Lenovo tops HP amid weak PC market

On a global level, Lenovo passed HP by a nose, though none of the top five vendors saw growth in PC shipments, according to Wednesday's IDC report.

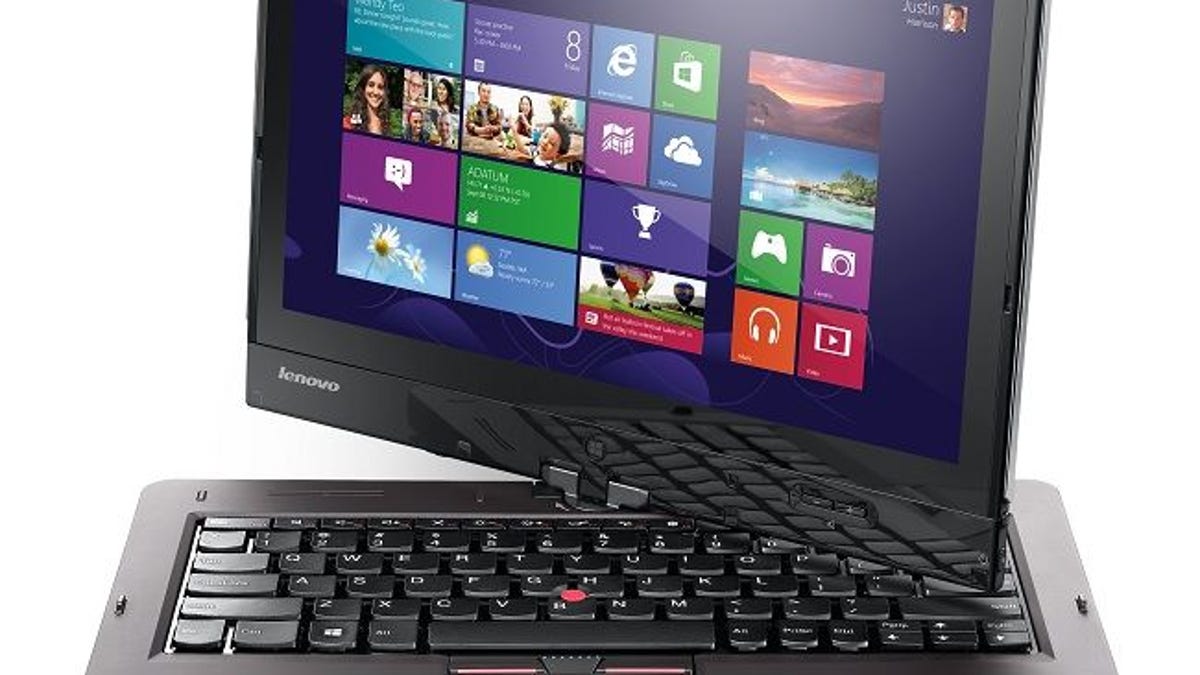

Lenovo is now the top dog in an overall struggling PC market.

Among the world's top five PC vendors, Lenovo fared the best this past quarter, showing only a 1.4 percent drop in PC shipments. That loss was low enough to give it a market share of 16.7 percent, according to IDC's Quarterly PC Tracker. Dropping to second place, Hewlett-Packard saw its shipments drop by 7.7 percent, earning a global share of 16.4 percent.

"Even in the toughest PC market ever, Lenovo has not only gained share, but we have steadily improved profitability and introduced even more innovative products for every market segment," Lenovo CEO Yang Yuanqing said in a statement. "The battle for PC leadership could certainly still go back and forth. But I am fully confident that there remains substantial room for profitable growth and groundbreaking innovation in the global PC marketplace."

Lenovo and HP have been duking it out in a market that's still on the ropes but seems to be fighting back.

Global PC shipments for the second quarter hit 75.6 million, a decline of 11.4 percent from the same period last year. But the numbers were slightly better than IDC had anticipated and not as bad as the 14 percent drop experienced in the first quarter.

Shipments in Europe, Africa (EMEA), and the Asia-Pacific region (excluding Japan) weren't as high as forecast, but those in the U.S. fared better than expected, balancing out the overall results.

The PC market is stuck in the middle of a transition from conventional notebooks to touch-based devices outfitted with

"With second-quarter growth so close to forecast, we are still looking for some improvement in growth during the second half of the year," IDC senior analyst Jay Chou said in a statement. "Still, the weakness in emerging markets is a threat to a core long-term growth area. In addition, while efforts by the PC ecosystem to bring down price points and embrace touch computing should make PCs more attractive, a lot still needs to be done in launching attractive products and addressing competition from devices like tablets."