Is the Samsung-Google alliance heading for a crossroads?

As Samsung unveils its next flagship Android device, there are things happening behind the scenes that could threaten the future of the Samsung-Google alliance.

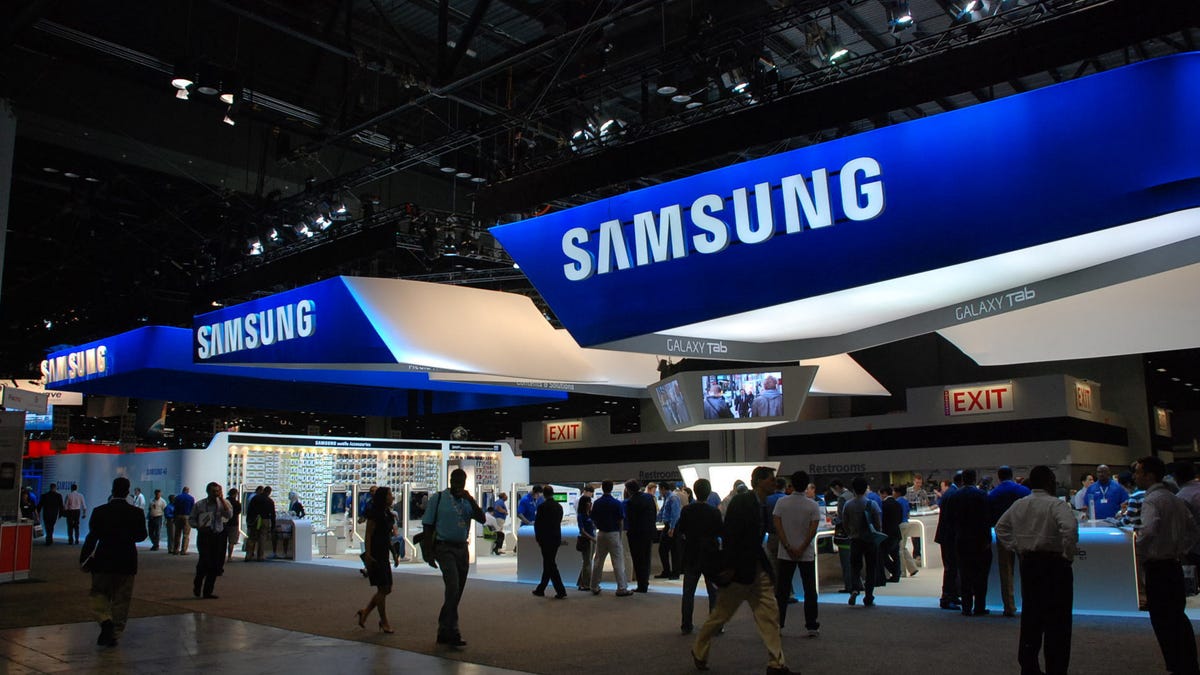

Samsung's pole position in the Android ecosystem is about to get another boost when the Korean electronics giant unveils the Galaxy S4 in New York today. But while it's all glitz and glamour this week, there's an underlying tension between Samsung, Google, and the Android ecosystem that is about to reach a crossroads in 2013.

The Android leaderSamsung's current flagship phone, the Galaxy S3, became the best-selling Android device in the world in 2012. In its first six months on the market, the Galaxy S3 sold more than 40 million units. In the third quarter of 2012, it even passed the iPhone as the single best-selling smartphone in the world -- though Apple snatched back that distinction in the fourth quarter with the launch of the iPhone 5.

Now, Samsung is so bullish on the S4 that it is reportedly ordering enough parts to handle sales of 10 million phones per month. With much of the world still converting from old-style cell phones to smartphones, there's certainly a solid case for that kind of bullishness. But, it also assumes that Samsung will remain Google's pre-eminent Android partner over the next 12 to 18 months. The big question is how safe that assumption is.

If you want to know how key Samsung has been for Android, just look at the fact that when Google bought Motorola in May 2012, Google's Eric Schmidt flew directly to Samsung's headquarters in South Korea to personally assure its executives that Motorola would not get special status in the Android ecosystem.

"I told them that the [Android] ecosystem has to be favored at all costs," Schmidt said. "The Motorola products can't be unduly favored, unless you're also unduly favoring Samsung. If it looks unfair, and then the ecosystem unravels, then it's a terrible mistake."

True to Schmidt's word, Google has not shown Motorola any outward favoritism. Since the acquisition, Google hasn't even tapped Motorola to build any of Android's flagship Nexus devices. And, during the past year, Samsung's leading role in the Android market has only been enhanced, with the help of runaway hits like the Galaxy S3 and the Galaxy Note.

Samsung now owns 40 percent market share of all Android sales. Second place? Huawei with about 7 percent.

Samsung has certainly earned its success. You can't begrudge it that. The company has out-executed other Android device makers in both hardware design and software enhancements.

