Biden Set to Sign Law to Pump $53 Billion Into US Chip Manufacturing

The boost for US chipmaking is part of the broader $280 billion CHIPS and Science Act. Fear of Chinese manufacturing power is part of the impetus.

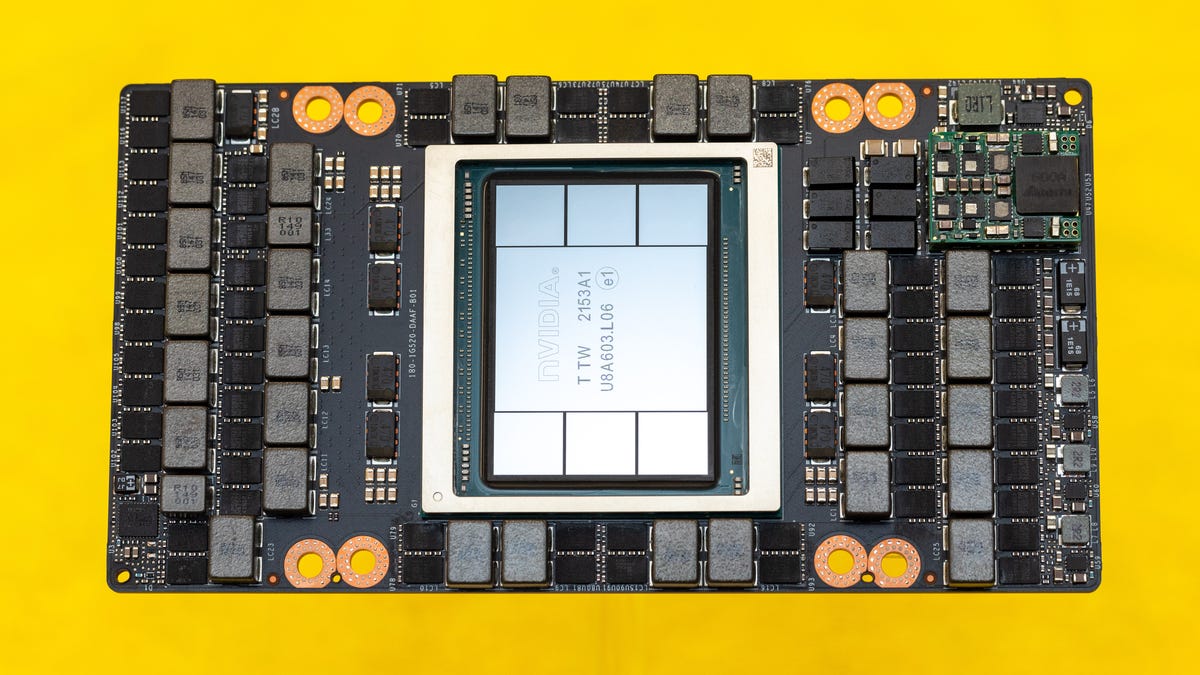

Nvidia's H100 "Hopper" processor, one of the biggest chips in the world, is manufactured by TSMC in Taiwan. The CHIPS Act is designed to bring leading-edge chipmaking back to the US.

President Joe Biden will sign the CHIPS and Science Act of 2022 into law on Aug. 9 in a Rose Garden ceremony, the White House said in a press statement Wednesday, a move that will flood $52.7 billion in funding to US chipmakers over five years.

The bill should help companies like Intel and GlobalFoundries compete with Asian processor manufacturers like Taiwan Semiconductor Manufacturing Co. (TSMC) in Taiwan, Samsung in South Korea and Semiconductor Manufacturing International Corporation (SMIC) in China.

The bill is designed to help tech companies in the US cut the enormous expense of chip manufacturing to help ensure a supply of the electronic brains that are critical to cars, computers, weapons systems, dishwashers, toys and just about any other product today that uses electricity. The extent of the US reliance on those processors became clear over the last two years when a global chip shortage halted shipments of many of those products, harming businesses and forcing automakers to shut down car plants.

Congress approved the measure last week with a 243-187 vote in the House of Representatives and a 64-33 vote in the Senate, largely with Democratic support but also with some Republicans on board.

