Groupon CEO tells employees the site needs to grow up

Andrew Mason says daily deals site has no margin for error, while blaming "too much beer" for difficulty speaking.

Groupon's CEO lectured his employees today about the need for his company to grow and shake off its difficult adolescence -- all while blaming the beer he was drinking for difficulty speaking.

Andrew Mason told employees at a town hall meeting that the daily deals site didn't have "any margin for error," according to The Wall Street Journal, which observed the meeting via Webcast. Mason, 31, drank from a bottle of beer while laying out the company's priorities for the next six months, including the buttressing Groupon's financial controls and staffing.

"We're still this toddler in a grown man's body in many ways," Mason said in an address to the closed-door employee meeting. At one point, his voice broke, leading Mason to say, "Sorry, too much beer."

The meeting was part of an informal town hall series, in which employees are encouraged to ask questions of executives and beer is made available to all in attendance, a spokesperson told the Journal.

The Chicago-based company, which went public only six months ago, has been struggling to regain investor confidence in the wake of a high-profile accounting miscue. The company revealed in a regulatory filing last month that it had discovered "material weakness" in internal controls over its financial statement and that its fourth-quarter results were worse than previously stated because of higher refunds to merchants. The revisions increased its net loss for the fourth quarter by $22.6 million and reduced revenue for the quarter by $14.3 million to $492.2 million.

In addition to two shareholder lawsuits resulting from the revision, the company may also be facing increased regulatory scrutiny. After Groupon announced its financial revision, there were reports that the company's accounting procedures had again attracted the attention of the U.S. Securities and Exchange Commission, though the commission has reportedly not yet elected to launch a formal investigation of the company.

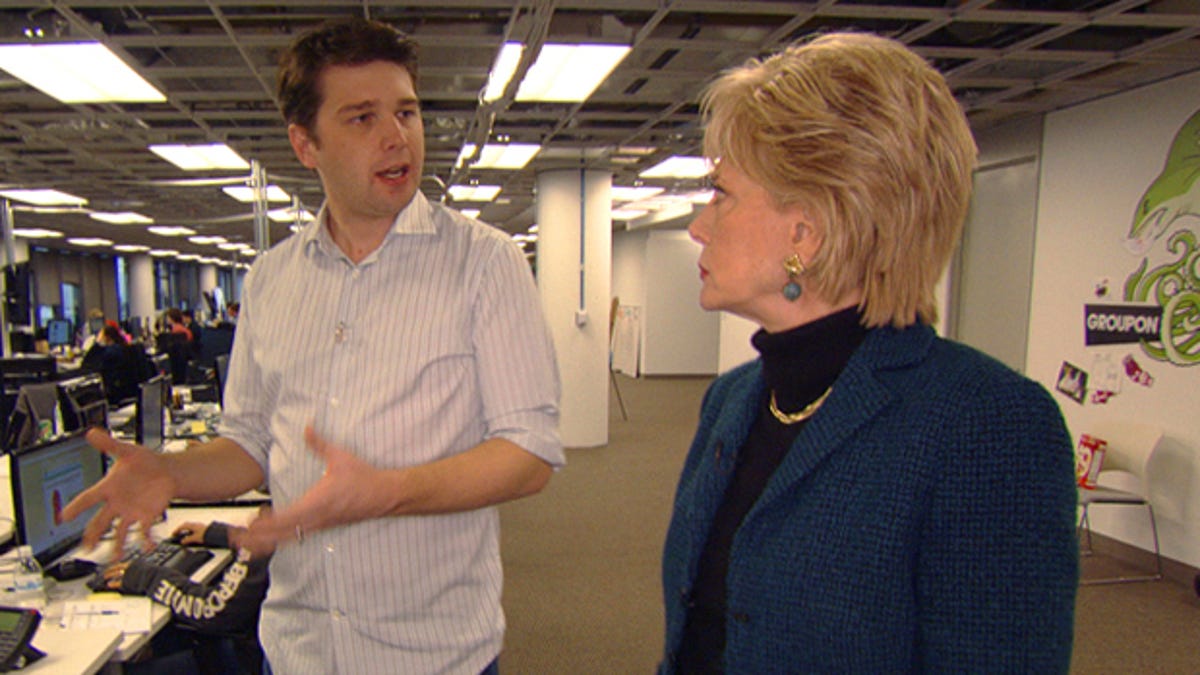

An SEC review of Groupon's accounting procedures forced the daily deals provider to revise its IPO filing papers last year after the company reported that it generated $713.4 million in revenue in 2010, while the SEC said that the figure should be $312.9 million. During an interview with CBS news magazine "60 Minutes," Mason admitted that the error was a "bush-league mistake."

In the aftermath of financial revision, Groupon is reportedly looking at making more senior-management hires and adding two new members to the company's board of directors.

Groupon went public in November at $20 a share, and its stock peaked at $31.14 in early February before beginning a steady decline over the past couple of months. Shares closed at $12.27 today, up 31 cents, or 2.59 percent.