Corporate VCs still have love for the Golden State

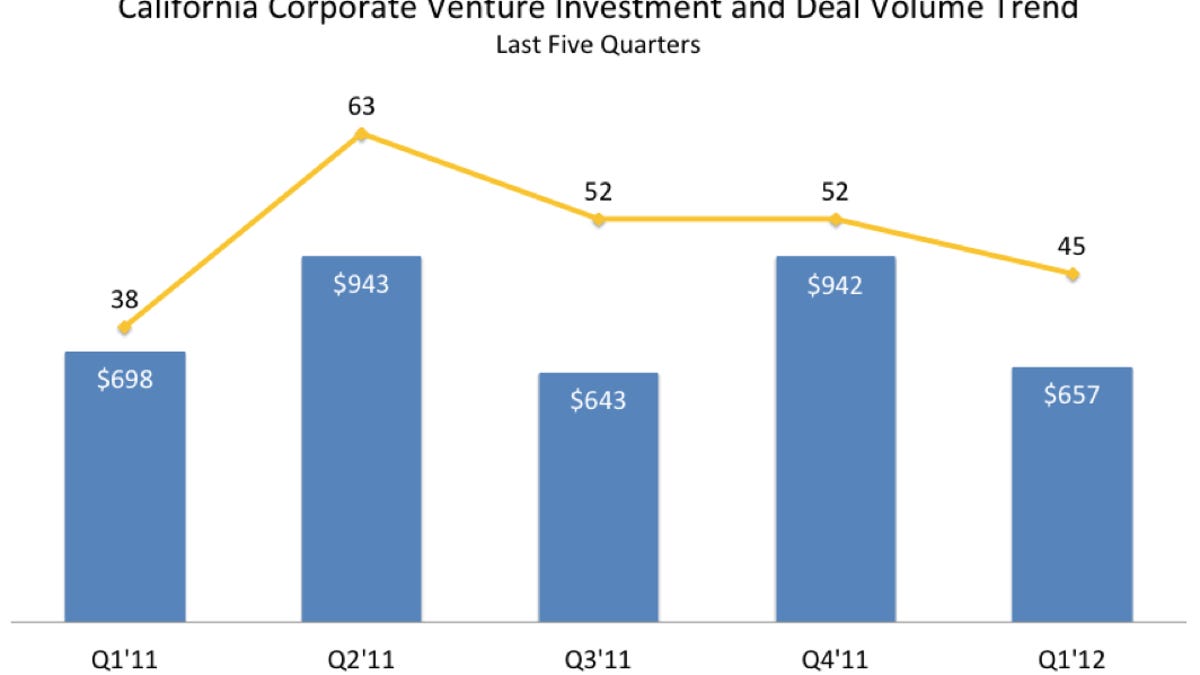

The venture capital arms of corporations favor investing in California, where tech businesses received $657 million from corporate VCs in the first quarter, according to a new report.

The money was spread over 84 deals, the number is down from last year. This is the fourth consecutive quarter that the number of deals made has gone down, the report noted.

While California deals and funds also fell, corporate VCs favored the Golden State, funnelling most of their money -- $657 million -- into the state's companies this first quarter. The funding was for 45 deals, with the tops deals being $85 million to Trion Worlds, $85 million to Joyent, and 53.4 million to Lithium Technologies.

Corporate VCs are also much more conservative than their VC counterparts, spending less on initial funding for start-ups, instead choosing to come in with lots of money when a company is fairly established, the study found.

The report also breaks down the numbers for the green sector, healthcare, Internet and mobile industries as well as by the top states. Read the full report here.