Why You Can Trust CNET

Why You Can Trust CNET Advertiser Disclosure

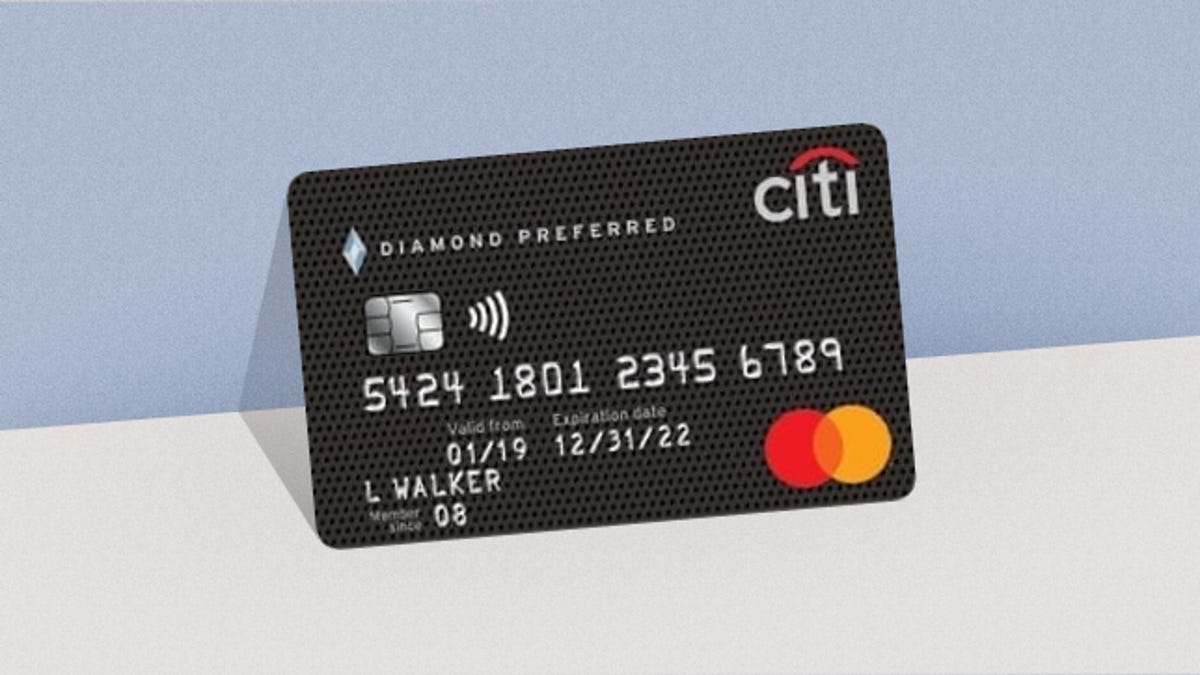

A Rare Find: This Balance Transfer Credit Card Just Added a Welcome Bonus

The Citi® Diamond Preferred® Card just got even sweeter.

Citi is an advertising partner.

The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. The Citi Diamond Preferred Card offer mentioned below is no longer available.

The Citi® Diamond Preferred® Card -- predominantly known for its long introductory APR period on balance transfers -- is now offering a welcome bonus.

Welcome bonuses are exceptionally rare among balance transfer credit cards. The Diamond Preferred card is offering a $150 statement credit after you spend $500 in purchases within the first three months of account opening. Balances transferred to this card won't qualify toward the spending threshold.

If you plan to use this card on new purchases to qualify toward the welcome bonus threshold, you would also get to take advantage of the 0% introductory APR on purchases for 12 months. This offer is in addition to the 21 months of 0% introductory APR on balance transfers (balance transfers must be completed within four months of account opening). After both introductory periods, the variable APR on purchases and balance transfers moves to 13.99% to 23.99%.

In terms of welcome bonuses, this is not the best one available on the market. However, it is very accessible with a low spending threshold. The Chase Freedom Flex℠ has this card beat with a slightly better welcome bonus ($200) for the same spending threshold ($500 in the first three months).

The editorial content on this page is based solely on objective, independent assessments by our writers and is not influenced by advertising or partnerships. It has not been provided or commissioned by any third party. However, we may receive compensation when you click on links to products or services offered by our partners.