How well does your ISP stream Netflix?

Netflix releases report about which bandwidth providers are tops at streaming films and TV shows over the Web. Charter comes in first. Clearwire finishes last.

As promised, Netflix released a report today on the company's tech blog about which Internet service providers are best at distributing the company's streaming video to customers' homes. According to Netflix's data, the nation's largest cable operators are tops in delivering the company's content.

Netflix, the high-flying video rental service, said cable operator Charter Communications was the best-performing Internet service provider, with Cox Communications, Comcast, Cablevision, and Time Warner Cable all outperforming phone companies AT&T and Verizon Communications, as well as wireless broadband provider Clearwire.

Ken Florance, Netflix's director of content delivery, wrote on the company's technology blog: "We find ourselves in the unique position of having insight into the performance of hundreds of millions of long-duration, high-definition video streams delivered over the Internet."

For January 15, the last date Netflix included in the report, the best-performing ISPs were as follows:

1. Charter

2. Comcast

3. Time Warner

4. Cox

5. Suddenlink

6. Cablevision

7. Cable One

8. Verizon

9. AT&T

10. BellSouth

11. Embarq

12. Windstream

13. Qwest

14. Century Tel

15. Frontier

16. Clearwire

Netflix's release of such a report is rooted in its dissatisfaction with ISPs that insist it pay all the costs of delivering streaming content to customers' homes.

"We think the cost sharing between Internet video suppliers and ISPs should be that we have to haul the bits to the various regional front doors that the ISPs operate," CEO Reed Hastings wrote. He then argued that ISPs should carry the bits the last mile to customers' homes, as it's their customers who are ordering Netflix's service.

By releasing the report, Netflix appears to be sending the message that it is prepared to try making some ISPs uncomfortable.

The performance data released by Netflix, however, makes it difficult to determine which companies Netflix may have been trying to embarrass. Comcast is one of the ISPs that has disagreed with Netflix on the issue of who should pay for "the last mile" of delivery to customers' homes, but the ISP fared well in Netflix's report.

