IRS gives taxpayers one-day extension after payment site crashes

IRS direct payment website was down most of tax day. Now The IRS says taxpayers get an extra day to file and make a payment.

If you were waiting until the last minute to pay your taxes and were depending on IRS.gov to make a payment from your checking account, there's some bad news.

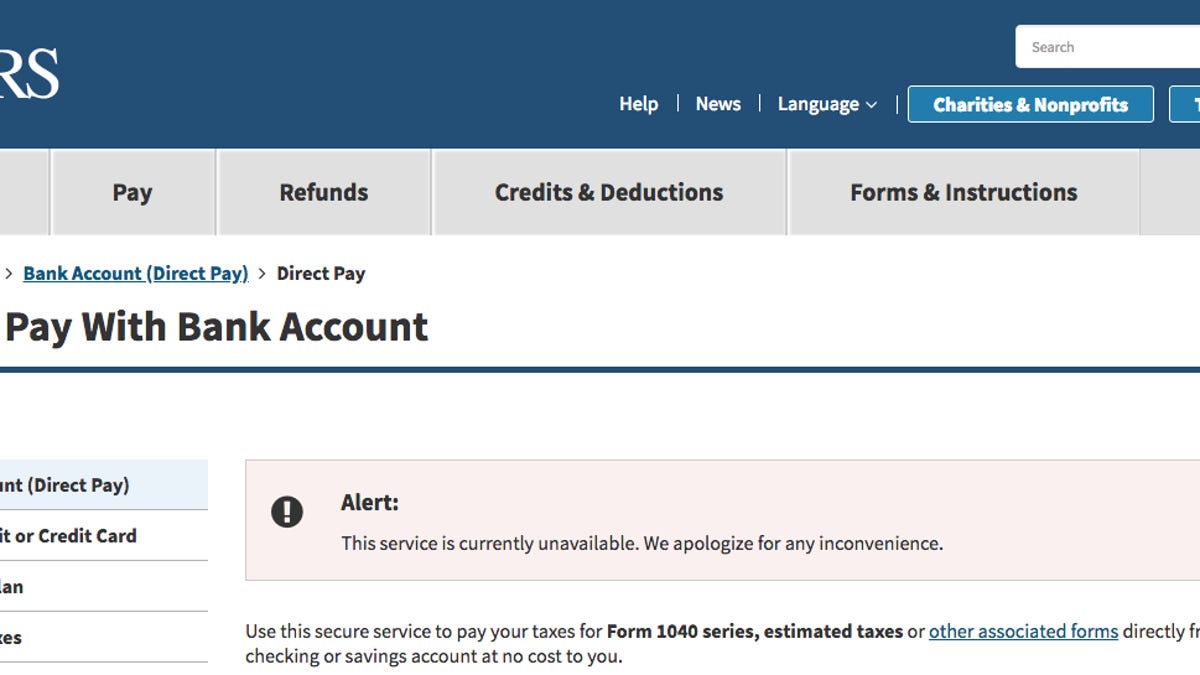

For most of Tuesday, the last day to file taxes, the Direct Pay section of the Internal Revenue Service's website wasn't working. Instead, people planning to pay electronically saw a message reading, "This service is currently unavailable. We apologize for any inconvenience."

Now there's good news -- of sorts. The site is working once again. And Treasury Secretary Steve Mnuchin told reporters Tuesday that Americans who couldn't pay their taxes because of the outage will receive an extension. The IRS later said that individuals and businesses with a filing or payment due date of April 17 will now have until midnight on Wednesday, April 18. Taxpayers need do nothing to qualify for the extra time.

Direct Pay is a service that lets taxpayers pay their estimated taxes directly via a bank account, free of charge. Paying with a credit card through the IRS site costs around 2 percent of the payment amount, starting at $2.50.

Earlier in the day, according to the Washington Post, IRS Acting Commissioner David Kautter acknowledged the problems in a House hearing. "We are working to resolve the issue and taxpayers should continue to file as they normally would," he said. He went on to note that the agency was also having difficulty processing electronic returns from services like H&R Block or Intuit's TurboTax.

While the problem persisted, both vendors had continued to accept electronic returns. At the time, an H&R Block spokesperson said, "We are encouraging taxpayers to continue to use our retail services or our do-it-yourself products as they normally would."

It was a similar story at TurboTax. "For those that prepared and filed their taxes with TurboTax earlier today, TurboTax is now submitting those returns to the IRS and is currently processing newly filed returns as normal," an Intuit spokesperson said after the government restored functionality to the IRS site.

Originally published at 9:41 a.m. PT.

Update, 1:34 p.m. PT: Added comments from Intuit and H&R Block.

Update, 2:20 p.m. PT: Adds Mnuchin's promise of tax extension to people who couldn't use IRS website.

Update, 4:01 p.m. PT: Adds additional comment from Intuit.

Update, 4:55 p.m. PT: Adds IRS extension information.

IRS website suffers partial outage on Tax Day: Read coverage at CBS News.

How to do your own taxes: The best (and cheapest) online tools.