[MUSIC]

The US government is pumping $2 trillion into the economy to relieve some of the financial stress caused by the corona virus epidemic.

That includes payments up to $1200 to individual taxpayers.

Roughly nine in ten households may receive a recovery rebate under the economic stimulus.

Not everyone will receive the complete payment, and some won't receive a check at all.

How much you can expect will depend on how much you reported on your most recent tax return in either 2018 or 2019.

Here's the breakdown of who qualifies.

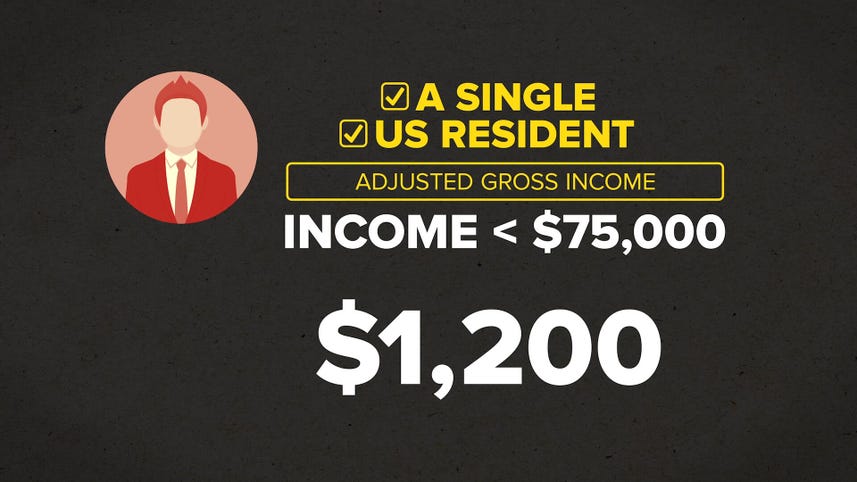

If you filed as a single us resident with an adjusted gross income of under $75,000.

Then you will receive the full $1200 payment.

Singles who made more will get smaller payments and get nothing if you made more than $99,000.

If you filed as head of household You'll get the full $1,200 and lessor amounts up to the income max of $146,500.

If you're part of a couple that filed jointly without children who made less then $150,000, you'll get the full $2,400 payment with lessor amounts up to $198,000.

Over that, nothing.

For each child age 16 and younger in the family, parents will get a payment of $500.

Retirees and those who receive disability benefits, but earn to little to file tax returns, will also receive checks based on the amount of their monthly benefit.

If you think you qualify for a check, You don't need to do anything, including contacting the IRS.

Just wait for it to arrive via direct deposit or in the mail.

Whichever way you normally receive your tax refunds.

When can you expect the money mid April, coincidentally just after April 15, which would be tax day in any other normal year.

For all the details go to irs.gov/coronavirus.