For AT&T, the future is (DirecTV) Now

Strong early numbers for its streaming TV service -- despite some high-profile hiccups -- have the company on its way to transforming itself from a simple phone company.

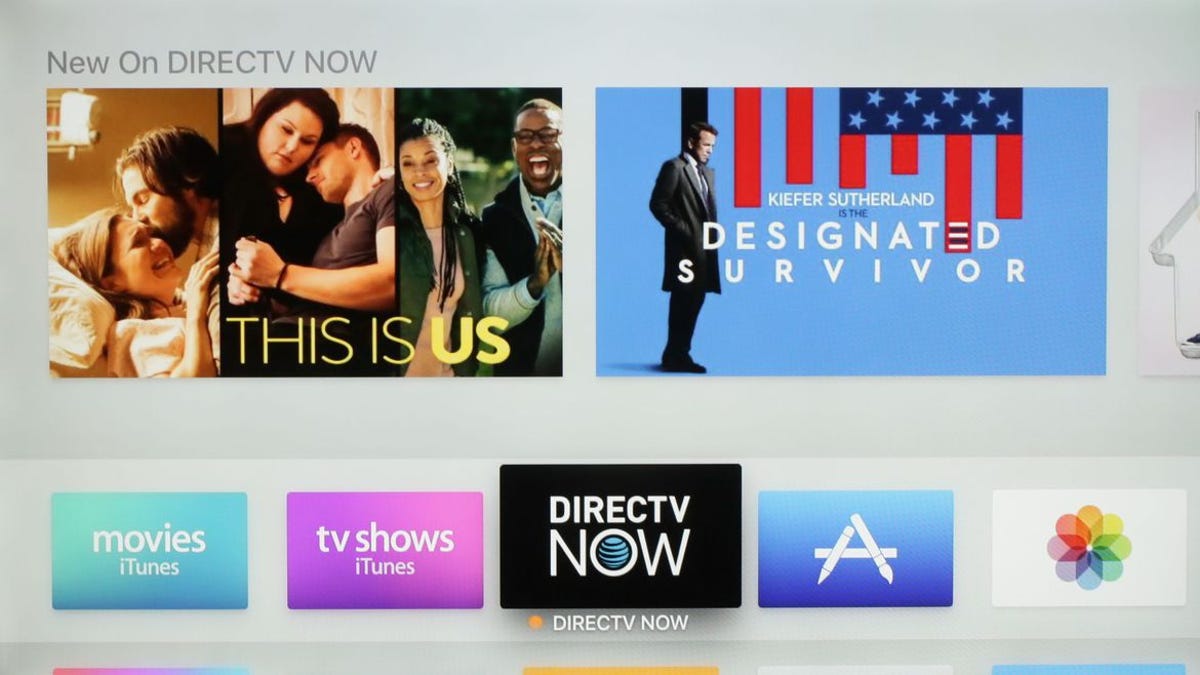

DirecTV Now delivers more than 100 channels for an introductory price of $35, streams over the internet, works with numerous devices including mobile phones, and doesn't consume mobile data on AT&T networks.

You get only one chance to make a first impression.

If that's the case, AT&T may have dropped the ball with many customers who signed up for its DirecTV Now streaming TV service. The telecommunications giant saw its service choke under the demands of its users, marking an embarrassing start for the company.

It was bad enough that T-Mobile CEO John Legere on Wednesday, ahead of AT&T's earnings report, said he would offer any AT&T customer who switched a year of Hulu service to make up for the bumpy start of DirecTV Now. Legere upped his troll game after claiming Tuesday that Verizon is suffering from a midlife crisis.

In its defense, AT&T can now point to the 200,000 customers it added since the Nov. 30 launch, far higher than Wall Street expected. The numbers, released last week, were likely buoyed by the introductory promotional offer of 100 channels for $35 a month.

On a call with analysts, AT&T CEO Randall Stephenson acknowledged that "we're still not completely there on the plumbing" on DirecTV Now, but called it a "very elegant experience."

DirecTV Now represents AT&T's push to transform itself into more than just a phone company, taking control of the content you watch and of how you watch it. AT&T made its push to own the distribution through last year's acquisition of DirecTV, and with its pending deal to buy Time Warner, it wants to be the company behind "Game of Thrones" and Superman.

Its eagerness to evolve arises in part from the harsh competition in its core wireless business, in which smaller rivals Sprint and T-Mobile are scooping up its subscribers. It's the same trend that has forced Verizon to make its own acquisitive bets, although they're relatively smaller ones, in AOL and Yahoo.

The fourth quarter saw more of the same for AT&T. While the company added 1.5 million connections, 1.3 million came from lower-revenue connected devices. It also lost 67,000 so-called postpaid customers -- people who pay at the end of the month and tend to be more loyal. Much of its postpaid growth came from connecting tablets.

Meanwhile, it saw a jump in prepaid users through its Cricket and GoPhone arms.

Stephenson warned that 2017 would continue to see a competitive environment with more promotions. AT&T will likely compete through bundles, he said.

As with previous quarters, AT&T said that the customers who left were feature phone users and that its higher-end customers stuck with the service.

On the video side, the company added 235,000 satellite TV subscribers in the period, although it lost 262,000 U-Verse TV subscribers. Stephenson noted that after U-Verse launch, it took a year and a half to add the number of customers DirecTV Now garnered in a month.

Most people will be looking at the DirecTV Now numbers, since the company is betting on the "over the top" streaming strategy to eventually win out. But even AT&T said there isn't enough data to see how loyal customers will be.

AT&T posted a fourth-quarter profit of $2.4 billion, or 39 cents a share, down from 65 cents a year ago. Remove one-time items like merger and acquisition costs, and earnings were 66 cents a share versus 63 cents a share a year ago.

Revenue slipped slightly to $41.8 billion.

Earnings fell right in line with expectations, although revenue was slightly disappointing relative to analysts' expectations, according to Yahoo Finance.

For 2017, AT&T expects adjusted earnings in the mid-single digit range and revenue in the low-single digit range.

AT&T shares slipped 0.2 percent to $41.32 in after-hours trading.

Updated at 2:17 p.m. PT: To include comments from the CEO.