Qualcomm, Amazon boost Intel plan to leapfrog chipmaking rivals by 2025

New CEO Pat Gelsinger says a "torrid" pace of innovation helped convince Amazon and Qualcomm to pay Intel to build future processors.

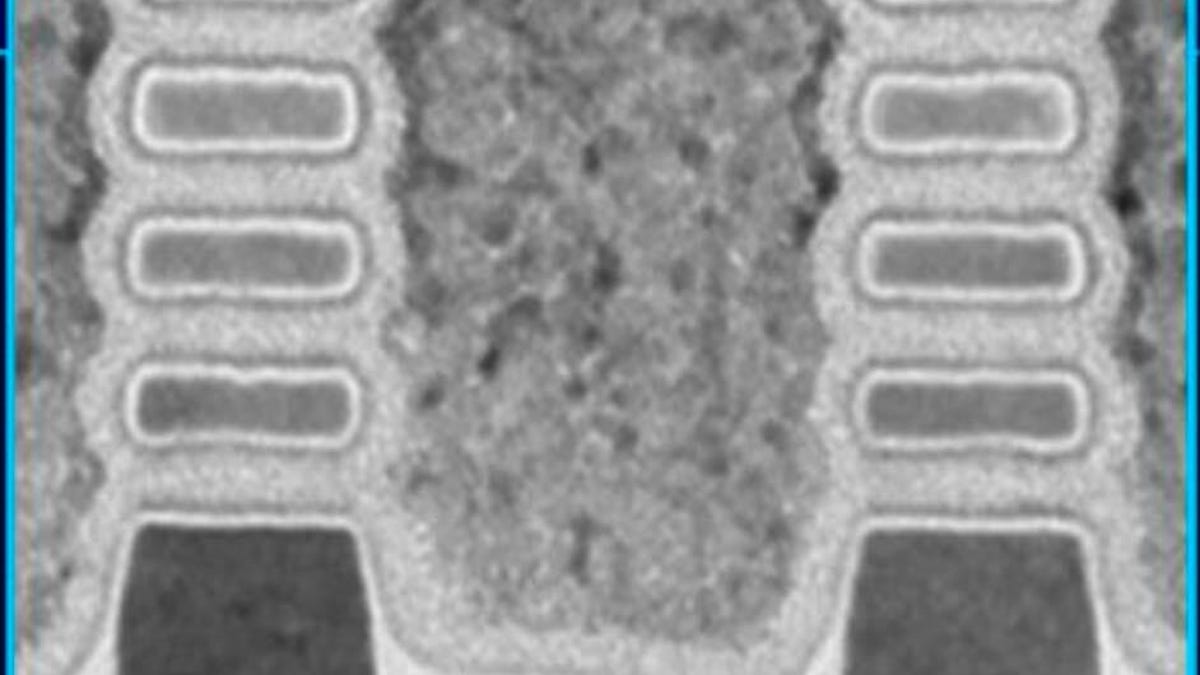

Intel's RibbonFET version of transistor "gate all around" technology could help the chipmaker catch up to competitors.

Intel unveiled on Tuesday a smorgasbord of new technologies designed to help it reclaim processor manufacturing leadership within four years. The plan bears the fingerprints of newly installed CEO Pat Gelsinger, who's pledged to restore the company's engineering leadership and credibility. Qualcomm and Amazon, whose processors rival Intel's, are now becoming Intel chipmaking customers.

Intel's technology developments include a new push to improve the power usage of Intel chips, a key element of battery life, while simultaneously raising chip performance. The technologies involve deep redesigns to how processors are constructed.

One technology, RibbonFET, fundamentally rewires the transistor circuitry at the heart of all processors. Another, PowerVia, reimagines how electrical power is delivered to those transistors. Last, Intel is updating its Foveros technology for packaging chip elements from different sources into dense stacks of computing horsepower.

If realized, Intel's commitments will mean faster laptops with longer battery life. The advancements could also boost technologies like artificial intelligence at cloud computing companies and speed up the services on mobile phone networks. The company made the announcements at an online press event.

"In 2025, we think we will regain that performance crown," Sanjay Natarajan, who rejoined Intel this year to lead the company's processor technology development, said in an interview.

Two companies, Amazon and Qualcomm, are convinced Intel's technology is worthwhile. They became the first customers to tap into Intel's new foundry business that builds chips for other companies. Intel didn't detail the plans, but it's notable that both companies design chips in the Arm processor family, a rival of Intel's x86 designs. In July, Intel said it's in discussions with 100 potential customers to use its manufacturing. (Another part of Gelsinger's recovery plan is for Intel to use rivals' chipmaking capabilities.)

