Survey: VMware, Red Hat to claim more IT dollars

The virtualization vendors will get more from CIOs' wallets, according to a new survey from Goldman Sachs, but which of these will get most is a matter of ambition.

IT spending may be tight, but chief information officers plan to increase their budget allocation to a select group of virtualization vendors, including VMware, Citrix, and Red Hat, according to a Goldman Sachs CIO survey released Monday.

It's not surprising that virtualization is top of mind and wallet for CIOs, but things look particularly rosy for Red Hat, given its position as the market leader in open source and a strong challenger in virtualization.

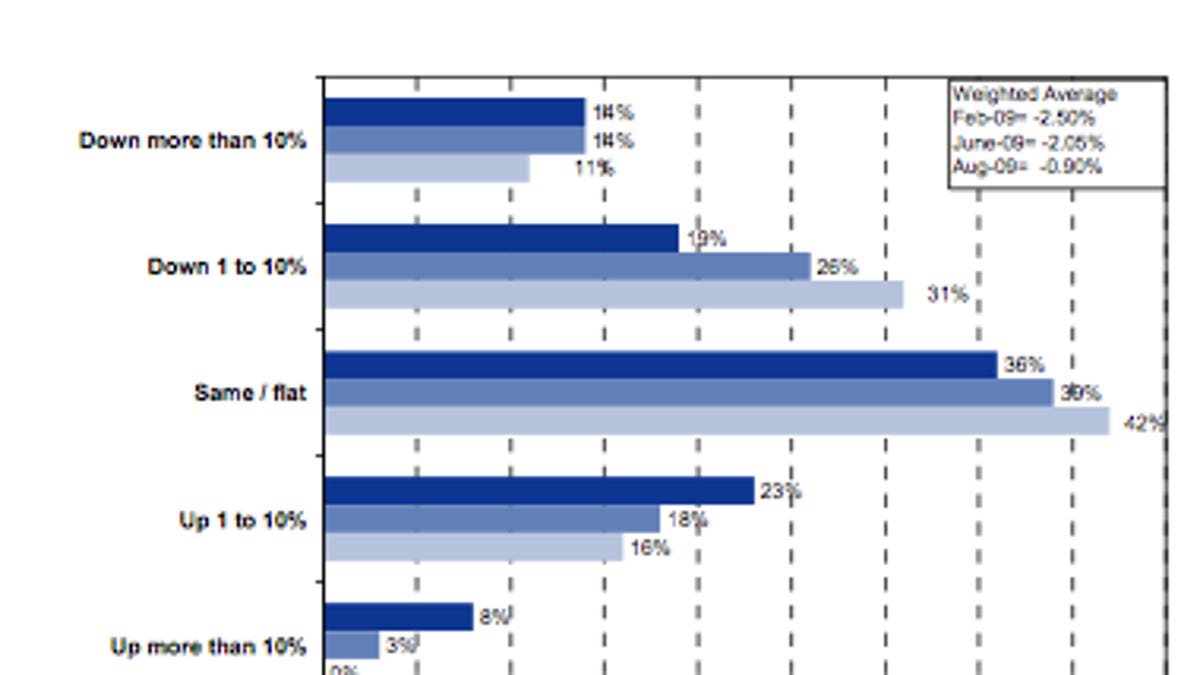

While the percentage of CIOs expecting to increase IT spending has grown since Goldman Sachs' last survey in June 2009, a full 69 percent expect to maintain or decrease their IT spending.

Against this backdrop, Goldman Sachs sees Red Hat boosting its share of IT spending as the open-source leader claims the lion's share of a Unix-to-Linux server shift that "remain(s) in the early innings." Equally important, Red Hat is seen as a critical integration and distribution point for other vendors:

Red Hat is positioned well for the emerging cloud-computing ecosystem, given its open-source background and current positioning in data centers, including enterprises as well as cloud providers such as Amazon. In addition, Red Hat's strategic importance to others is also increased by its platform capabilities that provide a beachhead for many other software products into the corporate data center. That being said, cloud computing remains a nascent opportunity with little revenue contribution to date and an increasing competitive landscape.

To date, Red Hat has mostly resisted the temptation to expand its product portfolio beyond the operating system, and directly adjacent opportunities like virtualization and cloud computing. However, as the company further strengthens its balance sheet and grows in confidence, we should finally see Red Hat use its dominant brand to give CIOs more reasons to pay Red Hat money.

Intriguingly, Red Hat may be pushed to this step by the increasingly ambitious VMware, which has far more cash and a strong interest in being the foundation for enterprise's cloud-computing technology. According to the Goldman Sachs report:

VMware is a leader in three important growth themes in IT: server virtualization, desktop virtualization, and cloud infrastructure. We also believe that as virtualization penetration increases, the company has an opportunity to take significant share of the large systems management software market. Microsoft's increasing focus on the space is a risk; however, our latest checks give us greater confidence in VMware's customer loyalty and the company's significant technology lead. We also see room for significant ongoing margin expansion as the company matures.

With the recent acquisition of open-source vendor SpringSource, VMware can deliver on the powerful "Build-Deploy-Manage" mantra that SpringSource championed to its 2 million developers.

Both companies should thrive as IT budgets remain lean. But which will ultimately benefit most is a question of execution and ambition.

Follow me on Twitter @mjasay.