Facebook score a bargain with $16B acquisition of WhatsApp?

The popular messaging app is larger and growing faster than Facebook's closest rival, Twitter, which has a higher market cap.

Facebook's announcement Wednesday of its multibillion-dollar acquisition of WhatsApp might have many wondering why Facebook thinks the popular messaging app is so valuable.

But if you can ignore the eye-popping price tag -- a base price of $16 billion ($4 billion in cash, $12 billion in stock), plus $3 billion more in stock options that vest a few years down the road, for an eventual grand total of $19 billion -- Facebook may have gotten quite a deal on WhatsApp. Like the central premise of "Moneyball," it's all about the numbers.

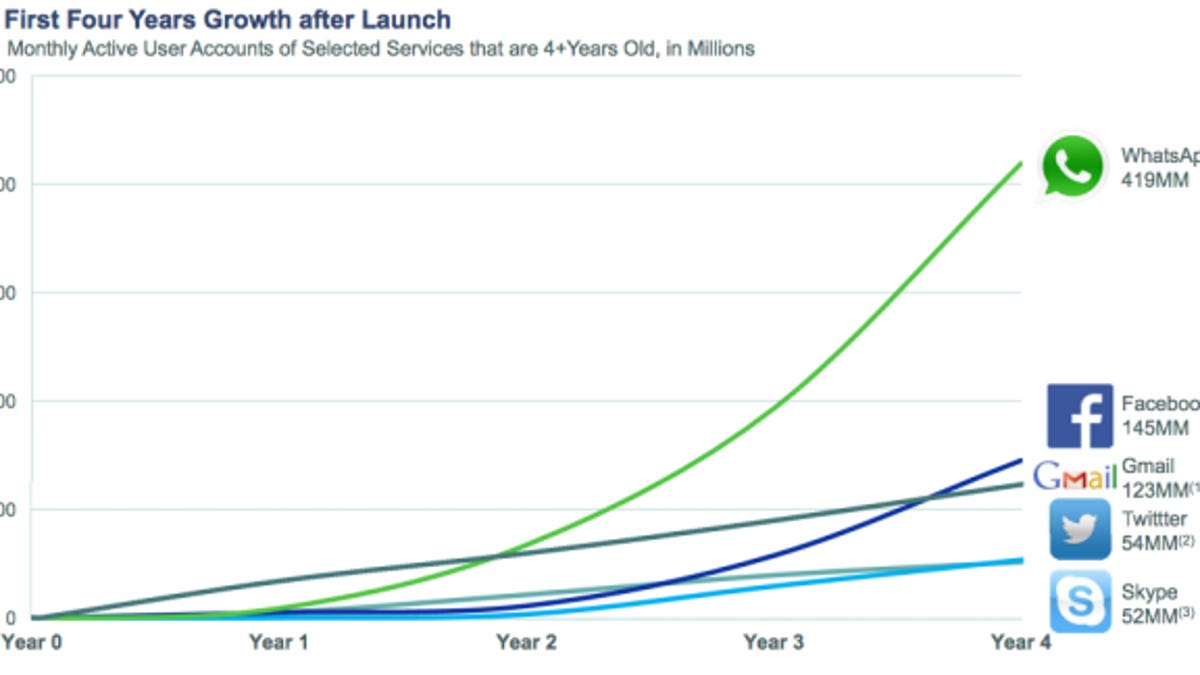

And WhatsApp has plenty of them. Founded in 2009, the Santa Clara, Calif.-based startup's cross-platform app has quickly attracted a large and engaged user base, serving up more than 1 billion messages daily, just two years after its launch.

The ad-free platform has more than 450 million monthly active users (MAUs) worldwide and more than 320 million daily active users (DAUs), more than three times the 100 million DAUs it claimed in December 2012. More than 200 million of those MAUs were added in the past eight months.

Meteoric growth aside, WhatsApp's MAU count is close to twice that claimed by Facebook rival Twitter, which has managed to grow from 200 million MAUs since December 2012 to the 241 million MAUs it reported with its earnings earlier this month -- a little more than 20 percent in a little more than a year.

Facebook also notes that WhatsApp's daily user engagement level is about 70 percent, outpacing even the 61 percent engagement level that the social network reported in October.

"WhatsApp is the only widely used app we've ever seen that has more engagement and a higher percentage of people using it daily than Facebook itself," Facebook CEO Mark Zuckerberg said in a conference call with analysts and the media Wednesday.

Facebook will also acquire a new revenue stream thanks to the 99-cent annual fee WhatsApp's 450 million users pay to send messages. Run by only 55 employees, the service has pledged to stay ad-free, which should go a long way toward deflecting a mass exodus.

So Facebook is paying $16 billion, and then some, for a company with a larger and faster-growing user base than Twitter, which currently has a market capitalization of about $20 billion. It looks like Facebook is covering its bases with a real steal.