If you owe the IRS money, you may wonder if you can pay your tax bill with a credit card. The answer is yes -- but that doesn’t mean you should.

Paying your tax bill with a credit card results in processing fees and potential interest charges if you’re unable to pay off your balance in full at the end of the month. But there are a few cases where it may be worthwhile, particularly if you can earn a high welcome bonus or offset fees with the rewards you earn.

Before reaching for your credit card, make sure you understand all of the costs and risks.

How do you pay taxes with a credit card?

If you’re filing your taxes online with a tax software provider like TurboTax or H&R Block, you can usually enter your credit card number directly on the software provider’s website when filing. You can also pay your taxes directly with the IRS online or by phone at 888-729-1040.

The maximum number of credit card payments you can make depends on your tax type. You might only be able to make up to two credit card payments per month, quarter or year. You’ll also have to pay a minimum $2.50 fee depending on the processor and amount owed.

How much does it cost to pay your taxes with a credit card?

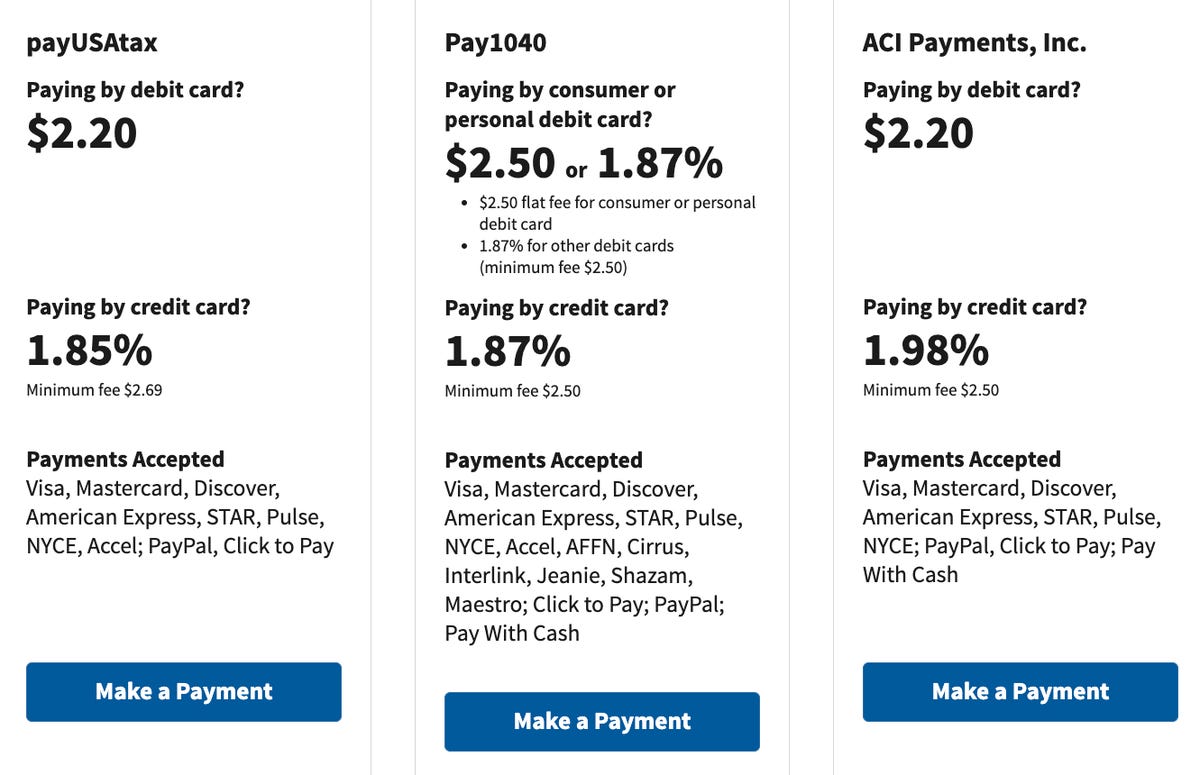

The IRS lets you pay your taxes through a third-party processor, but there’s a fee. The charge will vary depending on the payment processor. Here’s a breakdown based on the processor and the credit card fee, depending on the payment amount from the IRS.

Processing fees for credit card tax payments

| Tax payment | payUSAtax | Pay1040 | ACI Payments |

|---|---|---|---|

| $50 | $2.69 | $2.50 | $2.50 |

| $100 | $2.69 | $2.50 | $2.50 |

| $250 | $4.63 | $4.68 | $4.95 |

| $1,000 | $18.50 | $18.70 | $19.80 |

| $2,500 | $46.25 | $46.75 | $49.50 |

| $10,000 | $185 | $187 | $198 |

Many tax software providers, such as TurboTax and H&R Block, also charge their own processing fees for credit card payments or may simply pass on the processing fee from the IRS to you. It’s generally more expensive to use a credit card to pay your taxes with a tax software provider than it is to pay via the IRS portal directly.

Can you pay estimated taxes with a credit card?

