Boku Accounts enables mobile payments anywhere, anytime

The new service means wireless carriers can sell customers a way to seamlessly make transactions at any credit card terminal with their phones, and no hardware has to be changed.

Mobile phone customers around the world may soon have a way to pay any merchant or any other person with their device.

Today, San Francisco-based Boku unveiled Boku Accounts, a white-label service that will allow wireless carriers to offer their customers a mobile payments system that could work throughout the world. Those mobile users, in turn, will be able to make payments at any credit card terminal either with their phones, or with a special debit card.

Though no carriers have yet formally adopted the new service, Boku says one U.K. operator is well into trials. The company, which has received $40 million in funding from Andreessen Horowitz, Benchmark Capital, DAG Ventures, Index Ventures, and Khosla Ventures, already has existing partnerships to provide payments processing services to more than 240 carriers around the world. All told, Boku's services have been deployed in 66 countries.

But with Boku Accounts, the company is hoping to make a much bigger mark--enabling mobile payments just about anywhere customers shop. As well, the service has a significant location element that will allow merchants to seamlessly offer shoppers special deals or discounts. Clearly, it is hoping that it can convince many of those carriers that Accounts is a service that will help the operators' bottom lines and please their users.

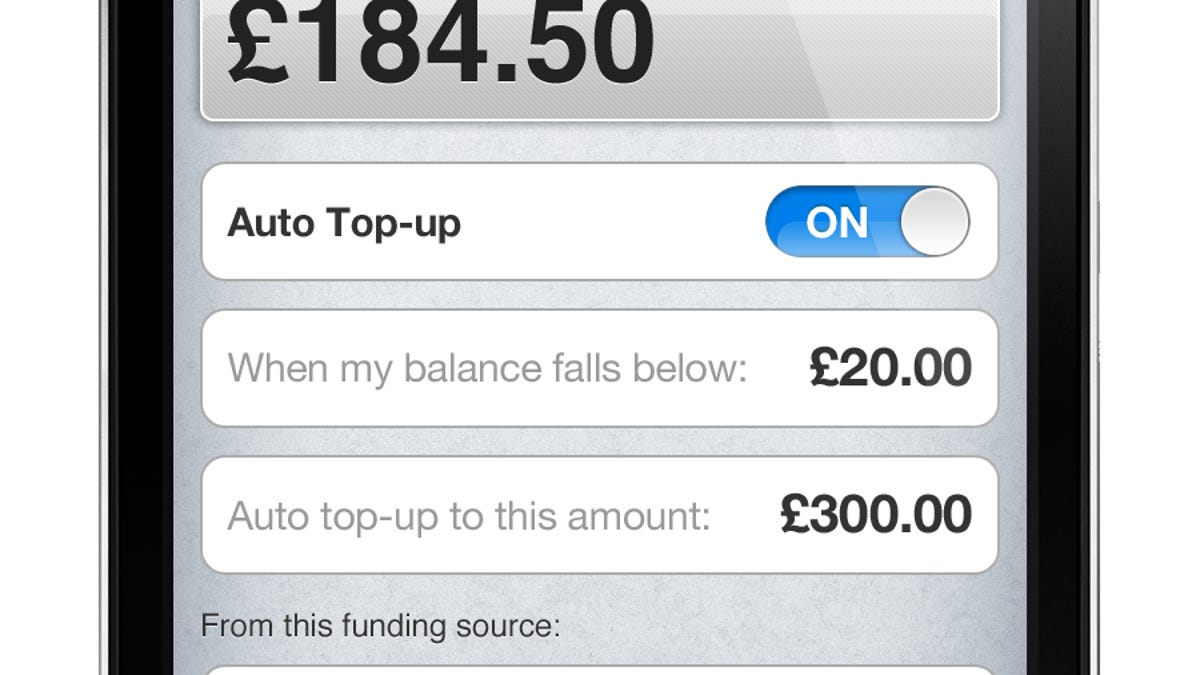

Essentially, Accounts users will front a certain amount of money and each transaction they conduct using the service will draw from those funds. The mobile payments service is meant to be both backward- and forward-compatible in a payments environment that is slowly moving toward global adoption of near-field communication--a technology that lets two devices exchange information when in close proximity to each other.

But since NFC, as its known, has been integrated with only a very small percentage of mobile phones--especially in the United States--Boku Accounts has come up with a sticker that can be applied to the back of a user's phone that is embedded with an NFC chip. That means the user can take advantage of NFC technology, even if their phone doesn't have the technology.

However, Boku knows that many customers--or their carriers--won't want to see phones with these stickers, so the company has also come up with a debit MasterCard that will apply funds for payments from the same source as phones running Boku Accounts.

And because payments and customer tracking is all done behind the scenes, Boku thinks that merchants will want to come up with a wide range of offers to give customers, such as discounts on coffee for those who walk into, say, a Starbucks with an Accounts-enabled phone. The offers will be applied automatically, meaning that neither someone working the register or the customer will have to do anything.

Boku Accounts also enables customers to make mobile payments to any other Accounts user, again with all funds coming from their pre-paid balance.

To be sure, the mobile payments space is filled with aggressive players, from PayPal to Zong, Square, WePay, and others. But Boku feels that its significant relationships with carriers around the world gives it a leg up on its competitors, especially because Accounts doesn't require merchants to change their payments terminals in any way.

Whether carriers--or their customers--go along with Boku's plan remains to be seen.