Why You Can Trust CNET

Why You Can Trust CNET Advertiser Disclosure

Preparing for an emergency: How to document your belongings

Speed up the insurance claim process by cataloging your possessions in advance.

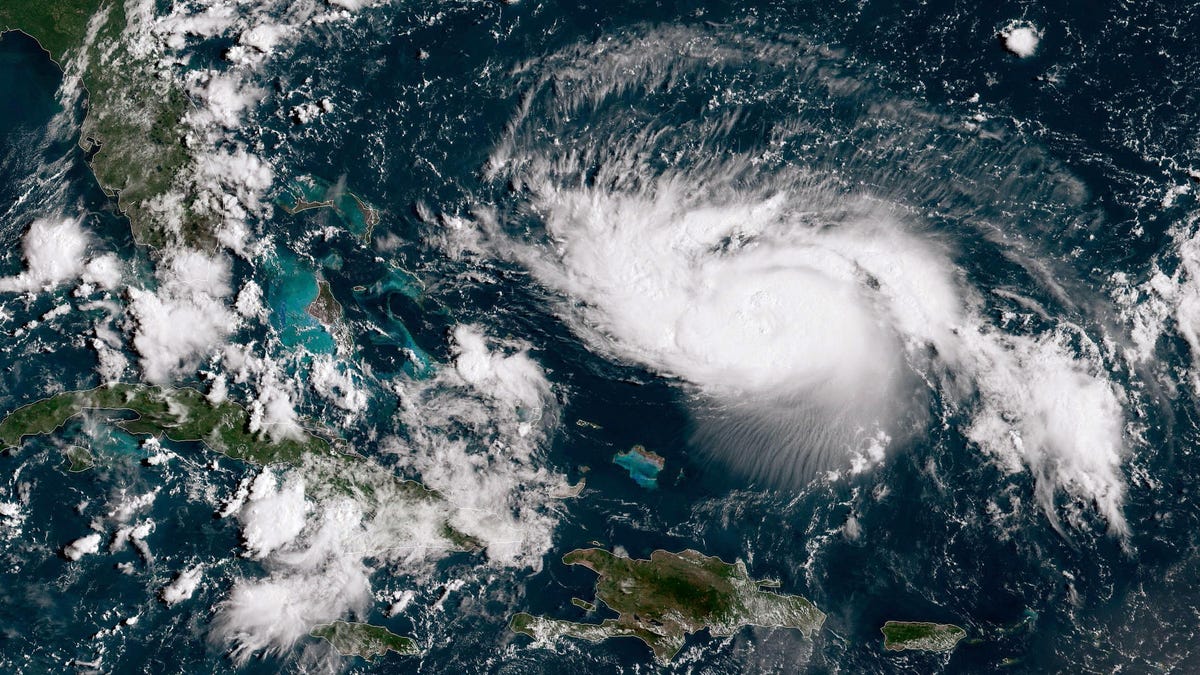

With advance warning of a hurricane, you can start documenting your home inventory.

Documenting your stuff is a pain. But doing so before a catastrophe -- whether it's an accident, theft or natural disaster -- will make dealing with the aftermath, and filing a claim with the insurance company, a whole lot easier.

If anything in your home is stolen, damaged or destroyed, your insurance company will want to know exactly what needs to be repaired or replaced. Not having a record means relying on your memory to reconstruct the details, which is less convincing, not to mention difficult.

Documenting your belongings with photos and detailed notes means you always know what's there. If you have to file insurance claims, it can help speed up the process. The better your inventory is, the faster your claims will get approved and processed.

Here's what to do to get started.

How to create a home inventory

Even for minimalists, the notion of cataloging every single thing in your home can be daunting. But there are plenty of tools and strategies to make this task more manageable.

Do it yourself

1. Create a folder. This should live in the cloud since that's easily accessible if your computer or phone gets lost or damaged. Google Drive can house your details and your images, but any cloud storage option will work. We recommend keeping a backup on a thumb drive just in case. If you decide to use an app, make sure you have an alternative method of accessing your documents, like downloading your inventory to a Google Sheet.

2. Use a spreadsheet. Keep a record of the item: the make, model and serial number. If you can, include when and where you bought it and how much it cost, or include a link to the product, if applicable.

3. Separate your belongings by category or room. There are many ways to catalog your things, so take the route that's easiest for you. You might put your appliances on one sheet and furniture on another. You may opt to list items by type (appliance, furniture, jewelry, etc.) or by room. For example, you could create a sheet for each room in your house and list the items contained there.

4. Record smaller items. Clothes may not seem important to document, but you wear them every day. Don't overlook smaller items that you would need to replace in the event of an emergency. You can catalog these items by general description and quantity, like how many pairs of jeans, coats and shirts you own. If you're a shoe collector, consider keeping these separate with their own details, like the designer, cost and when you bought each pair.

