For Chase cardmembers, Chase Ultimate Rewards is one of the most popular travel rewards programs out there. However, not all cards that earn points in this program offer the same redemption options.

There are three Chase Ultimate Rewards credit cards that let you move your rewards to airline and hotel partners at a 1:1 ratio: the Chase Sapphire Preferred® Card, Chase Sapphire Reserve® and the Ink Business Preferred® Credit Card.

Here’s everything you need to know about transferring your rewards with Chase Ultimate Rewards.

Chase Ultimate Rewards transfer partner list

All of Chase’s travel partners allow 1:1 transfer values in increments of 1,000. This means 1,000 Chase Ultimate Rewards points can turn into 1,000 airline miles or 1,000 hotel points with any of the partner programs.

Note that all of Chase’s point transfers are one-way, meaning you can’t change your mind and move your points back after a transfer.

So once you transfer your rewards to an airline or hotel partner, your points then belong entirely to that program and become subject to the program’s expiration policies and other fine print. While Chase Ultimate Rewards points never expire as long as your account is open, many airline and hotel currencies expire after 12 or 24 months of inactivity.

In total, Chase has 14 transfer partners -- 11 airlines and three hotels. Although that number is less than what American Express, Citi and Capital One offer, Chase has a few valuable transfer partners that the other three rewards programs don’t. These include Southwest Airlines Rapid Rewards and World of Hyatt.

While program transfer partners can change over time, here’s the current list of Chase’s partner frequent flyer programs and hotel loyalty programs.

Airline travel partners

- Aer Lingus, AerClub

- Air Canada Aeroplan

- British Airways Executive Club

- Emirates Skywards

- Air France-KLM Flying Blue

- Iberia Plus

- JetBlue TrueBlue

- Singapore Airlines KrisFlyer

- Southwest Airlines Rapid Rewards

- United MileagePlus

- Virgin Atlantic Flying Club

Hotel transfer partners

- IHG One Rewards

- Marriott Bonvoy

- World of Hyatt

Aer Lingus, AerClub

Aer Lingus is the national airline of Ireland, and the Aer Lingus AerClub program is its official loyalty program. This airline partners with a range of airlines like United and American, and it isn’t part of an official alliance.

Many frequent flyers use Aer Lingus rewards currency, called Avios, for cheap flights within Europe. For example, it can cost as little as 4,000 Avios to fly from Dublin to Paris or 8,500 Avios to fly from Dublin to Malaga, Spain.

It’s worth noting that British Airways and Iberia also use the Avios rewards currency, though each airline has its own loyalty program. You can freely transfer Avios between Aer Lingus AerClub, British Airways Executive Club and Iberia Plus.

Air Canada Aeroplan

Air Canada Aeroplan is a founding member of the Star Alliance, which includes partners like Lufthansa, Turkish Airlines and United Airlines. This means you can use miles in this program to fly to more than 1,250 airports in 195 countries around the world.

British Airways Executive Club

British Airways Executive Club is part of the oneworld Alliance, which includes partners like Alaska Airlines, American Airlines, Cathay Pacific and Iberia. Like Aer Lingus Aerclub and Iberia Plus, this program also uses the Avios rewards currency, which is redeemable with the airline and its partners to more than 900 destinations in 170 countries.

While British Airways is headquartered in England, many frequent travelers use this program to book partner awards on domestic flights with American Airlines.

Emirates Skywards

Emirates is one of the major airlines of the United Arab Emirates, and it’s not part of any of the major airline alliances. That said, this program lets you redeem miles for flights around the world, as well as for upgrades to a premium cabin and even luxury hotel stays.

Air France-KLM Flying Blue

The Flying Blue program is the frequent flier program of Air France and KLM, which are part of the SkyTeam airline alliance along with Delta Air Lines and Virgin Atlantic. This means earning Flying Blue miles paves the way to booking award flights with any of these participating airlines to 1,050 destinations in 166 countries. The Flying Blue program is also known for its cheap flights to Europe, both in economy and in business class.

Iberia Plus

Based out of Madrid, Spain, Iberia Plus is another airline that’s part of the oneworld Alliance. Like Aer Lingus AerClub and British Airways Executive Club, Iberia Plus also uses Avios as its rewards currency. This rewards program is popular among travelers who are looking for cheap award fares to and from Europe.