Intel has struggled in recent years to move to more advanced manufacturing, delaying new PC and server chips. The company's difficulties created room for Taiwan Semiconductor Manufacturing Co. to take the lead. Apple picked the company to build the M1 processors that are replacing Intel chips in its Mac computers. TSMC also makes chips for other Intel rivals like Nvidia, Qualcomm and AMD.

Samsung too has benefited from Intel's trouble. The third major chipmaker, Samsung makes processors for its own electronics products, as well as for other companies.

Despite its struggles, Intel is still making lots of money. On July 22, it reported an $8.4 billion profit for the second quarter of the year on revenue of $19.6 billion. Under Gelsinger, Intel is investing more money in research and development to support its long-term future.

"This is the first time Intel really put it all together. I think that's a direct result of what Pat's bringing to the party," said VLSI Research analyst Dan Hutcheson. "He's putting the tech people back in the driver's seat."

New names for Intel manufacturing processes

Also on Monday, Intel said it has renamed each node -- the collection of technologies used to improve chips -- on its multiyear plan for manufacturing progress. The company has deemphasized the physical size of transistor features measured in nanometers, or billionths of a meter. The new labeling approach is in line with the terms in use at other chip foundries and should clarify Intel's plans, Hutcheson said.

Intel's process node name isn't changing for today's 10-nanometer process. But an improvement previously called Enhanced SuperFin is now called Intel 7. It'll mean a 10% to 15% improvement in performance per watt. Intel's 7nm process is now called Intel 4 should bring a 20% performance per watt gain with chips in 2023. Intel 3 will show up in late 2023 with another 18% gain; RibbonFET and PowerVia arrive in Intel 20A in 2024; and another performance boost should arrive in 2025 with the Intel 18A process.

"It becomes very clear Intel is going to be delivering a lot higher performance than the foundries" when the gains are combined, said Real World Technologies analyst David Kanter.

The moves contrast sharply with Intel's years of difficulty moving to the company's most advanced process. "We're in a great position to achieve unquestioned leadership for our customers," Gelsinger said at the event.

Intel plans four new manufacturing process improvements in five years. The numbers no longer are tied to physical measurements like nanometers, but the Intel 20A process is a nod to the angstrom -- a tenth of a nanometer.

Intel's new transistor technology

RibbonFET describes Intel's gate all around technology, which is designed to make next-generation chips possible. TSMC and Samsung have announced GAA technology, though it isn't in production. Intel hopes its use will make the company competitive in 2024.

In a transistor, a gate controls when electrical current flows through the component. These tiny current flows, orchestrated by the instructions that software delivers to a chip, determine how billions of interconnected transistors can process information. GAA helps ensure gates can still control transistors as chips get smaller.

Intel is pairing RibbonFET with PowerVia, a new way to distribute electrical power to transistors. In today's chips, separate tiny copper wires attach to the top of the chip to deliver power, as well as input data and to retrieve output data. With PowerVia, Intel connects power distribution wires to the bottom of the transistor instead.

The upshot, as with RibbonFET, is "better performance at the same power," or if you fiddle the knobs differently, the same performance with lower power consumption, Natarajan said.

Given Intel's recent missteps, analysts aren't convinced the gains are a sure bet. For one thing, it's hard to convert research and development technology into high-quality, large-scale processing.

But Intel is working hard to telegraph confidence. It's basing plans on today's measurements for defects, performance and reliability. It'll test PowerVia on the Intel 3 process to make sure it's ready for production on 20A, too. "We have put a concerted focus on schedule predictability," Natarajan said.

Packaging improvements

Also new are improvements to Intel's Foveros technology for stacking smaller chips into one larger processing element. Foveros debuted with a chip code named Lakefield for ultralight laptops. The next generation of the technology will appear in Meteor Lake, Intel's chip for mainstream PCs due in 2023.

Intel also detailed new Foveros developments. Foveros Omni and Foveros Direct, both due in 2023, provide new ways to stack chip elements and to send data signals and power through the stack.

Foveros means better flexibility not just for Intel, which will be able to incorporate chips from other companies into Foveros designs, but for future Intel foundry customers wanting to assemble their own processor packages, said Ann Kelleher, who leads Intel's process and packaging work.

One example of Foveros' flexibility advantage is that Intel could make some key chip elements with cutting-edge manufacturing lines but then use older and cheaper but adequate designs for other elements, like controlling chips' communications with computer memory, said Tirias Research analyst Kevin Krewell.

Kelleher also said Intel plans a Foveros successor using optical connections that send data as light. Such silicon photonics technology hasn't yet become mainstream for short data transfer distances, despite years of work, but it remains an active area of research for the benefits it could bring in high speed and low power.

"Pat is very focused on getting back to leadership and really supportive of engineering teams," Kelleher said, referring to Gelsinger. "Projects don't happen without people and dollars."