It also did a better job of emulating best practices from Apple than any of the others Android vendors. While that strategy cost a lot in legal fees after a protracted court battle with Apple (that revealed just how closely Samsung was stalking Apple's moves), it ultimately came to a stalemate. Meanwhile, Samsung devices soared to the head of the class in Android.

The bottom line is that Samsung and Google forged an Android alliance that successfully stemmed Apple's momentum in mobile devices. Ironically, it was very similar to the way Intel and Windows stemmed Apple's momentum in personal computers a generation ago. And, let's not forget that Samsung is also the leading seller in the Android tablet market and the leading laptop seller in the Google Chromebook market.

The Google-Samsung combination is the most potent new partnership in computing, and it is putting tremendous competitive pressure on Apple and Microsoft. But can the partnership hold together? There are several competing interests that are driving a wedge between the two companies, as is common with these types of partnerships. However, in this case, the future of both companies in the mobile business as well as the overall health of the Android ecosystem itself is at stake.

Emerging threats

The first issue is that Samsung's lead over the rest of the Android phone makers is beginning to evaporate. Just as Samsung skillfully executed plays from Apple's playbook, now other Android vendors are emulating Samsung.HTC is taking a page out of the Apple and Samsung playbooks by consolidating down to one flagship smartphone. In this case, it's the HTC One, a sharp new device that was announced in February and is generally drawing strong reviews. Remember, HTC was the leading Android phone maker before Samsung's recent ascent.

Meanwhile, at CES 2013 in January, Chinese device maker Huawei unveiled a pair of high-end Android devices that are aimed squarely at Samsung's two hit products, the Galaxy S3 and the Galaxy Note. The 6.1-inch Huawei Ascend Mate is a phablet that goes even a little larger than the Galaxy Note, with a very similar design.

The Huawei Ascend D2 also emulates Samsung's thin plastic design and features a quad-core processor, 32GB of built-in storage, 2GB RAM, a 13-megapixel camera, a screen with 443dpi pixel density (surpassing both the S3 and iPhone 5), and a 3000mAh battery that rivals the Droid Razr Maxx. Those are eye-popping specs that the Galaxy S4 will struggle to match when it is unveiled today.

After the Samsung Galaxy S3, the next hottest Android phone of 2012 was the Nexus 4, built by Google in partnership with Samsung's Korean rival LG. In fact, the Nexus 4 would likely have taken a bigger chunk out of Galaxy S3 sales if the product hadn't been sold out for most of the fourth quarter due to overwhelming demand.

With Google subsidizing the Nexus 4 so that it could be sold for $299 (8GB) or $349 (16GB), one of the Nexus 4's greatest features was clearly its price tag -- since the device is unlocked and does not require a contract with a wireless carrier. The unlocked version of the Galaxy S3 costs $500 to $600.

The Nexus 4 price tag is great for consumers and for Google, which simply wants to get more Android smartphones in the hands of more people because it makes money off of consumers using its mobile platform. However, it's not so great for Samsung, which makes its money off of selling devices. And that is where the major conflict comes into play.

Bolstered by the success of the Nexus 4 and a similar scenario with the Nexus 7 tablet (built by Asus), we have to expect Google to get even more aggressive in selling inexpensive Nexus smartphones and tablets directly to consumers to help free them from expensive and onerous contracts with wireless carriers and to help get more Google-centric devices in the hands of more people.

Google has been betting on this scenario since the launch of the Nexus One in January 2010, and it finally generated significant momentum around the concept in 2012. As such, I fully expect Nexus devices to take a bigger chunk out of Samsung's Android market share in 2013.

While fighting low-priced Nexus devices on one front, Samsung will also have to deal with the re-emergence of HTC and the rise of Huawei, which could steal customers away from its core business of selling subsidized phones to consumers on traditional wireless plans.

Since Samsung's devices are based on standard industry hardware components that any of the electronics companies can use and the Android software platform is open for any company to co-opt, that leaves Samsung very little room to innovate as an Android device maker. And when there's little room to innovate, the primary differentiator becomes price.

Samsung's parachute

The primary product innovation that catapulted Samsung into the lead in the Android ecosystem in 2012 was arguably that it did a better job than its Android competitors of integrating hardware and software.While Samsung's Android success can also be attributed to its go-to-market strategy (getting its devices sold everywhere with wireless carriers and retailers), its massive advertising budget, and its ability to get parts inexpensively from its affiliates, the demand for its products was ultimately driven by a perception of quality and ease of use.

Again, Samsung had a jump on its Android competitors by being able to watch how Apple carefully integrated hardware and software on the iPhone since Samsung was one of Apple's key parts suppliers for the product during its early years.