Freelancers, side hustlers and business owners who earn wages that do not have taxes withheld are on the hook for making estimated tax payments to the IRS four times a year. If you fall into this category, you might be considering using a credit card to maximize cash back, points or miles on your favorite credit card.

We only recommend doing this if you can earn more in rewards than you’ll pay in processing fees. The IRS lets you use a credit card to pay your estimated taxes -- IRS form 1040-ES -- twice per quarter. So if you normally make monthly or bi-weekly payments to the IRS and want to start using a credit card, you’ll want to instead limit your estimated tax payments to once or twice per quarter.

Read more: Side Hustle Taxes Are Complicated. 5 Tips I Wish I Knew When I Started Freelancing

When should you pay your taxes with a credit card?

It may make financial sense to pay your taxes with a credit card if:

The rewards outweigh the costs

The biggest perk of paying your taxes using a credit card is the rewards you’ll earn. For instance, if you’re paying $1,000 in taxes using a flat-rate 2% cash back credit card, you’ll earn $20 cash back. But depending on the processing fee, you may barely break even because the fee ranges between $18.50 and $19.80.

A welcome bonus will offset IRS fees

If you’re opening a new credit card with a welcome bonus, you may be able to meet the spending requirement for it by paying your taxes. This option may be more lucrative in comparison to paying your taxes using a credit card you already have.

For example, let’s say you open the Chase Freedom Flex℠* to earn a $200 bonus after you spend $500 on purchases in your first three months from account opening. If you use this card to pay a $1,000 tax bill within the three-month time frame and earn the $200 welcome bonus, it may be worthwhile. After you subtract the IRS processing fee, you’ll essentially earn about $180 with the bonus.

You need some breathing room

While we don’t advise taking on credit card debt if you can’t repay the balance in full when your next bill is due, a 0% introductory APR credit card can be helpful when used responsibly. If you need more time to pay your tax bill in full, you could save on interest by using a 0% introductory APR card.

Many 0% introductory APR cards offer 12 to 20 months’ worth of reprieve from interest. Just make sure you can pay off the balance in full before the 0% introductory period ends -- otherwise, the interest charges you’ll accumulate may cost you much more than an IRS payment plan would.

Drawbacks of paying taxes with a credit card

You can’t avoid processing fees

Whether you’re paying with a debit or credit card, you’ll be charged a processing fee by the IRS. And the credit card processing fee is higher than you’d pay by using a debit card. For example, if you’re paying $2,500 in owed taxes using payUSAtax, you’ll pay a $2.20 processing fee with your debit card but $46.25 with your credit card -- a big difference that may not be worth it, depending on your goal for paying with your credit card.

And, if you can afford to pay the bill in full, you can avoid processing fees altogether by paying directly from your bank account rather than entering your debit card. You’ll just need to provide the IRS with your account and routing numbers.

Your credit utilization ratio may increase

Depending on your credit limit, you may increase your credit utilization ratio if you pay your tax bill with your credit card. For instance, if your card limit is $2,000 and your taxes are $1,600, the high utilization may cause your credit score to drop.

Most experts recommend keeping your credit utilization below 30%. So if you’re planning to pay your taxes with your credit card, you should use one with a much higher limit than your tax bill, or pay as much of the tax bill as you can, then charge the rest to your credit card to keep your credit utilization lower. Either way, do your best to pay the balance in full by your payment due date to avoid the higher balance being reported and paying interest.

Alternatives ways to pay your taxes

In almost all cases, we don’t recommend paying your taxes with a credit card if you’ll be unable to pay off the balance right away.

“For those who can’t pay their taxes, the IRS charges a lower interest rate than conventional credit cards,” says Los Angeles CPA Rob Seltzer, referring to the agency’s payment plans. If you need more time to file, you can also look into filing an extension with the IRS -- but even with an extension, you may incur penalty fees if you don’t pay on time (this year’s due date is April 18).

Before signing up for a 0% introductory APR credit card, consider an IRS installment plan. The IRS offers payment installment plans to help spread out your tax payments. You can choose between short- and long-term plans, depending on your needs. There are setup fees for these plans, and rates vary depending on your installment plan and whether you apply online, via phone, by mail or in person. If you pay any portion of your bill after the due date (April 18, 2023, for most), you’ll incur interest and penalties. However, interest rates the IRS charges for late payments and late filing are much lower than average credit card APRs.

Even though you may not be able to earn rewards or avoid fees with IRS payment plans, you’ll be able to stretch your payments over time. And it’s a good way to avoid credit card debt if you can’t pay the bill in full right away.

The bottom line

You can pay your tax bill with a credit card, but it’s not always the best option. We recommend doing the math first to make sure any potential rewards or welcome bonuses are higher than the processing fees you’ll pay. If you need more time to pay, a 0% introductory APR card can help -- but we suggest comparing this option to an IRS installment plan to find the best payment method for your financial situation.

Recommended Articles

*All information about the Chase Freedom Flex has been collected independently by CNET and has not been reviewed by the issuer.

The editorial content on this page is based solely on objective, independent assessments by our writers and is not influenced by advertising or partnerships. It has not been provided or commissioned by any third party. However, we may receive compensation when you click on links to products or services offered by our partners.