Credit monitoring services help you keep close tabs on your credit score while helping to protect you against fraud and data breaches.

Since your credit score helps determine whether you’re approved for a personal loan, credit card, mortgage and even renting a new apartment, it’s important to make sure the number is accurate.

Monitoring your credit score can also help you stay one step ahead of fraudsters and identity thieves. The highest number of data breaches recorded in a single year occurred in 2023, according to an Identity Theft Research Center report.

According to the report, there was a 78% increase in publicly announced data breaches from 2022 to 2023.

By keeping a close eye on your data, you could avoid being added to the ever-growing list of victims. Here are some of the best free services to use for both monitoring your credit and keeping your data secure.

Cost: $0 to $24.99 monthly

Experian -- one of the three major credit bureaus -- lets you check your FICO credit score and your Experian credit report for free, whenever you’d like. Though, what puts this service ahead of other options is its free access to Experian Boost, which factors in additional financial information to improve your FICO score from Experian. It also provides the clearest breakdown of your credit report, with clean visuals displaying information like your credit utilization and open credit accounts.

You do have to navigate through tons of product recommendations, which is a tad annoying. Of the three credit bureaus, Experian offers the best user experience.

There’s a premium membership for $24.99 monthly that adds benefits like a credit score comparison among all three credit bureaus, subscription cancellation and bill negotiation service, identity theft insurance, and fraud alerts and resolution support.

Cost: Free

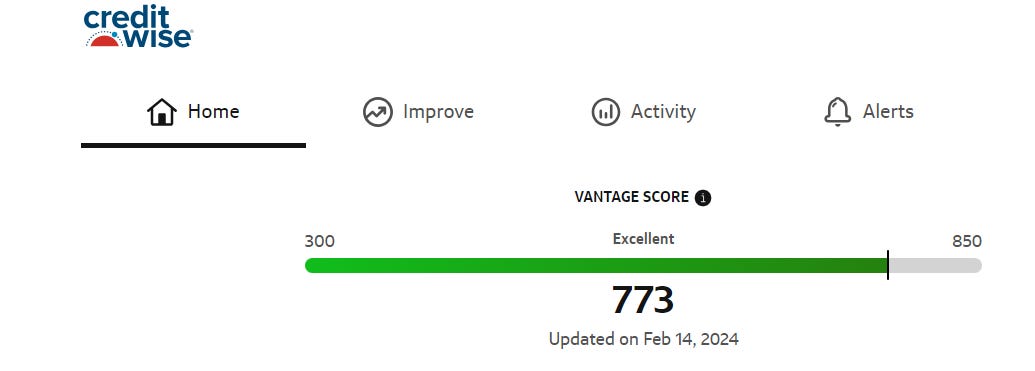

This is a free service that everyone can use, not only Capital One cardholders. You’ll need to supply your Social Security number, phone number and address. Once you’ve signed up, you can check your VantageScore 3.0 credit score and TransUnion credit report whenever you like.

Beyond that, there are a number of useful features. Chief among them may be free dark web monitoring for your personal information like your email and address. In fact, CreditWise alerted me that my personal email address was found on the dark web and prompted me to take action.

There are also educational resources that explain important terms like credit utilization and offer advice for reducing debt. CreditWise also offers a breakdown of what is impacting your credit score, anything that has affected it recently (though you’ll need to have your account open for a bit to benefit from this) and actionable tips for improving your credit score.

Cost: $0 to $19.95 monthly

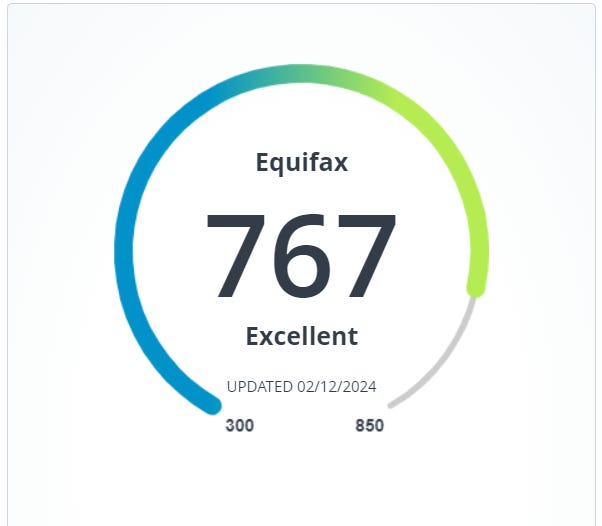

Another of the big three credit bureaus in the US, Equifax, suffered one of the worst data breaches in 2017 affecting more than half of all Americans.

If you’re feeling forgiving, Equifax’s credit monitoring services are on par with competitors, and its multiple pricing options may allow you to find a plan better suited to your needs and budget. And its product offers are less intrusive than other options.

The service provides a copy of your Equifax credit report and monitors your credit and Social Security numbers by scanning websites where consumer information has been sold. Equifax also sends alerts about suspicious activities, like someone applying for credit in your name on the other side of the country.

Cost: $30 per month

Also among the top three major credit monitoring services is TransUnion. With TransUnion, you can check your credit score as often as you’d like.

While it will cost you around $30 to enroll in TransUnion’s credit monitoring services, the credit bureau offers some free services, such as the ability to freeze your credit, dispute your credit report and enroll in fraud alerts to help protect your credit profile. However, you’ll need to give them your credit card information to create an account.

