BlackBerry CEO out as Fairfax deal hits the rocks

The $4.7 billion deal to take BlackBerry private is dead, and Thorsten Heins is headed for the exit. Now BlackBerry plans to raise $1 billion selling convertible notes to investors.

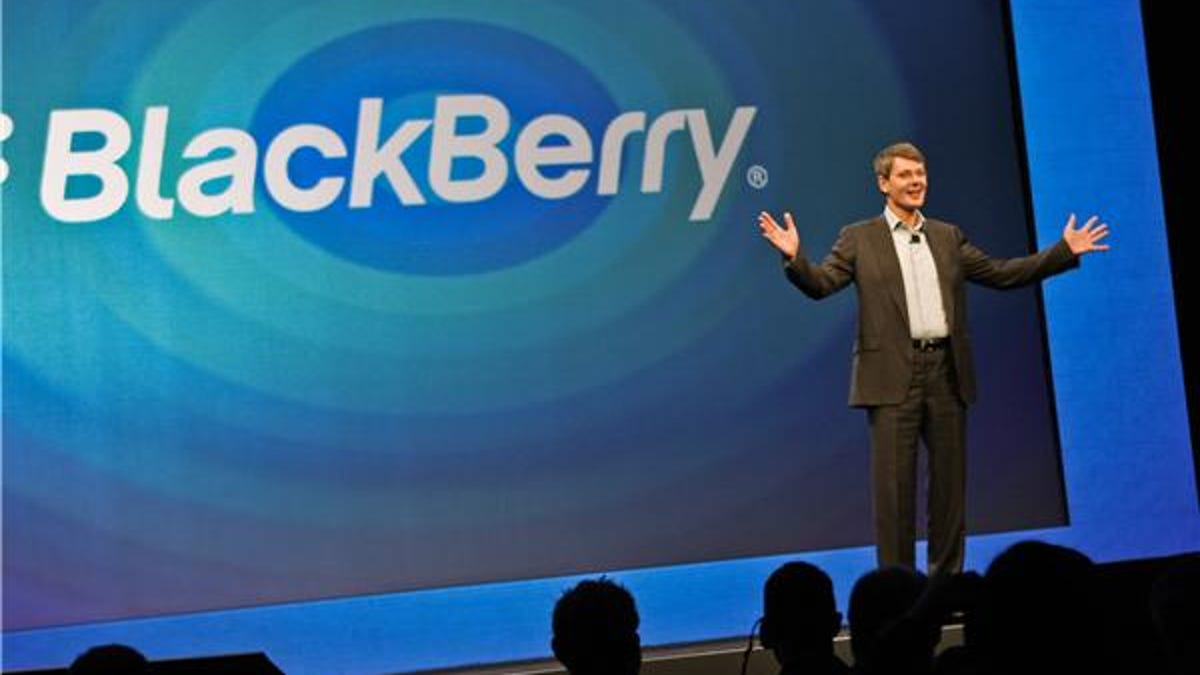

Gone: CEO Thorsten Heins. Scratched: The $4.7 billion plan to take BlackBerry private.

Still hanging in there, after a fashion: BlackBerry, with a new plan to save itself.

BlackBerry said Monday morning that there is no future for the Fairfax Financial deal, valued at $4.7 billion, that was going to take the deeply troubled smartphone maker off the public markets and give it some relative peace as it seeks to turn itself around. Instead, BlackBerry will raise $1 billion through a sale of convertible notes to investors.

The company will also replace Heins as CEO and will put new members on its board.

According to BlackBerry, upon closing of the transaction, which will require approval from the Toronto Stock Exchange, Heins will be out and John S. Chen will be appointed interim CEO. Chen will also be appointed executive chair of BlackBerry's board.

Chen is a well-respected figure in the enterprise-computing world. Prior to his involvement with BlackBerry, Chen served as Sybase CEO and chairman. He's also a director on the boards of Wells Fargo and Walt Disney. He will serve as interim CEO until BlackBerry can find a permanent replacement.

Fairfax isn't entirely out of the picture. The company will acquire $250 million of the "convertible debentures." The remaining $750 million will come from institutional investors.

BlackBerry's deal with Fairfax and others marks the end to the company's review of possible new routes toward revival. In August, BlackBerry announced that it planned to entertain strategic alternatives that could have included an outright sale. Fairfax Financial had planned to invest $4.7 billion in the company to take it private. It's not clear whether Fairfax decided against acquiring BlackBerry or the companies couldn't come to terms.

In addition to helping finance the deal, Fairfax CEO Prem Watsa will be appointed as lead director and chair of BlackBerry's compensation, nomination and governance committee. Heins and BlackBerry director David Kerr will both resign from the board following the close of the transaction.

Although BlackBerry put a positive spin on its announcement Monday, investors don't seem enthused. BlackBerry's shares were down 18.5 percent in premarket trading to $6.33. The shares closed on Friday at $7.77.

CNET has contacted BlackBerry for comment on the announcement. We will update this story when we have more information.

This story has been updated throughout the morning.