Why You Can Trust CNET

Why You Can Trust CNET Advertiser Disclosure

'Paying for the Rest of My Life.' Student Loan Debt Is Crushing an Entire Generation

Millennials are lagging behind the financial milestones of their parents -- and it's not their fault.

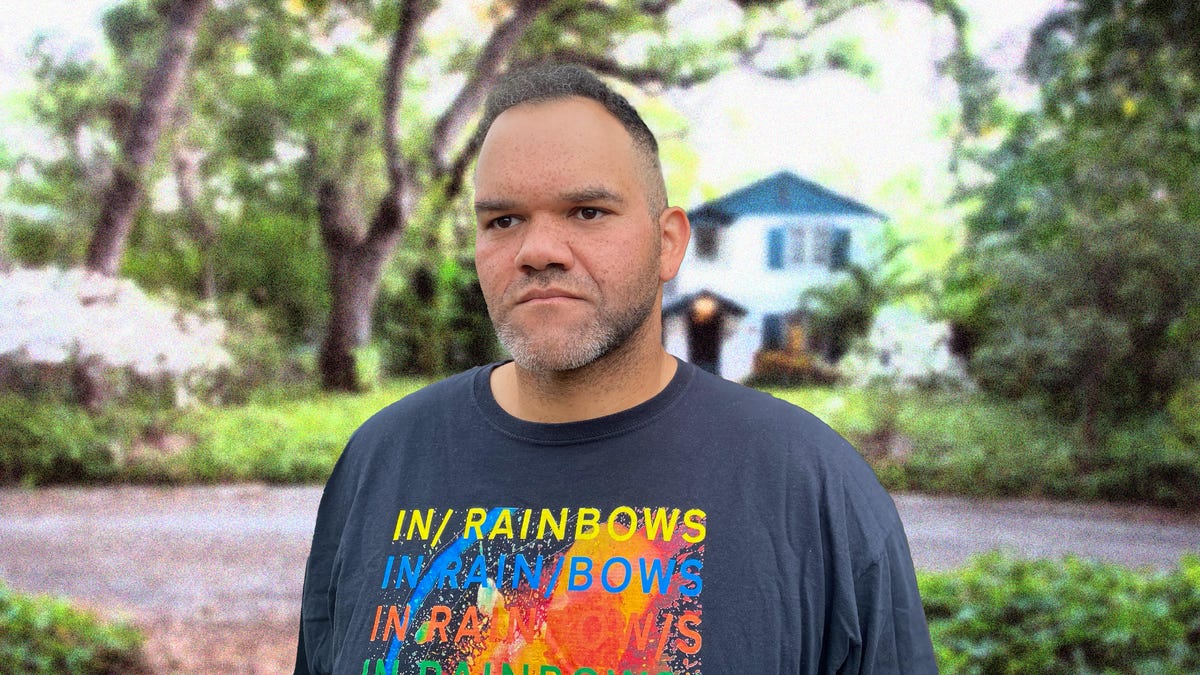

After earning a graduate degree from Syracuse University in 2009, Nick Shekeryk faced a total of $93,000 in student loan debt.

Then, last year, he accomplished something that tens of millions of borrowers from his generation haven't been able to: He paid it all off.

His student loan journey had been anything but smooth up to that point. For over a decade, due to his high balance, monthly payments were eating up a considerable portion of his budget. Because of loan interest, he could barely make a dent in his principal, and couldn't put money aside for savings or investments. The burden of debt was affecting his relationships, making it impossible to plan for the future. "I was prepared to deal with it for the rest of my life," Shekeryk said.

Well into their adulthood, millennials are finding it impossible to achieve the financial milestones of their parents or grandparents. A 2018 study published by the Center for Household Financial Stability found that those born in the 1980s face the greatest risk of becoming the "lost generation" for accumulating wealth. Young adults today face declining mobility, decades of stagnant wages and broader economic uncertainty. Millennials also have the highest debt burden, making them especially susceptible to financial instability.

After meeting with a financial adviser in 2020, Shekeryk and his wife decided to take advantage of the pandemic-era pause on student loan interest and payments, and threw every spare penny at knocking down the balance to zero. "I'm fortunate to be making enough money in a two-income household that we were able to do it," Shekeryk, now 37, said. "We didn't have kids yet -- some people don't have the same luxuries."

Student loan debt stunts financial stability

As of 2021, there were nearly 45 million student loan borrowers in the US, with the average debt per borrower at more than $31,000. While the White House's recent student debt cancellation plan was welcomed by many, for other borrowers struggling with high monthly payments and ballooning balances, the partial relief barely makes a dent.

