy now, pay later services, or BNPL, have grown in popularity in recent years, with people spending $120 billion through these plans in 2021, according to GlobalData. Companies including PayPal, Amazon, Affirm, Klarna and Afterpay offer BNPL options, as do some credit card providers. Though BNPL plans offer flexibility, some financial experts have warned the services also come with risks, including making it easier for people to overspend and accumulate debt.

Apple said "randomly selected users" will get an email invite to try a prerelease version of Apple Pay Later via the Wallet app starting Tuesday. Apple will offer the service to all eligible users "in the coming months," the company said. People must be 18 years of age or older to use Apple Pay Later, and they need to have Apple Pay set up with a debit card.

Apple didn't immediately respond to a request for additional comment.