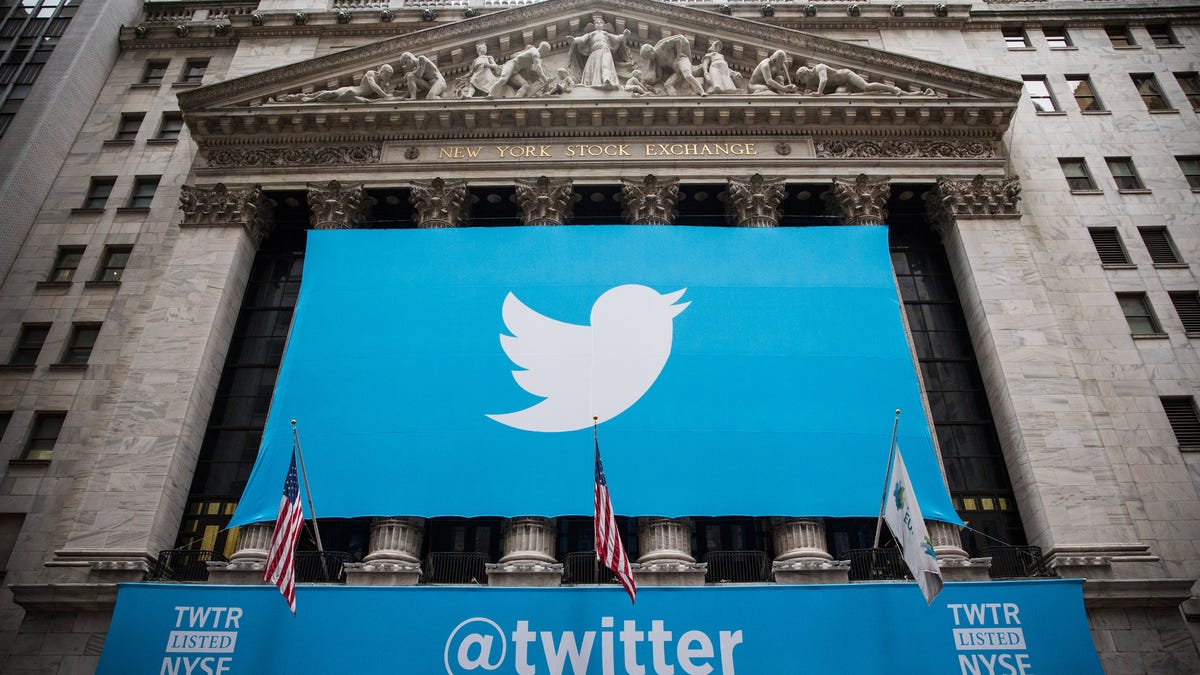

Twitter partners with S&P 500 on stock index that crowdsources public opinion

The S&P 500 Twitter Sentiment Index will monitor tweets to score public sentiment about publicly traded companies.

Twitter is teaming up with S&P Dow Jones Indices to give investors a broader view of opinions about companies they may be considering investing in.

The S&P 500 Twitter Sentiment Index launched on Thursday to measure public opinion of companies in the S&P 500 stock market index. Through the Twitter API, S&P analyzes both bearish and bullish tweets in real time to score the level of positive sentiment surrounding each company.

Conversations and opinions about companies posted on social media have had an increasingly significant impact on markets, as we saw in the "meme stocks" frenzy earlier this year, which saw stock prices surge due to individual investors sharing information on social media platforms such as Reddit.

"Social media is impacting the way information is being conveyed to investors," Peter Roffman, S&P Dow Jones Indices global head of Innovation and Strategy, said in a statement. "Factor-based indices are a popular strategy for passive investors, so we're excited to work with Twitter to bring this unique tilt to the S&P 500."

The Twitter Index will measure the sentiment performance of companies in the S&P 500 by analyzing tweets that mention the companies' $cashtag, which contain their ticker symbol (such as $TWTR), assigning a "z-score" that reflects sentiment surrounding each company. A training database is used to determine the likelihood that words in a tweet are positive or negative, and filters are applied to weed out spam tweets that could skew results.

The index will measure the performance of the 200 companies with the highest sentiment scores, taking into account float-adjusted market capitalization. A Sentiment Select Equal Weight Index will track the performance of the 50 S&P 500 companies with the highest sentiment scores.