Samsung learned those lessons well and by the time it launched the Galaxy S3, it had included a variety of unique feature that showed its growing savvy in software as well as strengths in hardware-software integration, including:

- S Beam sharing that lets you tap two Galaxy S3s together to share photos, videos, or files;

- Smart Stay eye-tracking technology that automatically keeps the screen bright for as long are you're looking at it;

- Best Photo camera feature that takes eight continuous photos and then suggests the best one (and lets you override it and manually select the best one of the eight);

- Direct Call lets you lift your phone to your ear to automatically call someone that you had been texting;

- S Voice (right) for enhancing the built-in voice commands that come with Android (read this TechRepublic article for some great S Voice tips);

- Split-Screen Multitasking that lets you run two programs at once.

While Samsung is likely to continue this kind of innovation in Android to help its devices stand out against HTC, Huawei, Motorola, LG, and others, these types of software add-ons will inevitably remain outside of the core Android functionality and will be overlooked by lots of mainstream users, who are more likely to be influenced by price and ease of use.

So, unless Samsung can leap forward by being the first to integrate a groundbreaking technology like the flexible OLED displays that its affiliates are developing, then it's destined to face long-term trouble in the Android market where it is going to become a race to see who can sell advanced smartphones at the lowest price. With Google being willing to sell Nexus devices at cost and Huawei being able to take advantage of Chinese manufacturing to bring its costs super-low and make profit on volume, Samsung could very likely get squeezed or be forced to lower prices and jeopardize its mobile profits.

That's why Samsung is doing Tizen, which could eventually become its parachute for jumping off the Android bandwagon.

Tizen was originally the next-gen mobile OS to replace Symbian, back when Intel and Nokia were collaborating on it and it was called "MeeGo." But, when Nokia hired Steven Elop as CEO and he burned all bridges and moved the mobile pioneer exclusively to Windows Phone, that left MeeGo abandoned. So, Samsung swooped in and picked up the pieces. It formed a new partnership with Intel, integrated its own LiMo project into the platform, and Tizen was born.

It seemed like a minor, futile endeavor when Tizen was announced in September 2011, but it's increasingly looking like it could become a critical part of Samsung's future. At Mobile World Congress 2013 last month in Barcelona, Samsung put the spotlight on Tizen and gave the tech industry a sneak peek at the platform (see screenshot on right). CNET has reported that the first Tizen phones will arrive this summer.

Tizen is still very raw, but it's clear that Samsung is getting more and more enthusiastic about the platform. It not only folded its LiMo project into Tizen, but it has now reportedly also folded its other pet project, Bada, into the Tizen platform as well.

Don't expect the Tizen phones released in mid-2013 to be much of a threat to the Galaxy S4 or the iPhone, but you should keep an eye on how many software innovations and hardware/software integrations like the ones we've seen from Samsung recently are integrated into Tizen. Many of the Galaxy features Samsung rolled out last year are core functions that could form the heart of an excellent mobile platform.

Samsung will be testing the waters. It won't quickly abandon the Android ecosystem and put a lot of potential phone sales at risk. Any time the question of Tizen is brought up, the overwhelming reaction on Internet forums from existing Samsung phone users is that they would likely stick with Android and switch to an HTC or Nexus phone if Samsung went all Tizen. So, this isn't going to be something radical that happens in 2013.

But 2013 could be the sea change.

I'll give you one scenario to consider. If the Galaxy S4 remains the best-selling Android phone in the world (but with greater competition) and Tizen becomes a modest hit (with Samsung giving it a few exclusive features), then we could see Samsung move a lot more aggressively. For example, what if Samsung used the equity of the Galaxy brand to push Tizen? What if the Galaxy S5 or the Galaxy S6 becomes a Tizen phone? What if the Galaxy Note 3 or 4 becomes a Tizen tablet?

Sure, Samsung would lose some users in those scenarios, but it would protect the profitability of its popular high-end devices. It would also gain the ability to make money off of services on the devices, rather than only making money on the hardware sales and then letting Google make all of the money from services, as Samsung currently does with Android. That's why the Tizen experiment is more than just a hedge or a negotiating tool to get a revenue-sharing deal with Google to get a cut of that services money.

If the Android ecosystem becomes a race to the bottom on smartphone prices and Google refuses to share any services revenue with Samsung, then Tizen could become the platform where Samsung redirects most of its energy. Even then, I doubt it would completely pull the plug on Android devices, but it could certainly bet on the Samsung brand and products being just as appealing to the market as Android.

In other words, Samsung isn't likely to market Tizen phones under the Tizen brand. It will focus on the Samsung brand, and it will attempt to create not just a device but a platform and an ecosystem. In the long run, that's where almost all of the innovation -- and the profits -- will be as the mobile device market matures.

The thing to watch will be how effectively Samsung can create its own platform and ecosystem versus how aggressively Google makes concessions to keep Samsung primarily focused on the Android platform and ecosystem.

This story originally appeared at ZDNet's Between the Lines under the headline "Samsung and Android: The next Wintel or destined for divorce?"