JetBlue TrueBlue

JetBlue isn’t a member of any of the major airline alliances, but it does partner with Hawaiian Airlines and Qatar Airways. JetBlue TrueBlue points are redeemable for award flights with JetBlue to more than 100 destinations in the US, Europe, the Caribbean, Mexico, Central America and South America, as well as for hotel stays, vacation packages and more.

Singapore Airlines KrisFlyer

Singapore Airlines is part of the Star Alliance alongside United, and it’s easy to rack up miles in this program since it’s a partner of Chase Ultimate Rewards, American Express Membership Rewards and Capital One Miles. Miles in this program can be redeemed for award tickets with Singapore Airlines and partners, upgrades to a premium cabin, merchandise, experiences and more.

Southwest Airlines Rapid Rewards

Southwest Rapid Rewards is another airline that’s not part of an alliance, yet this Chase travel partner is incredibly popular with families. Not only do all travelers who fly with Southwest get two free checked bags and fee-free flight changes, but the program uses a cost-based award system that lets you fork over fewer points for awards when prices drop. Overall, Southwest Airlines flies to 121 destinations in the US, the Caribbean, Central America and Mexico.

United MileagePlus

United MileagePlus is one of the biggest carriers in the US, and it’s known for offering decent flight awards with no fuel surcharges on United-operated flights. This program doesn’t offer an award chart and can occasionally charge a lot more miles than competitors for various itineraries. However, there are still exceptional deals to be had, and you can redeem miles for flight awards, upgrades to a premium cabin, gift cards, merchandise and more.

Virgin Atlantic Flying Club

Virgin Atlantic Flying Club is the newest member of the SkyTeam alliance, which means you can use points for flight awards on partners like Air France, Delta and KLM. You can use Flying Club points for award flights, upgrades to a premium cabin, Virgin Atlantic Holidays vacation packages and more. The program also offers a “reward seat checker” that lets you get an estimate of how many points you’ll need for a flight based on your home airport, travel destination, preferred airline (whether Virgin or its partners) and travel dates.

IHG One Rewards

IHG One Rewards is the hotel loyalty program of Intercontinental Hotels Group, and it lets members redeem points for stays at more than 6,000 global destinations. This program doesn’t have any blackout dates, and members get automatic perks like free internet access and late check-out (based on availability) when they stay with the brand. Free night awards with IHG One Rewards start at just 5,000 points per night.

Marriott Bonvoy

The Marriott Bonvoy program features nearly 8,700 hotels and resorts across 30 brands in 139 countries and territories around the world. While redemption rates vary, you can redeem points at traditional hotels and resorts, budget properties, all-inclusive resorts, and luxury properties around the world.

World of Hyatt

World of Hyatt is probably the most valuable hotel loyalty program available today, and you can rack up rewards in this program with paid hotel stays, Chase Ultimate Rewards credit cards or co-branded credit cards like the World of Hyatt Credit Card. You can redeem World of Hyatt points for stays at traditional hotels and resorts and all-inclusive properties. Free night awards over off-peak dates start at just 3,500 points per night.

How to earn Chase Ultimate Rewards points

Now that you know all about Chase transfer partners, you’re probably wondering how you can earn Chase Ultimate Rewards points.

Most of Chase’s cards, excluding co-branded ones, operate in the Ultimate Rewards ecosystem. You can earn Ultimate Rewards points by making purchases or earning a welcome bonus with any of the following cards:

- Chase Freedom Unlimited®

- Chase Freedom Flex℠*

- Ink Business Unlimited® Credit Card

- Ink Business Cash® Credit Card

- Chase Sapphire Preferred® Card

- Chase Sapphire Reserve®

- Ink Business Preferred® Credit Card

While all these cards earn Ultimate Rewards points, not all offer the same redemption options. The Freedom Unlimited, Freedom Flex, Ink Business Unlimited and Ink Business Cash allow you to redeem your Ultimate Rewards only as cash back, travel through Chase Travel℠ or a few other non-travel options. To transfer your Ultimate Rewards points to hotel and airline partners, you’ll need one of Chase’s premium travel cards: the Chase Sapphire Preferred ($95 annual fee), the Chase Sapphire Reserve ($550 annual fee) or the Ink Business Preferred Credit Card from Chase ($95 annual fee).

One great thing about Chase’s Ultimate Rewards ecosystem is that you can pool your points from multiple cards, both personal and business, into a single card account. That means as long as you have one of the three premium travel cards, you can pool the points from any Ultimate Rewards-earning cards to the premium card’s account to transfer to travel partners.

