New York Times can't build its pay wall alone

In switching digital content to a metered subscription model, the paper has stated it wants to make it an in-house operation--near impossible in a world where distribution is everything.

news analysis Following months of speculation, The New York Times announced Wednesday that it plans to begin charging for access to its Web site, with a flat fee required for frequent online readers of the legendary publication. This comes more than two years after the Times did away with TimesSelect, a subscription program that put much of its archives as well as popular opinion columns behind a pay wall.

The media, as usual, has jumped on the bandwagon of predictions, declarations of success, and premature doom-mongering. There's been a slow clap from Columbia Journalism Review's Ryan Chittum, as well as notable number-crunching from the likes of Reuters' Felix Salmon and TechCrunch's Erick Schonfeld about exactly how this means the company's business model will change, and how it can hope to profit from both advertising and subscription revenue.

Of course, we actually know very little about what the Times plans to do. The "meter" won't be turned on for nearly another year; no pricing has been disclosed, and the publication has obliquely said that "the amount of free access could change with time, in response to economic conditions and reader demand." There may even be a final result that blends monthly subscription models and an a la carte micropayment plan for purchasing individual pieces of content. We don't know yet, and there's a very good chance that the Times doesn't either.

The New York Times, to use a cliched analogy, wants to put a door in its pay wall. The complication is that this door will be able to move around and change in size in accordance with the Times' own augury of market patterns, which makes the whole thing sound like a piece of architecture you'd find in "Harry Potter." Plus, it may not even be the Times that's really calling the shots.

That isn't what the publication wants to hear. The Times' media columnist David Carr wrote in a blog post Wednesday that "what matters a great deal here is that the newspaper is building its own route to the sea of consumers." Carr points out that building the payment infrastructure in the first place does not fall under the traditional expertise of a media company, and that a partnership with the likes of Amazon or iTunes would have made the integration process of a payment system far easier for the Times in the first place. On the other hand, recent history has shown that the equivalent of an Amazon or iTunes in the deal could stand to benefit more than the Times itself would.

"Both Amazon and Apple see content as a kind of cheap, ubiquitous software to animate their business models," Carr wrote. "For The New York Times, the content is what we manufacture, at a very dear cost, and its best for the paper to control pricing and grow its database of consumers."