"The bill will supercharge our efforts to make semiconductors here in America," Biden said Tuesday.

China, America's top geopolitical rival and the world's manufacturing leader, has spent lavishly on a program to build its own native semiconductor industry. And many are concerned that the world's top chipmaker, TSMC, is headquartered on an island that China claims as its own territory, a concern that's grown after Russia invaded Ukraine despite international objections.

Although the CHIPS Act is designed to boost US chipmaking, TSMC remains important to US manufacturing. Taiwan's central role in geopolitics was on display this week as House Speaker Nancy Pelosi visited the island, including a TSMC meeting, according to The Washington Post. China objected to the visit and began five days of live-fire military drills in areas near the country.

Investing in science and tech

Sen. Chuck Shumer, a Democrat from New York and major backer of the legislation, last week called the bill "one of the largest investments in science, tech, and manufacturing in decades." It'll create jobs with good pay, help unclog supply chains, improve US security and lower costs for consumers pained by inflation, he tweeted.

Rep. Tim Ryan, an Ohio Democrat, was among those who urged passage of the bill on the House floor, raising the specter of an even more dominant China without the funding. "China is outmanufacturing us – semiconductors, communications equipment, electric vehicles, batteries," he said. "You look at all these boats out in California. They're not coming from Kansas. They're coming from China. If we don't reinvest and bring these supply chains back here, we're going to continue to lose."

The chip industry was born in the US, but consolidation squeezed dozens of high-tech companies out of the business, most recently AMD and IBM. That left Intel as the largest US chipmaker, but over the last decade, it struggled to advance its manufacturing technology to keep pace with Moore's Law.

Those struggles paved the way for the rise of TSMC in Taiwan and Samsung in South Korea, both of which make processors for other companies like Apple, Qualcomm, AMD, Nvidia and MediaTek through a foundry business. About 12% of chips are made in the US today, down from 37% in 1990, according to a 2021 Semiconductor Industry Association report.

The CHIPS Act would fund several suppliers of chipmaking equipment and materials, but arguably the biggest beneficiary are those who actually manufacture the processors by etching microscopically small electronic circuitry onto silicon wafers.

Intel Chief Executive Pat Gelsinger lauded the House and Senate votes. "This investment will shape the future of America's leadership in semiconductor manufacturing and innovation. We are excited to move full speed ahead to start building #IntelOhio," Gelsinger tweeted, referring to a new Intel chip manufacturing site. Intel canceled a groundbreaking ceremony earlier in July as part of its effort to push Congress to pass the CHIPS Act. Intel lost its technology lead to TSMC and Samsung and is suffering financially as it tries to claw its way back.

A new leading-edge chip fabrication plant, or fab, costs about $10 billion. Intel has said the CHIPS Act would cut about $3 billion off that price tag. It's investing heavily new new fabs in the US, including with $20 billion spending for a new "megafab" in Ohio that eventually could rise to $100 billion.

Spending $52.7 billion should help US processor manufacturing, but don't assume that'll mean a complete disconnection from Asia. The Boston Consulting Group expects it would cost $350 billion to $420 billion to create a self-sufficient semiconductor supply chain in the US. And that cost runs contrary to the capitalistic impulse to reward the least expensive suppliers.

But the idea behind the CHIPS Act is more independence from Asian manufacturing, not complete independence. And TSMC and Samsung, both building new fabs in the US, also could benefit.

To help ensure the CHIPS Act's passage after weeks of political machinations, sponsors reshaped the bill with funding for the National Science Foundation, National Institute of Standards and Technology, and Commerce Department for basic and applied research. Including that work, the legislation would appropriate $280 billion.

After a year of partisan wrangling that had left the bill stalled, the chip industry is now delighted with the progress. "The CHIPS Act will help usher in a better, brighter American future built on semiconductors, and we urge the president to swiftly sign it into law," the Semiconductor Industry Association said in a Thursday statement.

The CHIPS Act's investment tax credit and subsidies will be crucial steps to "bolster the semiconductor supply chain based in the United States and keep pace with industry incentives offered by other regions," said Ajit Manocha, chief executive of trade group Semi, in a statement last week.