Facebook Gifts: Important but not about the money (just yet)

Sure, sending gifts via Facebook could eventually become a $1 billion business. But for now, it's key in other ways vital to the social network's future.

When Facebook added a slew of retail partners to its Gifts product last week -- complete with a splashy party at FAO Schwartz in New York -- some observers got excited about the social network's ongoing march into e-commerce, even claiming (incorrectly, I would argue) that this helped push the stock up more than 6 percent on Friday.

Not so fast.

Facebook's decision allowing users to buy and send physical gifts is a shrewd move that could potentially grow into a $1 billion business (more on that in a moment). For now, however, the play seems less about boosting the bottom line and more about helping Facebook's broader goals -- namely, keeping people on Facebook a whole lot longer and getting more out of them.

Facebook wants to be the Internet

The raw numbers are astounding: Facebook has more than 1 billion monthly users. But what's most important is how much time those same users stay on Facebook. Indeed, during an interview at the Techonomy conference, product manager Sam Lessin stressed that engagement has "never been higher globally." But when asked whether that was true among U.S. users, he dodged the question. "It's true globally," Lessin said.

Adding Gifts, which is for now available for U.S. users only, is one more way to keep people from bolting. If you see it's a friend's birthday or that a friend got engaged, why not let people send the gift without leaving Facebook's walls? "Facebook's overarching goal is to keep you there," said Michael Pachter, an analyst with Wedbush Securities. "I don't think their goal is to profit from this business. They just don't want me leaving the site." Eventually, he said, talking about a decade out, "They want to be the destination for everything."

It's still about the ads, which means your data

Facebook's on track to report more than $5 billion in revenue for 2012, but the vast majority (roughly 85 percent) of that will come from ads. And that's unlikely to change anytime soon, even as Wall Street would love to see a more diverse revenue stream. But here, too, Pachter suggests that Gifts helps. When you buy your friend a gift, you're giving Facebook information about yourself and your friend. Suddenly, the person who received a subscription to Bon Appetit could see cooking-related ads. It's all part of Facebook's effort to sell the most targeted ads on the Internet -- for now that means on Facebook, but potentially it could extend across sites everywhere on the Internet.

Credit card, please

To date, the main way Facebook has gotten its users' credit cards on files has been from people who play games by Zynga and others and buy virtual goods. How many credit cards does Facebook have? It hasn't said, but Pachter figures it's about 10 million to 15 million. As people buy gifts on Facebook, he expects that will double over the next year or so.

Getting your credit card on file is a big deal, especially as more and more Facebook users bypass the desktop in favor of mobile. Gifts, for instance, grew out of Facebook's acquisition of Karma, a mobile social gifting company. While it's easy to imagine people sending a gift through Facebook from their mobile phone, it's also easy to imagine a lot of people giving up when it comes time to enter their credit card numbers. Ultimately, Facebook needs an Amazon one-click type experience.

More broadly, having people's credit cards (plus their email addresses) opens up a world of opportunities, potentially helping Facebook take on iTunes and Google Play by adding the power of social. "If I see a friend is listening to a song on Spotify," said Pachter, "I should be able to listen to that song and hit purchase."

It goes beyond songs, of course, so long as Facebook has your credit card on file. Think of it this way: Impulse purchases add up when you have a billion users.

So how big could Gifts get?