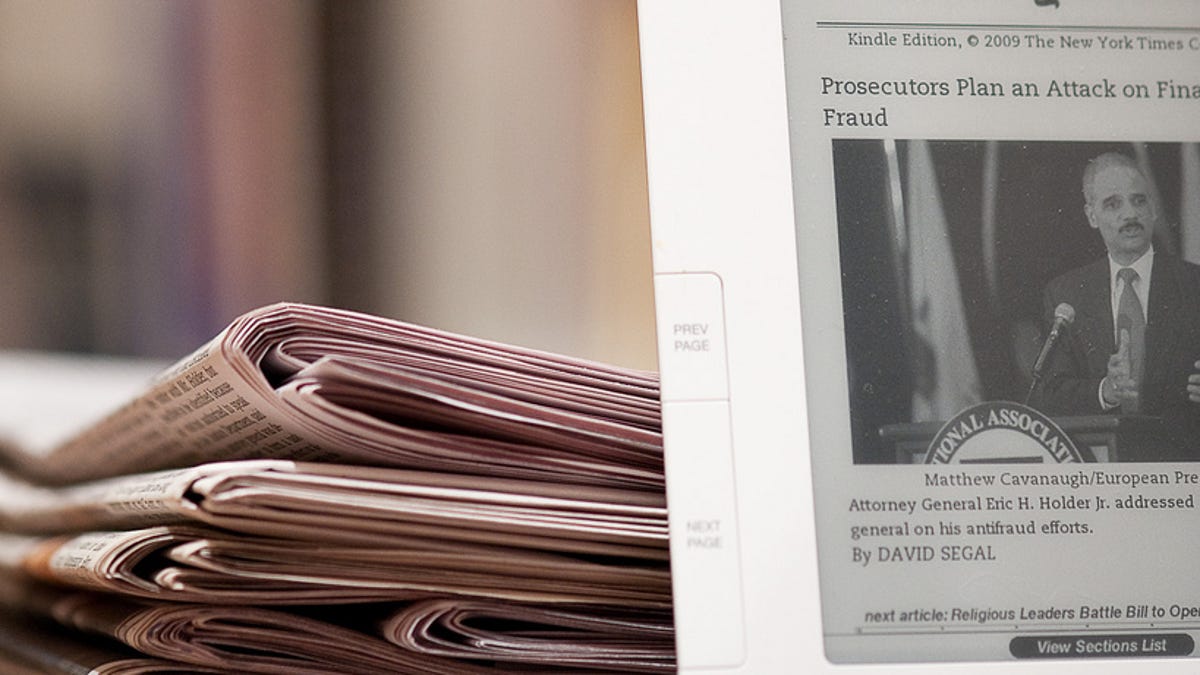

Carr is right. Just look at the music industry's not-so-infrequent grumbling about the cut of revenues that Apple takes from iTunes sales, or the fiasco over surprise book deletions (of Orwell's "1984," no less) on Amazon's Kindle. (The two tech giants are currently still changing their policies for e-book author royalties, as evidenced by an announcement from Amazon this week.) But failing to make those partnerships could be lethal for publishers like the Times, as it's going to be in their best interest to make paid access as ubiquitous as possible. Some media critics are already predicting "a black market for content" that would see news transformed into something much like the pirate booty of BitTorrent.

So, in moving to a restricted-access model on a Web where consumers have become conditioned to getting their news for free, the Times may need all the help it can get. And addressing digital distribution alone is nearly impossible. Even Facebook, the Web's quintessential we'll-do-it-ourselves player, aggressively courted developers to its API in order to build out the level of content hosted on Facebook's domain, and continues to woo third-party sites to its Facebook Connect product and brand marketers to its fan pages.

The Times will need to find ways to make readers want to pay, something which eluded it in the days of TimesSelect. While the News Corp.-owned Wall Street Journal has successfully stayed behind a pay wall, that's likely because readers have long since been conditioned to know that the respected business publication requires a subscription--and even still, some are calling the publication out for billing online and mobile access separately. The Times is no less prestigious, but online readers are used to getting that content for free. The transition means that the company may indeed have to make some concessions with regard to third-party technology and distribution, even though that doesn't fall in line with its vision.

The good news for the Times is that the likes of iTunes have made consumers far more comfortable paying for small pieces of content online. With Amazon's Kindle (where you can subscribe to the Times) and other e-book readers, not to mention Apple's allegedly forthcoming tablet device, there are more digital platforms than ever where the Times can sell its content. Going back to the iTunes model, Apple lured erstwhile BitTorrenters to iTunes by providing an experience that was easier, faster, and safer than illegal file sharing. The New York Times will have to do the same for its digital content, ensuring that it can build a successful new business model in the wake of significant competition from free media outlets, not to mention the possible emergence of that black-market content.

That's where it may have to build some bridges in that attempt to "reach the sea of consumers." Allowing multiple outlets for payment could pull in more potential subscribers, and deals with multiple handheld device or mobile software manufacturers could mean a more high-quality experience that the media company itself couldn't build. One could even see, perhaps, a partnership with Facebook for some kind of implementation of the social network's fledgling "credits" system that would push Times content out through the webbing of the "social graph." True, many of these companies operate "open" platforms, bringing all varieties of developer tools into the mix, these are still major corporations we're talking about. Deal making and content partnerships are still key.

Think about it: No record label has successfully sold its digital catalog on its own site, and in spite of the splashy debut of the label-backed Vevo--which, by the way, still required a Google partnership--YouTube remains the destination of choice for people who want to watch music videos. The created-in-house exception in the media business is Hulu, a joint venture between three major entertainment companies which, against everyone's expectations, has been very well-received as a hub for ad-supported, professional video content. But even that might not be working, as rumors of a switch to a subscription model for Hulu persist.

What it all may amount to for The New York Times is something that, like iTunes or the Facebook Platform, has quite a few hats in the ring. It's probably not the most ideal situation to get Apple or Amazon (or that great media industry bogeyman, Google) involved, as the publishing and music businesses have already shown, but the Times will be very lucky if it can get this "meter" ticking on its own brand value alone.

And as the company's Chairman Arthur Sulzberger, Jr. underscored when he said that the Times "can't get this halfway right or three-quarters of the way right...we have to get this really, really right," it's clear that this meter will be a bellwether, too. All eyes in the industry will be watching the Times--even those who haven't opted to get a peek behind the door of its pay wall.