5. Catalog receipts. Scan your receipts or make PDFs of your email receipts and keep them in a folder on your drive and the cloud. Any time you buy something, make sure your inventory list is updated.

6. Take photos. This shows the accuracy of your inventory list. It can both showcase your possessions and document how they looked and the condition they were in before you made an insurance claim. This might sound tedious -- especially if you're cataloging every pair of shoes you have -- but it's an added layer of proof and protection.

7. Go through every room. You may not think your bathroom has a lot of expensive things, but if you bought a nice vanity for a few hundred dollars, it's worth noting. Don't forget your garage, laundry room, attic, basement, shed, etc.

8. Update as necessary. As you add to your home and buy new things, update your inventory list. And if you've recently sold some goods or offloaded things, adjust your document as needed.

Using an app

Why do all the work yourself when you can get an app to help walk you through the process? There are plenty of tools out there that offer some added security in case you switch insurers or just want to keep your information separate. A few popular ones include:

Add up to eight photos of each item, along with a serial and SKU number, expiration date, purchase date and other product details. You can break up items into folders, which is helpful when organizing your things by room.

Plans available:

- Free ($0): Add up to 100 items; limited to one user.

- Advanced ($25 per month): Add up to 2,000 items; up to three users.

- Ultra ($59 per month): Unlimited items; up to five users.

- Custom ($5* per month per user): Same features of Ultra; minimum of 10 users.

*When billed annually; if you pay month to month, the fees will be higher.

This app is available for most platforms, but its Google integrations work best with Android and Windows users. You can sync your inventory list directly to Google Sheets, letting you edit and share outside the app. Choose from premade templates or libraries to start your inventory build.

Plans available:

- Lite ($3 per month): 2GB cloud storage; unlimited entries and libraries; one user.

- Pro ($6 per month): 5GB cloud storage; unlimited entries and libraries; one user.

- Pro plus ($10 per month): 20GB cloud storage; unlimited entries and libraries; one user.

- Team ($5 per month per user): 5GB cloud storage per user (minimum of five users); unlimited entries and libraries.

You can also save money by paying annually, which brings the Lite plan down to $2.50 per month, the Pro plan to $5 per month and Pro plus to $10 per month. Team accounts cost the same monthly or annually.

Scan product barcodes to retrieve product information. For a one-time fee, you can use Nest Egg and have everything stored in the app or you can use Nest Egg Cloud for free. You can get an overview of your things from your dashboard, pull reports for specific categories and access information across multiple devices.

Plans available:

- Cloud free ($0): Add up to 100 items; limited to one device.

- Cloud standard ($3.99 per month): Add up to 600 items; access on up to two devices.

- Cloud enhanced ($7.99 per month): Add up to 1,000 items; access on up to three devices.

- Cloud professional ($15.99 per month): Add up to 1,000 items; access on up to three devices; allows access on up to two accounts.

If you want to try a paid option before committing, you can sign up for a free two-week trial.

Talk with your home insurance agent about your documents to see if you have enough coverage based on your inventory.

What to do when disaster strikes

Whether you live in hurricane territory like me or you face other types of natural disasters like earthquakes, tornadoes or wildfires, there's a chance emergencies can happen. Here's what to do:

1. Get to safety. If you're in your home and it's not safe, find a place to stay temporarily.

2. Contact your insurer. Call your insurance company and explain what happened.

3. Document the damage. Take lots of photos and videos of the damage as soon as possible. Don't throw anything away.

4. Save the receipts. Keep a record of all of your expenses related to the incident -- whether it's for supplies or temporary housing. And keep copies of all of the paperwork you send to your insurance companies in an easily accessible place (like your phone or computer).

5. Get ready for the adjuster. The insurance company may send an adjuster to your home to document the damage -- or you may just be given a form to complete. Either way, your home inventory list will come in handy. The more information you have about damaged items, the faster your claim can be settled.

6. Be mindful of others in your situation. If you're the victim of a disaster that's affected a large area, remember that you're not the only one going through the insurance process.

7. Use your adjuster to your advantage. Most insurance companies require claims to be filed within a year of the incident and most policies require adjusters to sign off on repair costs before they're complete. If an adjuster finds a quote too high, they can negotiate the price on your behalf. Likewise, if an adjuster comes out and doesn't do as thorough of a job as you would've hoped, contact your insurance company and ask for another visit.

8. Get your money. If you have a mortgage on the home, money for the housing structure (or dwelling) will go to your mortgage lender. If the contents of the home are damaged, like your possessions, you'll get a separate check for that.

You typically have two options for how to record your valuables during the claiming process: actual cash value and replacement cost. Actual cash value is the depreciated value of the lost or destroyed items. It doesn't replace the item, but it gives you an amount for what the item was valued at when it was destroyed. Replacement cost puts the value on what you'd pay if you were to replace the item. For this option, you'll usually get some money upfront and the rest after proof of purchase. If you don't replace it, you'll get the actual cash value. Most claims get paid out within 30 days.