Snap's shares crackle and pop

After much anticipation, Snapchat's parent company finally debuts on the stock market. It gets off to a fast start.

Snapchat is officially a public company.

Snapchat, the disappearing-photo app that's an all-consuming obsession for young people, is coming of age.

In one of the most anticipated tech IPOs in years, its parent company, Snap, went public Thursday morning, with a preopen share price set at $17.

That price didn't last long. Snap shares started trading just before 11:30 a.m. ET with an opening price of $24, a jump of 41 percent and a strong signal that investors are buying into the young company's promise. During the course of the day, the stock price came within a few cents of $26 before settling to close at $24.48, a first-day gain of 44 percent.

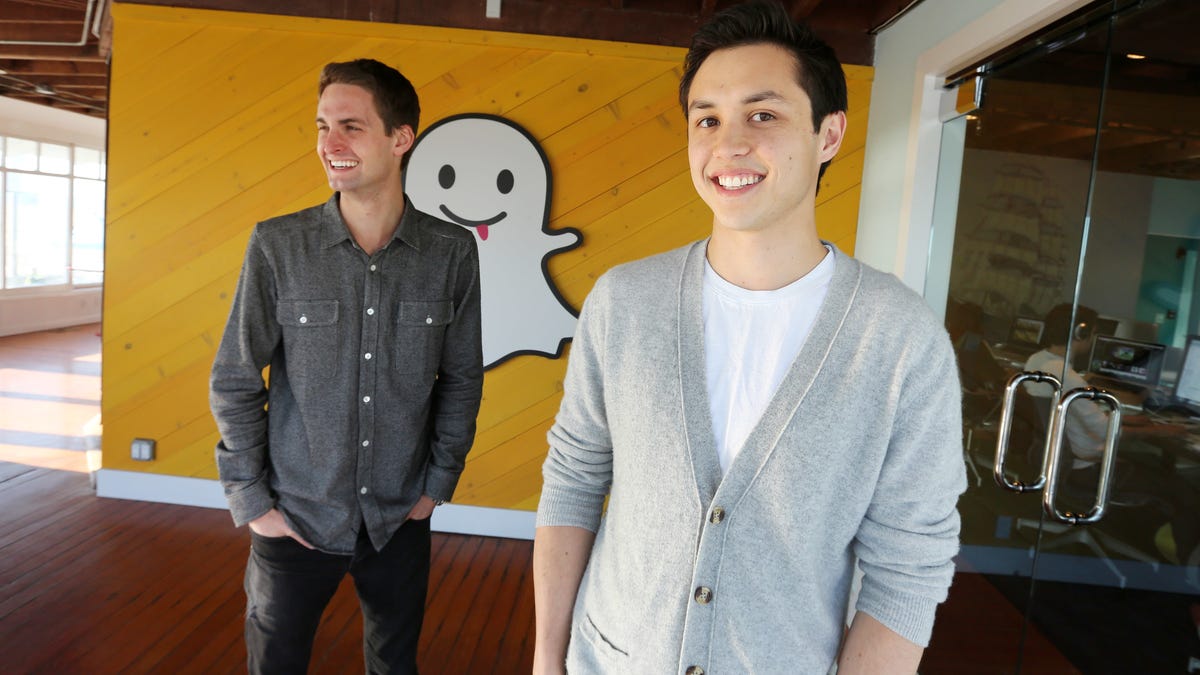

The co-founders, CEO Evan Spiegel and CTO Bobby Murphy, rang the opening bell at the New York Stock Exchange, where the shares are trading under the ticker symbol SNAP.

Snap is hoping to raise more than $3 billion with its IPO, money it's going to use to do things like hire more employees or make acquisitions.

If you haven't been keeping up, Snap has been one of tech's unlikeliest success stories in years. Started by Spiegel, a 26-year-old Stanford University dropout, the app was once dismissed as a sexting app before finding massive adoption among teens and young adults.

Now the Los Angeles-based social network is emerging as one of the biggest threats to Facebook and Twitter. Its claim to fame: popularizing casual social networking. Since posts quickly disappear, people don't have to worry about their photos and videos being around or impressive enough to stand the test of time. What Snap has shown is that people can feel comfortable posting anything, from the mundane to amusing.

And young people love it. Nearly 70 percent of all 18- to 24-year-olds in the US use the app, according to ComScore. More than 150 million people use the service every day.

That's why Snap has drawn the ire and envy of Silicon Valley's biggest companies. Most notably, Facebook is trying to duplicate its product mojo, with a near-identical clone of Snapchat Stories, which lets people post strings of videos and photos that self-detonate after 24 hours.

Still, the company has its challenges. In its IPO filing released last month, Snap warned of slowing user growth. That explains why Spiegel is hoping to convince investors it's not merely a social media company, but instead a "camera company."

'We are willing to take risks'

Snap has already released Spectacles, $130 sunglasses equipped with a camera to make it easy for people to post photos and videos to Snapchat. The company also reportedly has worked on a drone for photographing people from overhead.

"In the way that the flashing cursor became the starting point for most products on desktop computers, we believe that the camera screen will be the starting point for most products on smartphones," the company wrote in its IPO filing. "This means that we are willing to take risks in an attempt to create innovative and different camera products that are better able to reflect and improve our life experiences."

But even though Snap had a good first day on the market, that doesn't mean it's in the clear. Twitter, which went public in 2013, had a very successful debut on the stock market, with its shares popping 73 percent. Four years later, the company is struggling to get mainstream users beyond celebrities and media types and to make money off its products.

Facebook, on the other hand, had what many characterized as a disappointing first day on the market in 2012. Now, of course, it has almost 2 billion users and is a perennial Wall Street darling.

In a note to investors late Thursday, Aegis Capital listed a number of concerns about Snap's business, including the lack of an ecosystem, lack of a clear path toward profitability, the mix and targeting of ads, and "the ease by which ... Facebook has been replicating parts of Snapchat's product." It set a year-end target of $22 for Snap's shares.

Still, there's a positive in Snapchat's allure for young people. "We conducted extensive checks within the ad industry," Aegis' Victor Anthony wrote, "and find that marketers are enthusiastic about the prospects of creating ads to get in front of Snap's coveted demographic."

The thing to remember is that an IPO is just one day. Now that Snap is a public company, a new marathon begins.

"We built our business on creativity," Spiegel told the LA Times on Thursday after the shares started trading. "And we're going to have to go through an education process for the next five years to explain to people how our users and that creativity creates value."

First published March 2 at 6:55 a.m. PT.

Updated several times, most recently March 3 at 6:02 a.m. PT: On Thursday, added the opening share price for Snap shares and, later, the closing price for the day and analysis as well as more background information. On Friday, added comment from Aegis Capital.

CNET Magazine: Check out a sampling of the stories you'll find in CNET's newsstand edition.

Batteries Not Included: The CNET team shares experiences that remind us why tech stuff is cool.