Recession-proofing your open-source company

It's hard to feel cheery about the economic outlook for 2008. That is, unless you're an open-source company, in which case perhaps you're recession proof. Perhaps.

Reading through Morgan Stanley's January 6 report entitled "There Will Be Blood," it's hard to feel cheery about 2008. That is, unless you're an open-source company, in which case perhaps you're recession proof.

Perhaps.

But with Morgan Stanley projecting a pullback in IT spending in 2008, and especially for hardware, being open source, by itself, won't save a company. (Note: The "Blood" report is available only to clients, thus there's no link for it.)

Open-source companies should be hedging their bets by making sure they have money in the bank and lots of customers. In a downturn, it may well be easier for open-source companies to acquire new customers than their proprietary cousins, but this doesn't mean it will be easy. Having enough cash to weather the storm is critical.

As for tech, generally, the reasons for a bleak outlook are several, according to the Morgan Stanley report:

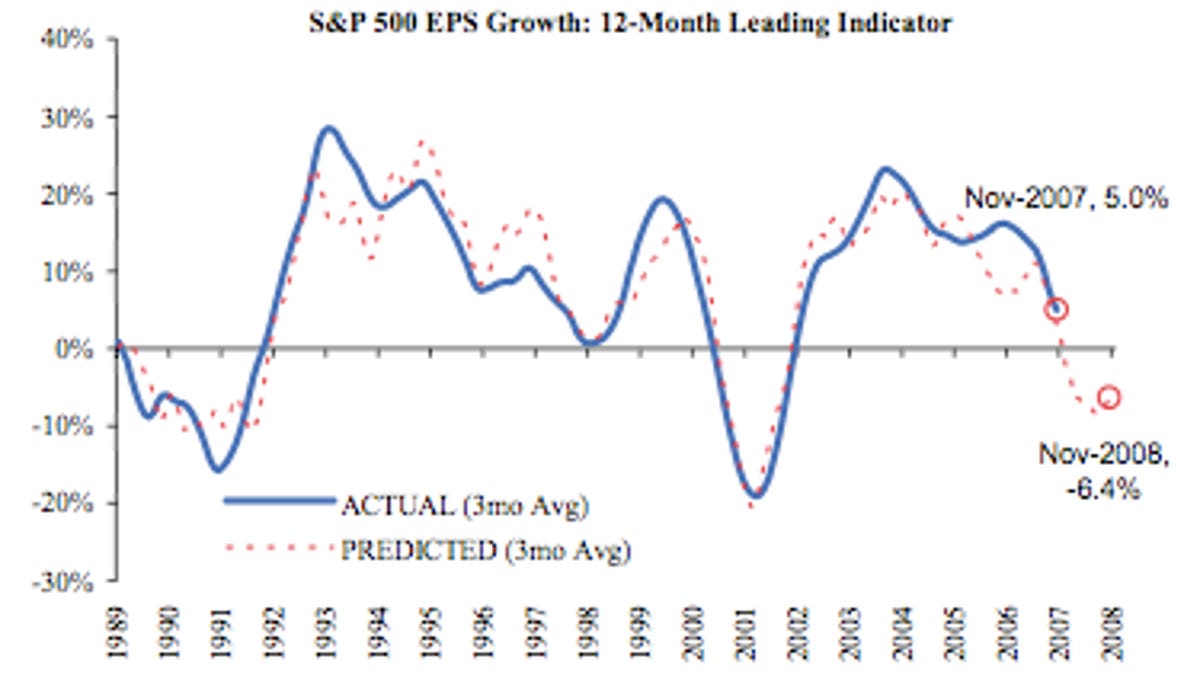

...(F)or technology there are three clear earnings headwinds. First, corporate profits lead business spending on equipment and software, and more than 50 percent of U.S. business spending is tech related. More important, the sector whose earnings are most important for tech spend is financials, and a 30 percent drop in financials earnings and diminishing prospects of a rapid turnaround suggest that tech budgets are vulnerable to cutbacks. Second, tech hardware and semiconductor earnings are highly leveraged to utilization. Slowing order momentum as corporate tech spend slows and consumer discretionary spend weakens will force utilization rates lower. Finally, the sector has the highest exposure to foreign earnings and has been a huge beneficiary of dollar weakness. A turnaround in the dollar will be an added drag.

Added to this, PricewaterhouseCoopers surveyed a range of U.S. executives of multinational companies and finds a significant softening of confidence in the U.S. economy. (See PWC's "Management Barometer: Business Outlook 3Q 2007" (PDF).) Interestingly, just as people tend to mistrust politicians but not their own elected officials, PWC's survey finds that "despite uncertainty about the US economy, 83 percent of (respondents) expect revenue growth in 2007, with 34 percent expecting double-digit growth and 49 percent expecting single-digit growth."

Sorry, people, it just doesn't work that way. If the economy tanks, everyone gets wet. Not just "everyone else."

In other words, now is a good time to seek shelter from a potential storm. That shelter comes from building a profitable, viable business and not letting spending run unchecked. Downloads won't save an open-source company. Customers will.

Incidentally, Morgan Stanley is recommending the following companies as "safe"(r) investments during a likely downturn: Accenture, ADP, eBay, Google, Microsoft, and IBM. Nobody gets fired for betting on Google, Microsoft, and IBM. They are the three easiest choices to make in technology. And I'm guessing that eBay makes the list because it becomes an acquisition point for customers who can't afford to buy retail during a downturn.

In sum, now is a great time for open-source vendors to get a round of financing before they need it. There will be money available during a downturn, but it won't be cheap.