BlackBerry 7 sales sputter after strong start

With the iPhone 4S and a wave of Android smartphones out in the market, and the delayed launch of next-generation BBX smartphones, one analyst expects increasing competition across RIM's products.

Research In Motion is stuck between an Apple and an Ice Cream Sandwich.

After some initial excitement for the new line of BlackBerry 7 smartphones and a strong launch--both unusual for RIM for the past year--sales are starting to sputter. That's according to Canaccord Genuity analyst T. Michael Walkley, who said his checks indicate a slowing trend for BlackBerrys.

It's likely sales have been blunted by the release of the iPhone 4S, as well as the lower price of the legacy iPhone 4 and 3GS models as well. The coming release of the Galaxy Nexus and phones running on the recently unveiled Android 4.0 Ice Cream Sandwich operating system is expected to provide additional pressure, while Nokia may take some shine off RIM's growth overseas, Walkley said.

"We anticipate increasing competition across all tiers of RIM's products in 2012," he said in a research note sent to clients today.

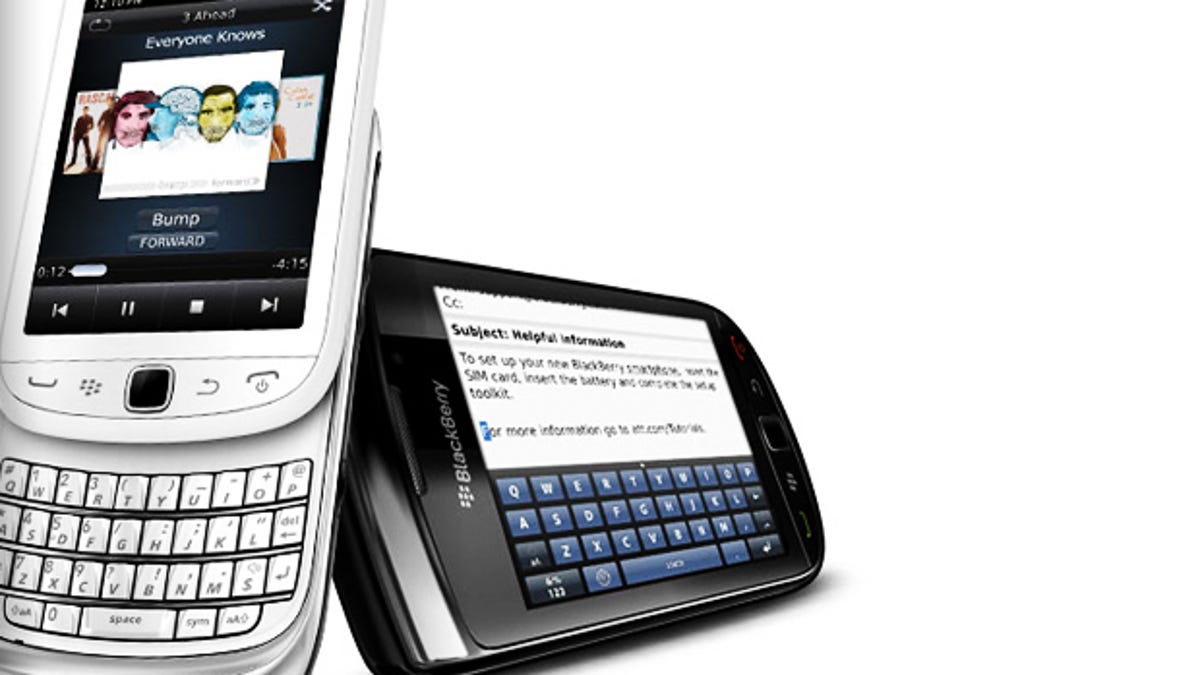

RIM had hoped for its upgraded BlackBerry 7 operating system to inject some life back into the company's prospects and get it back on track as it migrates to a slicker next-generation platform. With that platform, BBX, expected to be delayed until the middle of next year, it's more important than ever for its current BlackBerry 7 phones to have a strong showing.

A RIM representative wasn't immediately available for comment.

But aside from the flagship Bold 9900 smartphone, which has generally received favorable reviews, its other BlackBerry smartphones haven't sold so well. RIM was suffering from weaker sales to consumers at Verizon Wireless, T-Mobile, and Sprint Nextel, as sales were dominated by the iPhone and Android devices, Walkley said. Even the Bold has lost its momentum following the launch of the iPhone 4S and subsequent price cuts to the older models, he added.

Overseas, Walkley said he was more bullish on Nokia's prospects as it prepares to roll out its first Windows Phone devices in a few European markets. He expects Nokia to make more of a run in emerging markets where RIM has seen recent strength, which could cut into RIM's growth. He added that RIM's lower-tier BlackBerry devices that had been popular are slowing considerably in the face of new Nokia phones and sub-$200 Android smartphones showing up in Latin America and Eastern Europe. Nokia, meanwhile, is seeing more interest in its Asha series of phones in markets such as India and Indonesia, he added.

Walkley was also bearish on the prospects of the PlayBook, saying he only expects "soft sales" of the device. The PlayBook has been heavily discounted in recent weeks, with Black Friday specials pulling the price down to $200, but sales have still been anemic. The missing core features of the device--e-mail access, messenger services, and calendar--won't arrive until an update next year. Walkley dropped his fiscal 2012 estimate for unit sales to 900,000 from 1.5 million units. In total, RIM has only sold 700,000 units to its retail partners through the August quarter, an extremely disappointing number.

The competition is only going to get worse with the $199 Kindle Fire out and Ice Cream Sandwich-powered tablets hitting the market in the coming months.

All of this bodes poorly for RIM, which has a rough year. Even its traditional stronghold of enterprise customers is vulnerable. A recent study by iPass found more corporate users on an iPhone than a BlackBerry. IPass was quick to note that the change in market share may be more due to the extreme growth of iOS, as opposed to RIM losing customers.

But it can't be good if iPhone is beating RIM at its own game.