The economics behind Amazon's possible set-top box gambit

A Wedbush Securities analyst believes the opportunity could be huge if the retail giant gives away its Amazon Instant Video service for a year to consumers who buy a set-top box.

Yes, Amazon makes the successful Kindle Fire tablet computer. And yes, it's reportedly considering offering a smartphone.

But a streaming video set-top box? Bloomberg reported Wednesday that Amazon plans to dive into that hardware business, citing "three people familiar with the project who aren't authorized to discuss it." What's Amazon thinking?

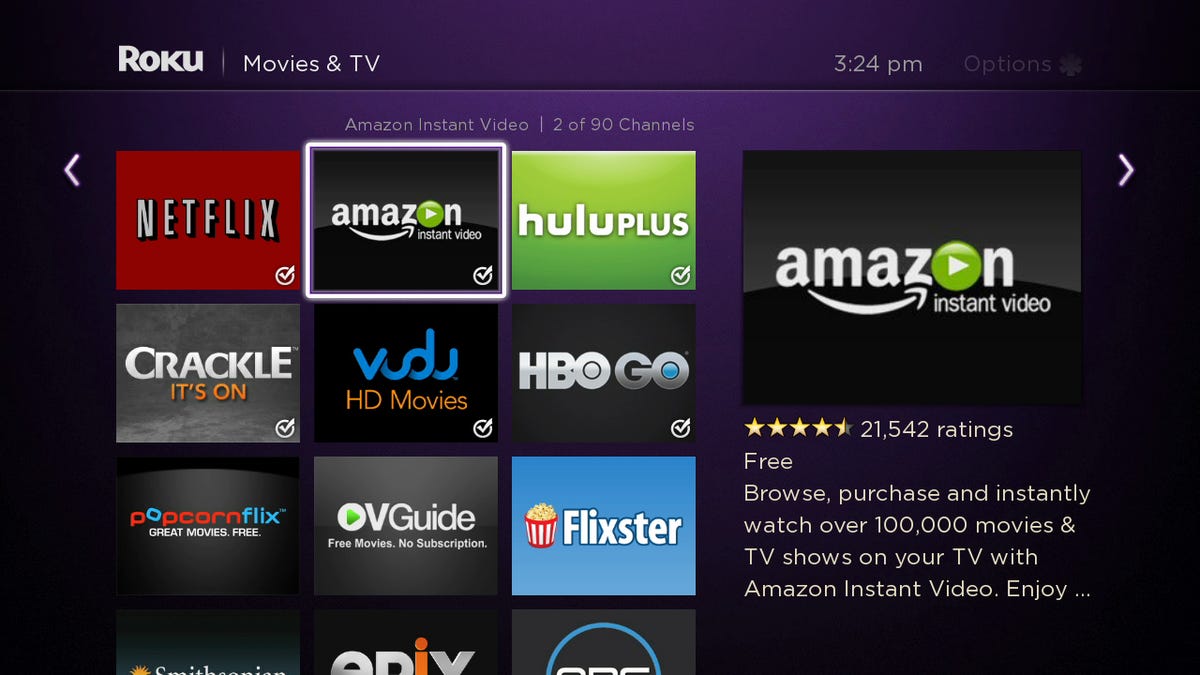

It's a crowded market already. Companies such as Roku and Boxee already make set-top boxes that can stream video content to televisions. Consumers can stream video from gaming consoles such as the Xbox 360 and the PlayStation 3. And they can catch streaming video through Apple TV boxes as well as TV sets made by Samsung, among others.

So where does that leave Amazon?

The online retail giant has a huge business with its Amazon Instant Video, a Netflix competitor. While Amazon doesn't offer much detail about the business, last month Morningstar estimated that Amazon Prime, the service that offers rapid shipping as well as streaming movies, tops 10 million subscribers.

What's more, Morningstar believes that number more than doubled in the previous 18 months, getting a huge boost after Amazon began giving away trials to the service with new Kindle Fire tablets.

Webush Securities analyst Michael Pachter believes the same strategy could be at work with Amazon's set-top box play. Here's his logic: If Apple, Roku, and others can make money on streaming media devices, so too can Amazon. The advantage Amazon has, though, is that it already provides streaming content. So if Amazon decides to give its set-top box customers Amazon Prime subscriptions for, say, one year, the company will be able to offer a better value than rivals even if they charge the same amount for the device.

Just consider the math. Pachter believes plenty of consumers would buy an Amazon streaming video box for $100, roughly what Apple charges for Apple TV, if it included unlimited streaming for a year. Amazon could then offer a second year of Amazon Prime for, say, $4 a month, a discount from the $79 a year it currently charges, in the hopes of retaining those customers. If each box generates $25 in gross profit, a number Pachter suggests is possible, while Amazon's streaming content costs remain largely the same, it's a huge opportunity.

"That means that Amazon can sell millions of boxes, make millions in profit, provide streaming to millions of additional customers, and have a chance to upsell them Prime," Pachter said. "Makes sense to me."

So is that what Amazon has in mind? An Amazon spokeswoman said, "We don't comment on rumors and speculation."

And where does that leave Amazon's partners, such as Roku?

"We don't comment on discussions with our partners," a Roku spokeswoman said. "We also don't comment on industry rumors and speculation."

Amazon reports first-quarter earnings after the market closes Thursday. It's likely that the company will face questions about the possibility of offering a set-top box then.