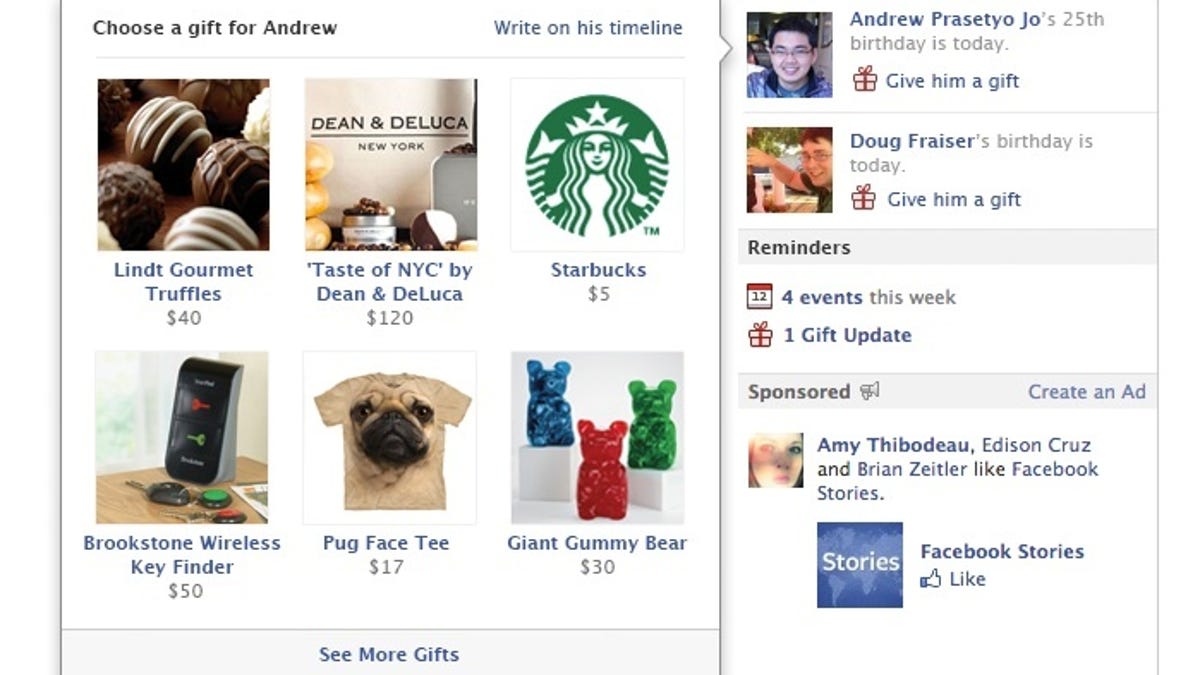

When you buy a gift from one of Facebook's more than 100 partners -- including BabyGap, Brookstone, and Dean & Deluca -- Facebook acts as the middle man, although in a far deeper way than that term implies. Facebook has a team that works with each merchant and, using data from behavior on Facebook, decides which products will work best, said Lee Linden, the head of Facebook Gifts. So when Facebook suggests gifts for you to give a woman with kids in New York, the selections will be different than if it's for a single guy friend in Austin, Texas. "Over time, we'll get better and better at making recommendations," said Linden.

Facebook began rolling out Facebook Gifts in late September and so far, he said, the average gift sent is $25. Linden won't say what cut Facebook is taking, although it varies with each partner.

In short, Facebook Gifts is far more complex than, say, an affiliate program that simply directs customers to a merchant. For now, Linden is only saying that the Gift service is available for "tens of millions of users" in the U.S., and that he's working to bring it to more in the coming weeks. (You'd think the company would have aimed for all U.S. users for the holidays). After that, presumably, it goes global.

I did some back-of-the-envelop math with Pachter to make some guesses on the potential once it's fully rolled out to U.S. users. Let's say about 5 percent of the 170 million or so U.S. members send gifts that amount to $50 per use per year. That would add up to a run rate of about $450 million for its first full year -- a figure Pachter expects could more than double eventually by pushing out Gifts globally and beefing up the offerings, bringing it to close to a $1 billion run rate. Even so, he figures the margins aren't high -- probably around 15 percent on average, compared with margins of 70 percent for the ad business.

That's hardly terrible, of course. And Facebook needs revenue where it can get it, especially as the stock, which today closed just below $23, still trades far below its IPO price of $38. But the bigger value will likely come from all these other benefits that Facebook gets by having you shop, send Gifts and, above all, share.

Updated at 4:58 p.m. PT to include comments from Lee Linden, who runs Facebook Gifts.