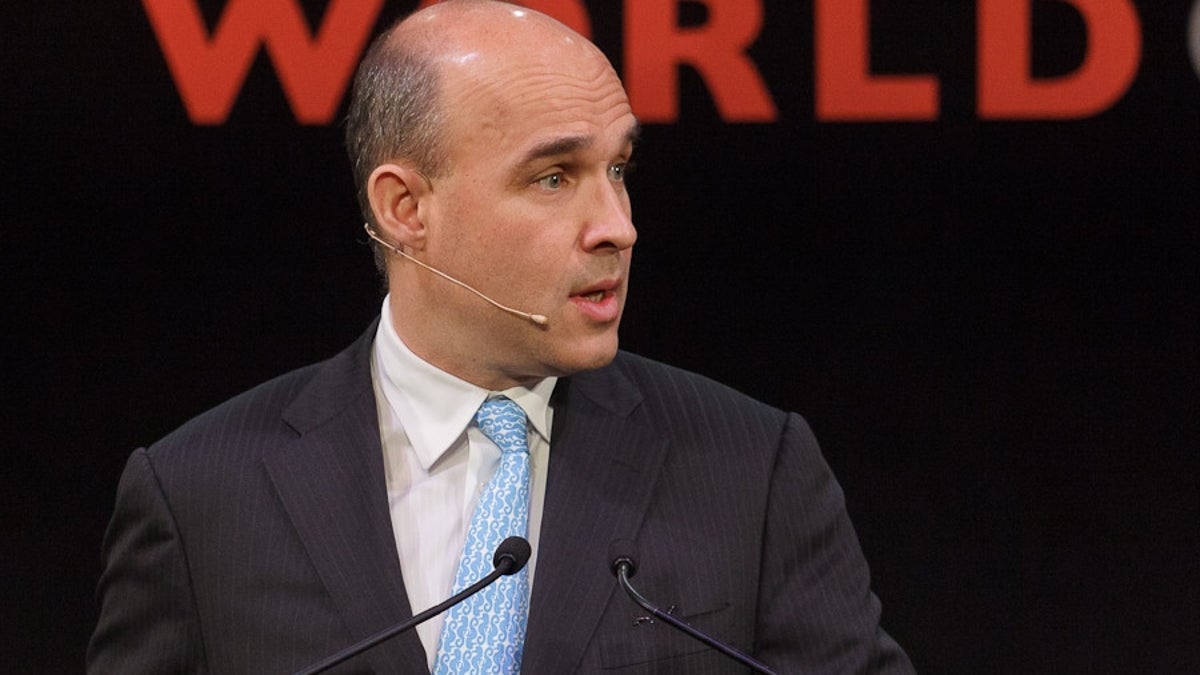

Ex-BlackBerry co-CEO Jim Balsillie dumps entire stake

A year ago, Balsillie owned 26.8 million shares of stock in the smartphone maker. Now he's down to zero.

Jim Balsillie, the former co-CEO of BlackBerry, has sold off his entire stake in the company, according to a regulatory filing.

A year ago, Balsillie was one of the largest individual shareholders in BlackBerry (formerly known as Research In Motion) with 26.8 million shares in the company. But in a document filed today, BlackBerry disclosed that Balsillie no longer holds any shares in the company.

Balsillie and fellow former co-CEO Mike Lazaridis stepped down last March amid shareholder criticism over the way the company was being run and a stunning drop in its share price. Current CEO Thorsten Heins stepped in to replace them, and has helped usher in the new BlackBerry 10 operating system and a rebound in the share price.

While there are questions about how well BlackBerry 10 will do in the market, the company's new

Lazaridis, who still serves as vice chairman of BlackBerry, owns 29.9 million shares in the company.

BlackBerry shares are down 3.5 percent to $13.50.