For example, if you have 10,000 points on your Chase Freedom Flex, 30,000 points on your Ink Business Cash and 60,000 points on your Chase Sapphire Preferred, you can pool all your points onto your Sapphire Preferred card and transfer a total of 100,000 points to travel partners.

Best Chase credit cards to earn Ultimate Rewards for travel

- Intro Balance Transfer APR

- N/A

- Intro Purchase APR

- N/A

- Regular APR

- 21.49% – 28.49% Variable

- Balance Transfer Fee

- Either $5 or 5% of the amount of each transfer, whichever is greater.

- Intro Balance Transfer APR

- N/A

- Intro Purchase APR

- N/A

- Regular APR

- 21.49% – 28.49% Variable

- Balance Transfer Fee

- Either $5 or 5% of the amount of each transfer, whichever is greater.

- Intro Balance Transfer APR

- N/A

- Intro Purchase APR

- N/A

- Regular APR

- 22.49% – 29.49% Variable

- Balance Transfer Fee

- Either $5 or 5% of the amount of each balance transfer, whichever is greater

- Intro Balance Transfer APR

- N/A

- Intro Purchase APR

- N/A

- Regular APR

- 22.49% – 29.49% Variable

- Balance Transfer Fee

- Either $5 or 5% of the amount of each balance transfer, whichever is greater

- Intro Balance Transfer APR

- N/A

- Intro Purchase APR

- N/A

- Regular APR

- 21.24% – 26.24% Variable

- Balance Transfer Fee

- Either $5 or 5% of the amount of each transfer, whichever is greater.

- Intro Balance Transfer APR

- N/A

- Intro Purchase APR

- N/A

- Regular APR

- 21.24% – 26.24% Variable

- Balance Transfer Fee

- Either $5 or 5% of the amount of each transfer, whichever is greater.

Should you book through Chase or transfer points to a partner?

Chase’s premium travel credit cards offer a flat rate redemption bonus when you use them to book travel through Chase Travel. The Chase Sapphire Preferred and the Ink Business Preferred give you 25% more value for your points, whereas the Chase Sapphire Reserve gives you 50% more value when you redeem points for airfare, hotel stays and more through the portal.

This is part of the reason you’ll want to compare pricing options for various awards before you transfer your points. In some cases, you can get a better rewards value for booking through the Chase Travel. This is more commonly the case for hotel stays, but it can also be the case for airfare.

Consider this example:

We searched for award nights in Miami with the IHG One Rewards program and found free night awards at the Hotel Indigo Miami Brickell starting at 27,000 points per night over dates in fall of 2024.

On the exact same nights we searched, however, the same hotel would set you back only 12,882 Chase Ultimate Rewards points if you booked through the portal and had the Chase Sapphire Reserve. In this case, it makes a lot more sense to book the hotel through Chase for less than half of the cost in points.

That said, you should never assume a specific booking will be a better value without taking the time to check. For example, we searched the World of Hyatt program for available properties in Miami on the same dates and found that you can book the Hyatt Regency Miami for 18,916 points per night through Chase with the Chase Sapphire Reserve.

However, the same hotel is only 12,000 World of Hyatt points for the same dates, so you would definitely want to move your Chase points to your World of Hyatt account to make this booking directly.

While the cost of a booking is likely the most important factor in your decision, there are other considerations as well. Point transfers to an airline or hotel’s loyalty program let you book directly through that hotel or airline, potentially making it easier to get help if you need to make changes or if something goes wrong with your booking. By contrast, booking through the Ultimate Rewards portal means you may have to go through Chase’s customer support instead of dealing directly with the airline or hotel.

How to transfer Chase Ultimate Rewards points

If you have an eligible Chase credit card and want to transfer your rewards to partners, here are the steps you need to take:

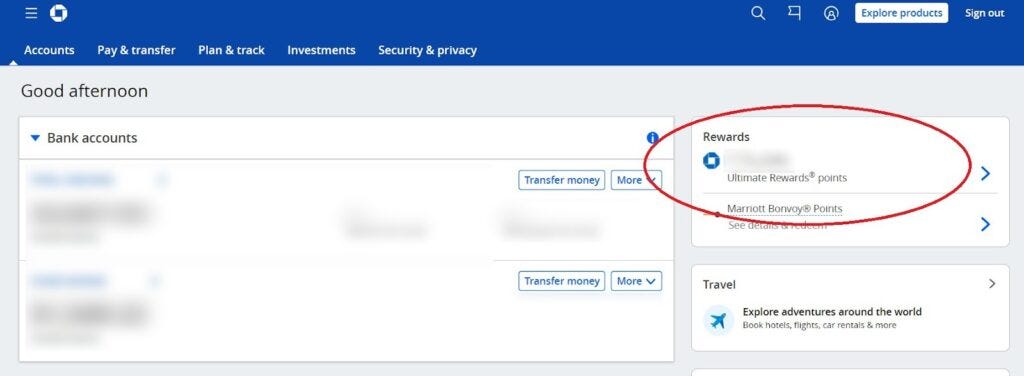

Step 1: Log into your credit card account at Chase.com. From there, you’ll click on the part of your online account interface that displays your rewards balance.

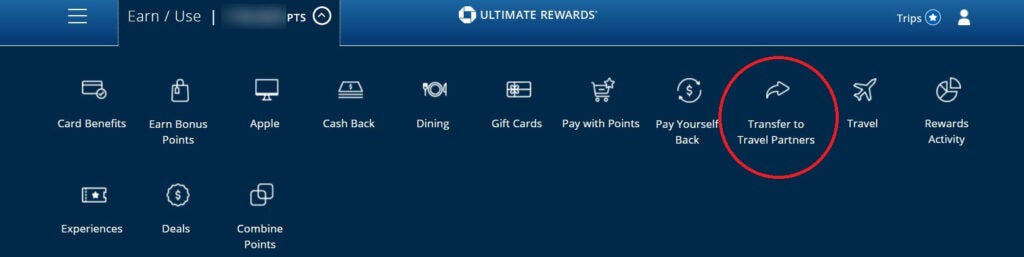

Step 2: Click where it says “Earn/Use” then where it says “Transfer to Travel Partners.” At that point, you’ll see a list of the Chase travel partners we listed in this guide.

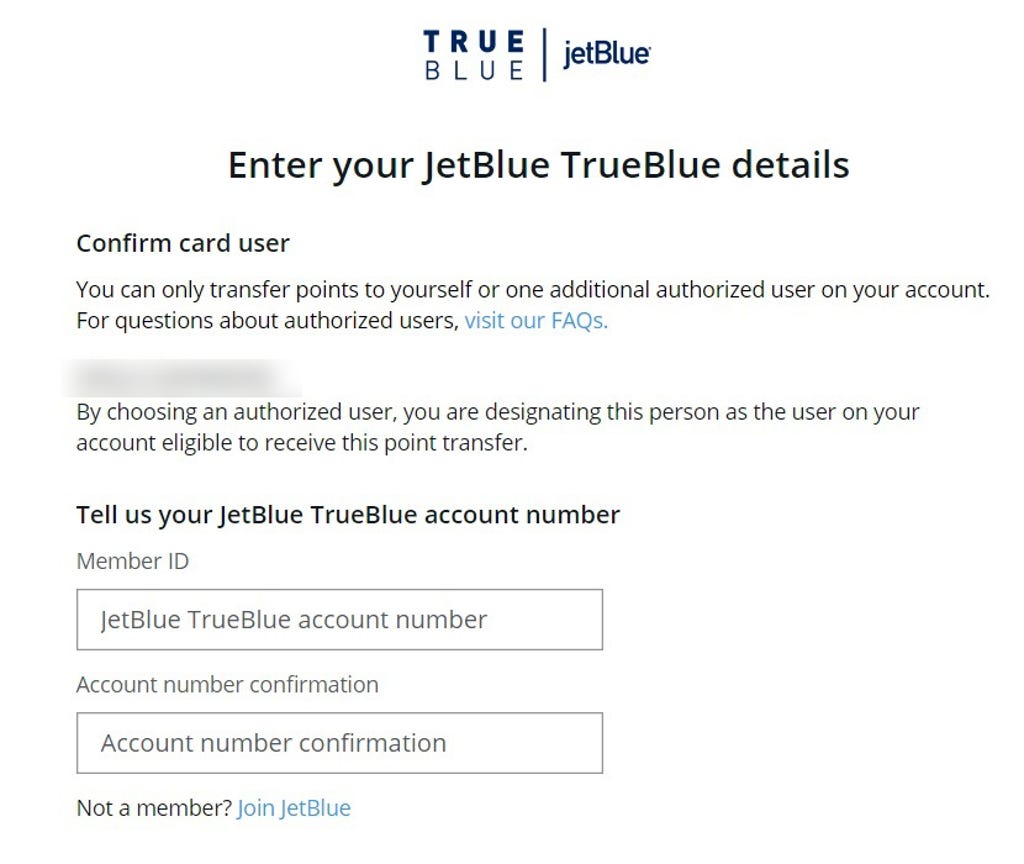

Step 3: Choose the travel partner you want to transfer points to. Chase lets you save your loyalty account information for partners you have transferred points to in the past. Otherwise, you’ll need to fill in information to facilitate the transfer, including your loyalty account number.

