Will 350,000 people file taxes on smartphones?

Around 350,000 iPhone and Android smartphone users have downloaded Intuit's SnapTax app to file simple returns, according to All Things Digital.

Intuit's SnapTax app for Apple's iPhone and Android-based smartphones has been downloaded 350,000 times since its launch last month, Intuit executives have told All Things Digital.

All Things Digital's Ina Fried reported today that so far, it has seen more than twice as many downloads on the iPhone than on Android-based devices.

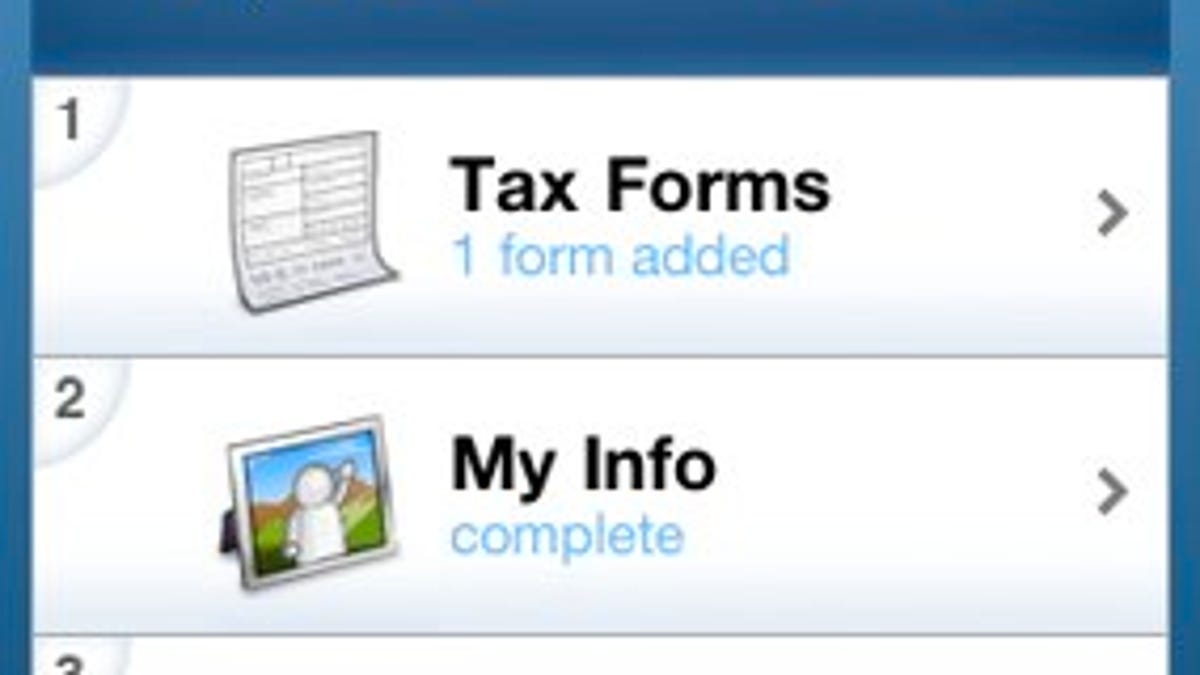

SnapTax is designed for simple tax returns that include little more than a W-2 wage statement. After downloading the free app, users need only to snap a picture of their W-2 from their smartphone, and the program will automatically input that information into the user's return. The data is also encrypted to ensure it's kept secure from others. After inputting their personal information and reviewing the return, users can then file it with the Internal Revenue Service for $14.99.

Actually paying that fee is somewhat difficult on an Android smartphone. Users must first download the free version of the program and then when they're ready to file, they have to dole out the $14.99 for the paid version of the app. The iPhone offering requires users to pay through an in-app payment system.

Even with 350,000 downloads, there's no telling if all those people will actually file their taxes with the app. In fact, Intuit told All Things Digital that it was "surprised" that people would want to file their taxes with a smartphone, given that sensitive data is included in returns. But after performing its research, the company found that younger taxpayers aren't especially worried about that.

For those with security concerns or with more sophisticated returns, hiring a tax preparer or using a software program is still the go-to way to pay Uncle Sam.