Cost: Free

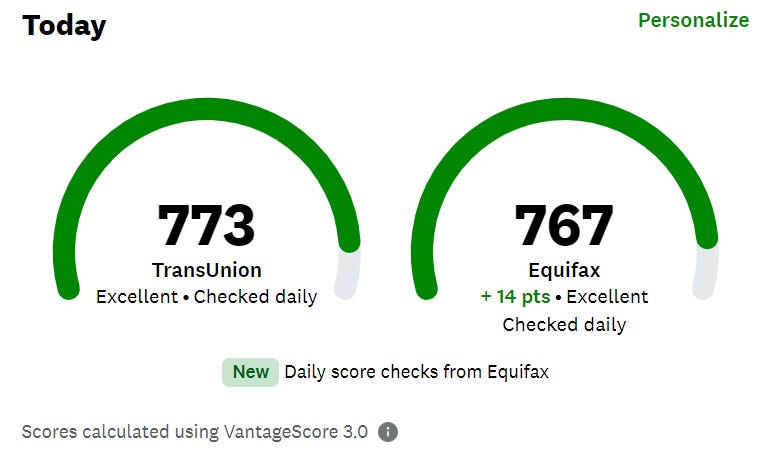

Credit Karma is a personal finance company that offers a service to check your Equifax and TransUnion credit scores as often as you’d like for free. You can also access your credit reports from both bureaus, but not from Experian.

Credit Karma monitors your credit and sends weekly updates and will notify you if there’s any change to your credit score. Both your TransUnion and Equifax credit report is displayed in a format that’s easier to parse than on either of the credit bureaus’ own websites.

The site also shows your score and factors that affect your score, like if you’re using too much of your credit card limit, as well as derogatory marks and hard inquiries.

Credit Karma will also alert you if any of your email or passwords have been exposed in data breaches and has a number of educational resources. And like the other sites, Credit Karma will match you with credit products. Although, you should take your approval odds with a grain of salt.

Cost: Free

American Express’ MyCredit Guide lets you check your Experian credit report and FICO credit score free of charge, even if you aren’t an American Express cardholder.

It’s a clean interface which displays your credit score, the factors that impact it and a graph showing your Experian score history. You can also set a target credit score, access financial calculators and see your entire Experian credit report.

You can also use a FICO score simulator to see how any changes in your finances might impact your score ahead of time. And like many of the other services on this list, Amex will alert you if any of your personal information has been compromised.

Cost: Free

FreeCreditReport.com is a pared-down service provided by Experian to access your credit report and credit score for free. The company provides you with an updated credit report every 30 days. You’ll have access to your account history, including mortgages and credit lines.

FreeCreditReport.com shows you hard inquiries on your account, tracks your credit usage and shows any potential marks against you, like late payments.

Mixing and matching services may help cover more ground

When it comes to checking your credit, there are a lot of ways to go. You can select one service or pair free services together to access your FICO score from all three major bureaus. However, if you go that route, keep in mind that you won’t have the promised credit protection and monitoring that Experian, TransUnion and Equifax offer.

It’s also a good idea to include Capital One’s CreditWise in the mix. Free dark web monitoring is another layer of protection against identity theft.

How we rate credit monitoring apps

We consider these factors when determining the credit monitor app’s overall rating.

How detailed the information is

If the information provided doesn’t give you the whole story or accurately depict your credit profile, it’ll get a lower score.

How the information is presented

The information included doesn’t matter much if you cannot clearly understand what it’s showing. A clean, easily parsed user interface will get a higher score than one that appears cluttered or outdated.

How easy it is to use the application

If the application is intuitive, meaning it’s easy to understand where you should go to find which type of information you’re looking for, it’ll score higher than one that appears convoluted or over-engineered.

Price

The cost of the application -- and if it’s actually worth it to pay for what the paid version provides -- will impact the score it receives.

If the company provides actionable tips on how to improve your credit

While it’s all well and good to see what’s going on with your credit score, it’s even more helpful when you know where to go from here. If the company offers useful tips on how to improve your credit score, it’ll score a bit higher.

If there are any educational resources users can take advantage of

If the company offers additional educational resources to improve your financial literacy and understanding, its score will slightly increase.

How intrusive the product recommendations were

Each of these companies has a business to run, which means they will take this opportunity to connect you with credit products that match your credit profile. That’s fine, so long as it doesn’t ruin or egregiously interfere with the other features it provides. The less intrusive the product recommendations are, the better the application will rank.

FAQs

Your credit score is a three-digit number that’s calculated based on your credit reports from the three major US credit bureaus, Experian, TransUnion and Equifax. Both FICO and VantageScore -- the two major credit scoring models -- range from 300 to 850.

When applying for credit, lenders may check your credit reports and credit score to determine if you’re worth lending money to. Some factors that can affect your score include hard inquiries that occur when you apply for credit, derogatory marks for paying a bill late and how much of your total credit you’re using (the less you use, the better). Each credit bureau maintains its own reporting, so your score may vary based on which credit reports are used in the analysis.

Many people believe checking their credit score will ding their credit report, but that’s not true. Checking your own credit score is considered a soft inquiry and won’t affect your credit. However, if you’re applying for a loan or credit card, and a company runs a credit check on you, that’s considered a hard inquiry, which can temporarily bring your score down several points.

The editorial content on this page is based solely on objective, independent assessments by our writers and is not influenced by advertising or partnerships. It has not been provided or commissioned by any third party. However, we may receive compensation when you click on links to products or services offered by our partners.