Why You Can Trust CNET

Why You Can Trust CNET Advertiser Disclosure

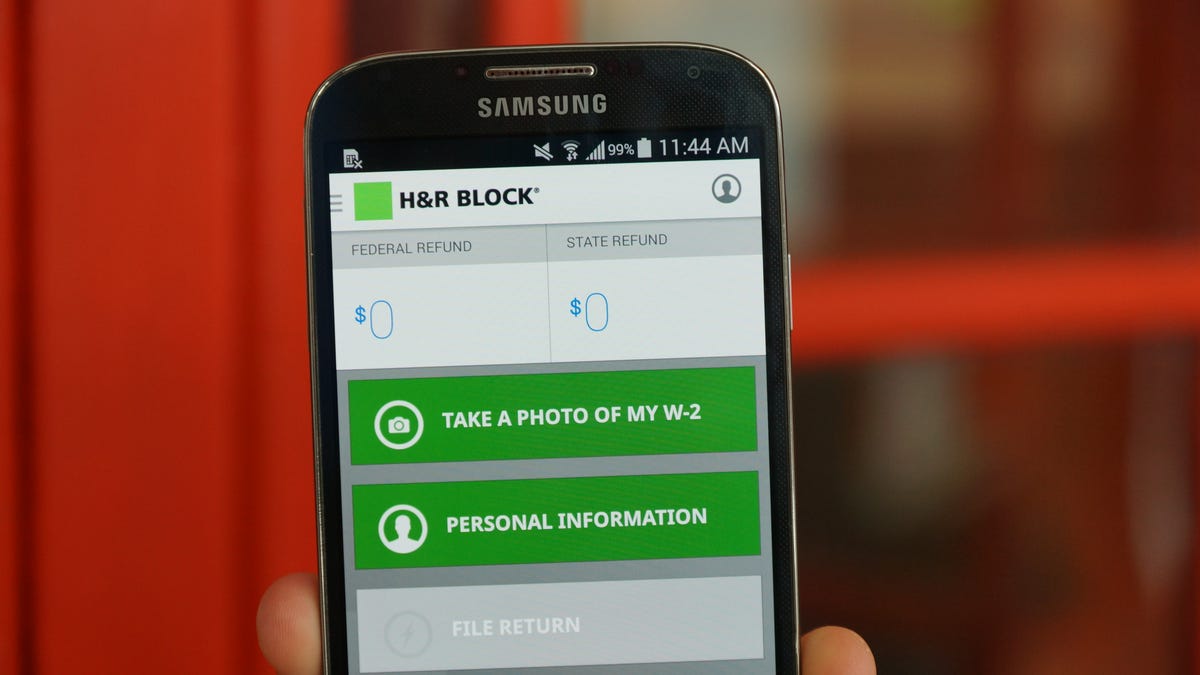

The Truth About Filing Your Taxes on a Phone or Tablet

Yes, you can conveniently file your taxes on a mobile device, but should you?

Income tax software made the leap to mobile phones years ago.

Nowadays you can use your phone for just about anything imaginable. So it shouldn't come as a surprise that people are filing their income taxes on their phones.

There's no need for pen and paper or even finding a computer to complete the duty most of us dread every year. Everything you'll need -- a camera to scan important tax documents, tax software apps like TurboTax and H&R Block, and video software for chatting with experts -- is easily found on your phone or tablet.

Here's everything you should consider before going mobile to complete your tax return in 2023. It doesn't matter if you are team Android or iOS, we'll help you weigh your options. Then if going mobile is a yes for you, we dive deeper into four tax apps that can help you maximize your tax refund and get it quicker.

You can start doing taxes on one device and continue on another.

Why should I do my taxes on my smartphone or tablet?

You might not be keen on doing taxes on your smartphone because it may seem difficult and tedious, but there are many reasons why it might be a great idea for you:

It's convenient. Not everyone has access to a computer, but most people own a smartphone -- whether it's an Android or iOS device. The most popular tax apps are available in both the Google Play Store and the Apple App Store, so filing taxes on your mobile device, especially a tablet, is incredibly convenient if you don't have a laptop or desktop.

It could be quicker. If you've used a tax app before, using it again can make the filing process quicker thanks to information previously saved. And if you take advantage of mobile features, such as document scanning with your camera, you could potentially fill out your taxes quicker on a phone or tablet than you would on a computer.

Live support is available on camera. If you have trouble with filling out any of the tax forms via app, you might have the option to do a video call or share your screen with a tax specialist (like an accountant or attorney) to get personalized advice. And if you're worried about them seeing your information -- they can't. They don't have access to your personal information unless you provide it to them.

Scammers and hackers could take advantage of you doing your taxes on your mobile device.

What's bad about doing my taxes on a mobile device?

There is a negative side to doing taxes on your mobile device.

It could be a major security issue. Most of these tax apps have a built-in feature that lets you scan your physical W-2 or other tax papers with your smartphone camera, to automatically import your information like your Social Security number, address and phone number. Unfortunately, this may save a photo in your camera roll, which is bad news if you forget to delete it and your phone is then lost or stolen. If anyone has access to your device, they could easily find photos with all your precious information and use them for malicious purposes.

It might be difficult to do, especially if your taxes are complicated. Did you invest in cryptocurrency this year? Did you buy a house? Do you own a business? If you answered yes to any of these questions, filing your taxes on your phone or tablet might not be the best idea, because working on your phone might get unwieldy when taxes get more complicated.

Features that are available on the computer might not be accessible on mobile. Many times when computer software is ported over to mobile, certain functions and settings get lost. It could be something as simple as a file size limit for uploads, which might make it more difficult to upload files to the tax app via your phone. Whatever it is, these missing features can make it more difficult to do your taxes on mobile.

If you do go mobile for your taxes in 2023, here are some of the best tax apps

TurboTax: TurboTax by Intuit is one of the most popular tax apps available for mobile devices. If you've used the online version on your computer, then the application is pretty much the same thing. First you'll be asked to answer several questions so that TurboTax has a better understanding of what your tax return will look like (dependents, deductions, credits and so on). Once that's finished, you can begin the free process of e-filing (you'll need to pay for more complicated returns) using any number of features -- such as document scanning, video calls with tax professionals, multidevice integration and previous year data transfer -- to make it all as seamless as possible.

H&R Block: The H&R Block Tax File and Prep app provides many of the same features as the other apps on this list. You scan documents with your camera, contact tax experts for help, use multiple devices to finish e-filing and enable security features such as two-factor authentication and Face ID/Touch ID sign-in options. Once you're ready to file, you can have a tax pro do a thorough review of your return and file on your behalf, or do it yourself. You can file for free if you have a simple tax return, but there are also paid options for more complex taxes (you pay only when you're ready to file).

TaxSlayer: TaxSlayer isn't a household name like the other two tax apps on this list, but there is one major reason to look into using it for e-filing on your smartphone this year -- the cost. Although it lacks some of the features that its competitors have, like scanning documents with your camera or receiving midyear tax check-ins, TaxSlayer offers good prices for more complicated tax returns that involve self-employment, investments, rental properties and more.

Cash App Taxes: If you've got Cash App on your phone already, you don't even need to install another app. Just tap the banking tab, and select "Free Tax Filing" in the Taxes section to get started. Formerly known as Credit Karma Tax, Cash App Taxes is free for both federal and state returns. It doesn't have all the help and support features of paid tax software, but it includes all of the major IRS forms and schedules that most taxpayers will need.

Taxes are due pretty soon, which is why we've got you covered. Learn how to scan important tax documents with your phone or tablet, and discover the best tax software for 2023.