On average, tuition costs have tended to increase around 8% per year, according to Finaid, which means the total cost of a college education doubles every nine years. The dramatic rise in debt from higher education costs has a profound collective impact on young adults today, both economically and socially, creating a widening wealth gap when compared to previous generations.

According to Anya Kamenetz, author of the 2006 book Generation Debt, student loan debt is "a significant headwind" for millennials, who range from their mid-20s to early 40s. Student loan debt undermines prospects for wealth building and means "waiting longer to get married and have children, making people less likely to own a home, start a business or leave their hometowns," Kamenetz said.

Moreover, because the labor market as a whole is more unstable, getting a four-year college degree doesn't provide the same job stability as it did a generation ago, according to Natasha Quadlin, an associate professor of sociology at the University of California, Los Angeles. While it can still open doors and increase career opportunities, there's no guarantee that a college degree will lead to reliable income, unlike with older generations.

What's more, college degrees don't help shrink the income gap between workers of different racial and ethnic backgrounds. In fact, the disproportionate debt that Black students take on to finance their education reinforces the racial wealth gap, according to the Brookings Institution.

Another factor in the millennial wealth gap is the fact that younger generations are facing higher health care expenses and soaring costs of living while earning significantly less. A 2019 report from the think tank New America showed that median earnings for workers between 18 and 34 years old were 20% lower than they were for the baby boomer generation at the same age. The study noted that "millennial families feel burdened by debt, disillusioned by the eroding social contract, and frustrated that the promise of the American Dream and financial stability seem out of reach."

And now, many households are facing two generations of student loan debt -- millennial parents and their older Gen Z children. According to Kamenetz, this could lead to new challenges, with more college students "trading down" on their dreams, attending community college or trade school or taking longer to graduate.

A debt that feels like forever

Student debt has stymied the long-term goals of Jess Meoni, a 32-year-old graphic designer from Scranton, Pennsylvania. Meoni earned her undergraduate and graduate degrees from Marywood University, and racked up a total of $50,000 in debt -- and that's after receiving scholarships and tuition benefits for working on campus.

Because her parents didn't go to college, Meoni didn't have a lot of guidance when it came to paying for her education. Still, she felt she had a solid grasp on how much debt she was taking on to go to school, and figured it was necessary to achieve her career goals. "I wasn't oblivious to the costs," she said. "However, I was worried about other things at the time. I wanted to be a graphic designer, and thought I couldn't get a job without a bachelor's degree."

Like Meoni, students graduating from high school today often feel they have no choice in paying the sticker price for a four-year degree since it seems to be the only path to viable employment. Yet, since these borrowers are young, they can't always gauge the full financial burden that they're assuming for decades into their adult lives. Being responsible for regular monthly payments of hundreds of dollars, or using a large percentage of take-home income to pay off debt, isn't always tangible for an 18-year-old.

Combine that with the fact that students exist in a competitive environment, often encouraged by their parents and guidance counselors to attend the most expensive, high-ranking university. "You have this dynamic of families and students pushing for more of everything, and then the family is left wondering how they'll pay for it," said Jennifer Finetti, director of student advocacy at ScholarshipOwl, an education technology platform.

Today, Meoni is chipping away at her remaining $27,000 student loan balance, paying around $500 per month -- more than her minimums, but less than she'd like to pay. "At this rate, it'll take a couple more years to pay off," she said. But, like other millennials, she's simultaneously paying down a car loan and credit card debt, too.

Meoni's student debt has made her set aside some of her bigger life goals. "I definitely don't think I'll ever buy a house," she said, noting her aversion to taking out any more loans. But sometimes, Meoni thinks the opposite. Since she'll be paying down debt for the rest of her life in any case, why not take out more?

Rewiring how we think about higher education

Both Shekeryk and Meoni said they would probably do things differently if they could go back in time, such as attending a community college for a couple of years to save on tuition costs. But Finetti noted how an affordable path doesn't always feel like an option, given societal stigma surrounding community college. In fact, enrollment in two-year colleges has dropped significantly in recent years, accounting for more than half of undergraduate enrollment losses since the pandemic.

"The bottom line is that students should be focusing on an affordable path to college," Finetti said. While President Joe Biden in August approved widespread student loan forgiveness of $10,000 or $20,000 for borrowers, Finetti noted that it's unlikely to happen again in the future. Plus, this measure only provides relief for student loans issued before June 30, 2022, so future loans do not qualify.

What can be done to combat the increasing wealth gap rooted in student debt? When it comes down to it, Finetti said the only thing that parents and students can do is explore all their options and be realistic about how student loans will impact their family's financial future.

But that's not always enough. Even with a practical approach, Finetti noted that "it's often far more expensive than they planned for."