Bezos, Musk and other billionaires pay next to nothing in income taxes, report says

ProPublica got its hands on a trove of IRS documents.

Jeff Bezos paid no federal income taxes in 2007 and again in 2011, according to a report from ProPublica.

Most people know the ultrarich pay much less in taxes as a percentage of their wealth than the average working stiff, but a new report from ProPublica suggests the disparity may be greater than imagined.

Jeff Bezos , Mark Zuckerberg and Elon Musk , among other moguls, built their wealth into the high billions while paying almost nothing in federal taxes by structuring their pay to avoid income, the investigative site reported after it received a stash of IRS documents.

None of the activity was illegal, ProPublica said. The tax records, however, reveal how the super-rich minimize taxes, sometimes by taking out loans using their stock holdings as collateral. Wage earners, by comparison, live primarily off their paychecks, which are taxed as income.

The 25 richest people in the US amassed wealth of $1.1 trillion as of 2018, according to ProPublica's analysis of the tax records. It would have taken the wealth of 14.3 million average US wage earners to equal that amount, the publication said. Those wage earners would have paid an estimated $143 billion in taxes, 75 times as much as the $1.9 billion the 25 wealthiest Americans paid in 2018.

The analysis exposes highly personal and secret information on Bezos, Zuckerberg and Musk, as well as other well-known members of the richest ranks in the US, including George Soros and Warren Buffett. The tech CEOs didn't immediately respond to CNET's requests for comment, and didn't provide comment to ProPublica (though Musk reportedly responded to an initial inquiry with a sole "?").

Here's what we learned about major tech heads from the report:

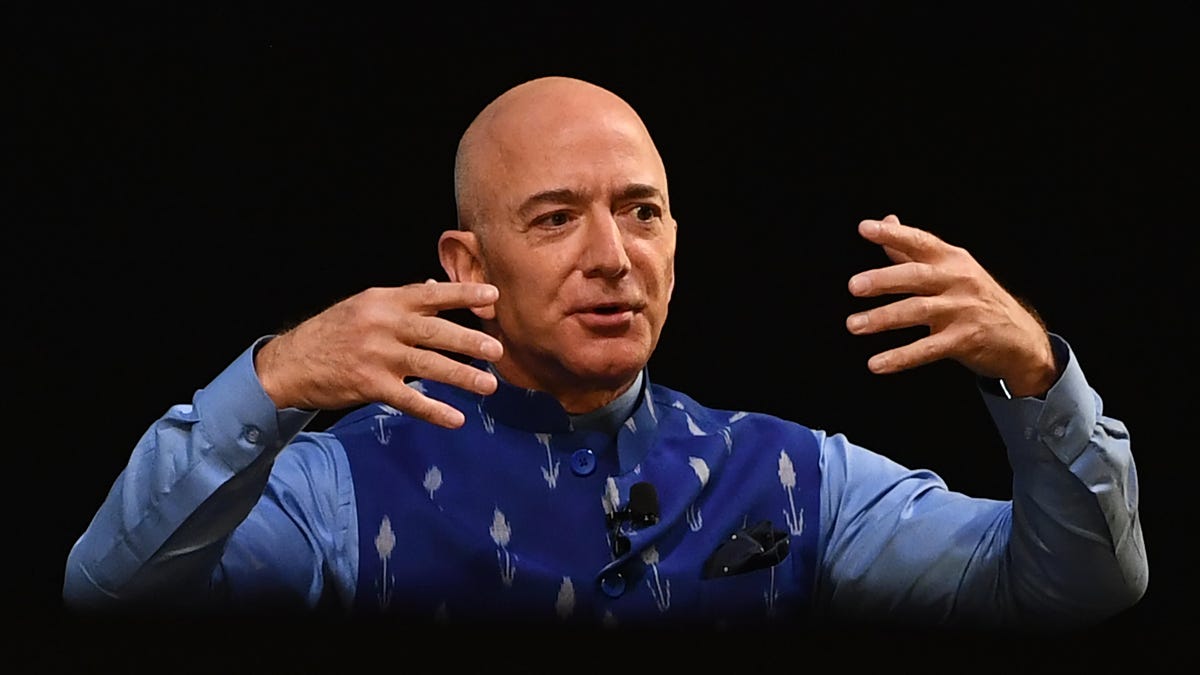

Jeff Bezos

The man who's currently the world's second richest person reportedly paid no federal income taxes for two separate years, 2007 and 2011. In 2007, Bezos' wealth grew by $3.8 billion according to numbers from Forbes, but he (legally) reported $46 million in income. He offset that income with losses on investments and tax deductions, resulting in zero dollars of taxable income, ProPublica said.

Between 2006 and 2018, Bezos' wealth reportedly grew by $127 billion, but his total reported income over that 13-year period was $6.5 billion, with a cumulative tax bill of $1.4 billion. That works out to a tax rate of about 21% on his reported income, or 1.1% on his total wealth.

According to ProPublica, average wage earners Bezos' age paid more in federal income taxes than the amount their average wealth grew during the same 13 years.

Amazon didn't respond to a request for comment.

Elon Musk

The world's third-richest man as of Tuesday morning reportedly paid no federal income tax in 2018, according to ProPublica. The news outlet also reported the Tesla CEO paid $68,000 in federal income tax in 2015 and $65,000 in 2017.

Elon Musk was among the 25 richest Americans who paid little in taxes in proportion to the growth of their wealth.

A graph that accompanies the story shows that Musk's wealth grew $13.9 billion in the five years from 2014 to 2018. He reported $1.52 billion in income and paid $455 million in taxes over the same period.

Musk has used Tesla shares as collateral for personal borrowing, a strategy employed by many wealthy people.

Musk doesn't accept direct messages through his Twitter account. Tesla didn't immediately respond to a request for comment.

How wealth goes untaxed

The federal government only taxes "income," which includes wages, dividends from stocks, interest from bonds and proceeds from the sale of financial instruments. The result is that when a billionaire holds stocks that skyrocket in value, that wealth won't be taxed in its own right.

Like Musk did, wealthy people can still extract value from company shares without selling them by using them as collateral for loans. Funds from loans aren't taxed because they have to be paid back.

Ultrarich investor Warren Buffett has said he believes tax law must be reformed, even though he makes use of current laws to keep his tax payments low relative to his wealth. Buffett has repeatedly called the current taxation system part of a "class war," and declared, "my class has won."