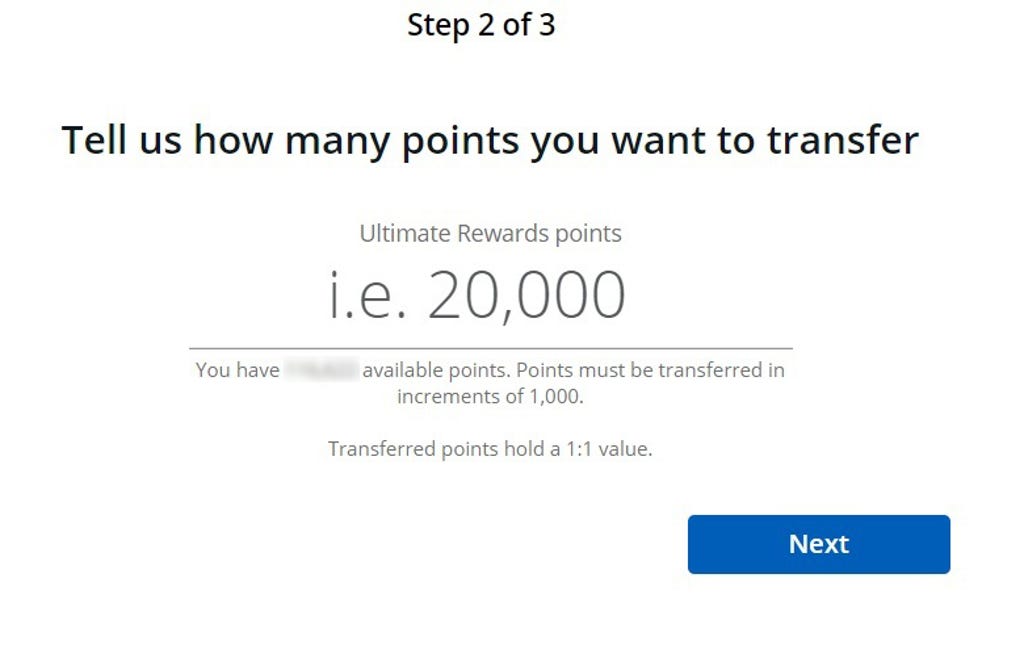

Step 4: Enter your transfer amount. Enter the number of Chase points you want to transfer to a partner. Keep in mind that points must be transferred in increments of 1,000.

Once you have completed the final step, your points will move from your Chase account to the airline or hotel program. Some point transfers are instant, meaning you can log into your loyalty account and use them right away. Others can take up to 48 hours or even up to seven days.

FAQs

Chase transfer partners include Aer Lingus AerClub, Air Canada Aeroplan, British Airways Executive Club, Emirates Skywards, Air France-KLM Flying Blue, Iberia Plus, JetBlue TrueBlue, Singapore Airlines KrisFlyer, Southwest Airlines Rapid Rewards, United MileagePlus, Virgin Atlantic Flying Club, IHG One Rewards, Marriott Bonvoy and World of Hyatt.

Chase credit cards that allow point transfers include the Chase Sapphire Preferred, Chase Sapphire Reserve and Ink Business Preferred Credit Card from Chase.

Chase Ultimate Rewards points don’t transfer to Delta Airlines, but they do transfer to other SkyTeam alliance partners, including Virgin Atlantic, AirFrance and KLM. You can transfer your Chase points to one of those airlines and book Delta flights indirectly.

Chase Ultimate Rewards points don’t transfer to American Airlines, but they do transfer to other oneworld alliance partners, including British Airways and Iberia. You can transfer your Chase points to one of those airlines and book American Airlines flights indirectly.

*All information about the Chase Freedom Flex has been collected independently by CNET and has not been reviewed by the issuer.

The editorial content on this page is based solely on objective, independent assessments by our writers and is not influenced by advertising or partnerships. It has not been provided or commissioned by any third party. However, we may receive compensation when you click on links to products or services offered by our partners.