Best and worst

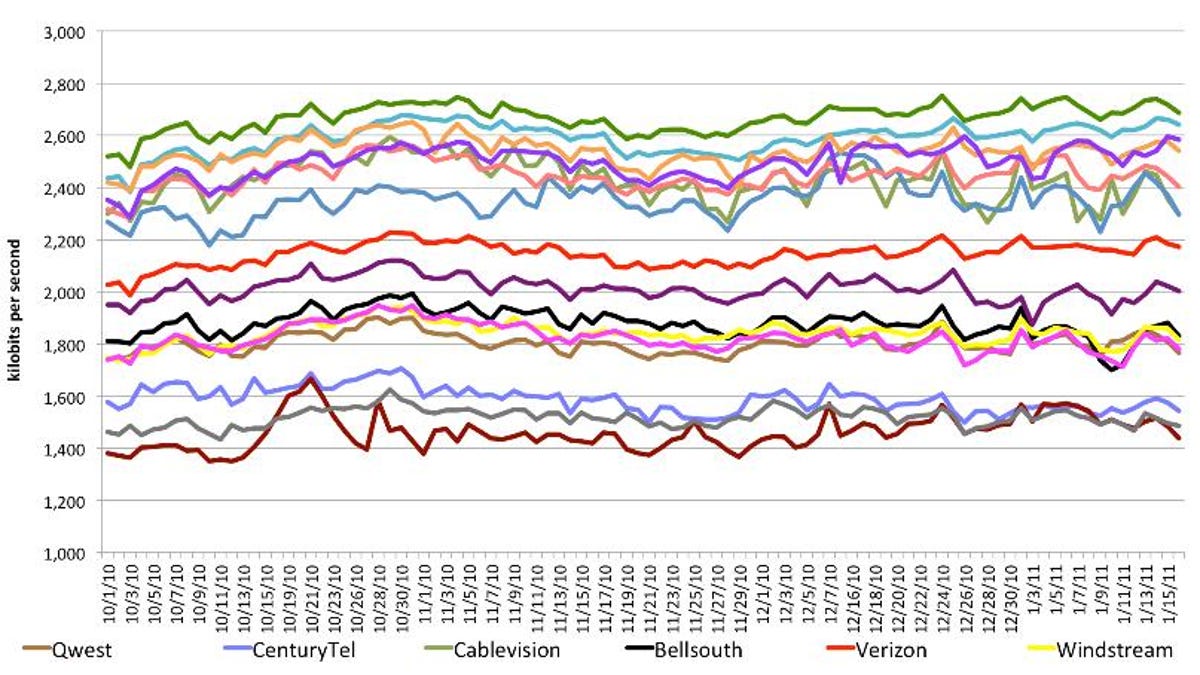

To get a handle on which broadband service providers offered the best service to Netflix's streaming-video customers, the company compiled data from October 2010 to January 15, 2011. Netflix tracked the performance of customers streaming high-definition video over their broadband connections. A time-weighted bit rate metric was used to represent the effective data throughput subscribers received over many of the top ISPs.

Content delivery director Florance explained that Netflix's top HD streams are about 4,800 kilobits per second. But it's likely that Netflix subscribers will switch through a number of bit rates, as they watch a movie streamed over the Internet. Sometimes, the streams ramp up to the highest bit rates, but when networks are congested, they shift down to lower bit rates.

Viewers cannot sustain a 4,800kbps bit rate from start to finish, Florance said. But the higher the bit rate that can be sustained throughout the viewing of the video, the better the performance and ultimately the better the quality of the image over the duration that the video is played at home.

Florance also pointed out that the quality of the video stream is affected by a number of factors, including which content delivery networks--or even which physical technology of the broadband network--are used by the viewer. This means that performance could vary between fiber-based Internet Protocol networks, DSL networks, wireless broadband, or cable networks. Regions of the country where infrastructure is better may also play a part.

In its study, Netflix averaged the performance of these network providers throughout their footprints. This means that Verizon's results include data about performance on its DSL network, as well as its faster Fios, fiber-to-the-home network. And AT&T's results include DSL, as well as its fiber-to-the-neighborhood U-verse service.

Charter came in first by providing an average bit rate of 2,667 kilobits per second over the three-month period evaluated.

"Charter strives to consistently deliver the fastest and most reliable Internet service," a representative said in an e-mail to CNET. "We're pleased that our efforts are paying off."

At the bottom of the pack, Clearwire delivered an average bit rate between 1,400Kbps and 1,600Kbps, Netflix reported.

The results should not shock anyone. On average, cable networks offer faster throughput on their broadband networks than either the phone companies or wireless broadband providers. With DOCSIS 3, cable operators are capable of delivering download broadband speeds up to 160Mbps. DOCSIS 3 is the next generation of cable-networking technology that allows operators to bond digital channels together to get faster throughput.

In areas where they have deployed their fiber networks, AT&T and Verizon are able to keep up with cable operators, in terms of download speeds. This is especially true of Verizon, which has spent billions of dollars over the past few years upgrading about 70 percent of its footprint with fiber to the home.

Fiber provides almost limitless broadband capacity. AT&T was not as aggressive in its fiber deployment, but the company has been able to significantly boost fiber deep into neighborhoods and get big boosts in performance.

The problem for each of these providers is that they are unable to provide these faster services to every customer. About 30 percent of Verizon's customer base will never get access to the Fios fiber service. Instead, these customers are only offered the slower DSL technology. And the DSL technology that is used to deliver broadband services for the phone companies in these areas cannot compete, in terms of speed, with cable offerings.

It's also not surprising that Clearwire's service doesn't perform as well as the cable or phone companies' broadband services. One problem with wireless is that network performance degrades the further away a user is from a cell tower. So customers on the edge of the network will get slower network connections than customers very close to the bay stations. This likely factors into the overall quality of streamed video into the home.