Apple's AirPods Pro, services deliver a record holiday for the iPhone maker

Apple has been moving beyond being just the "iPhone company," and it's paying off.

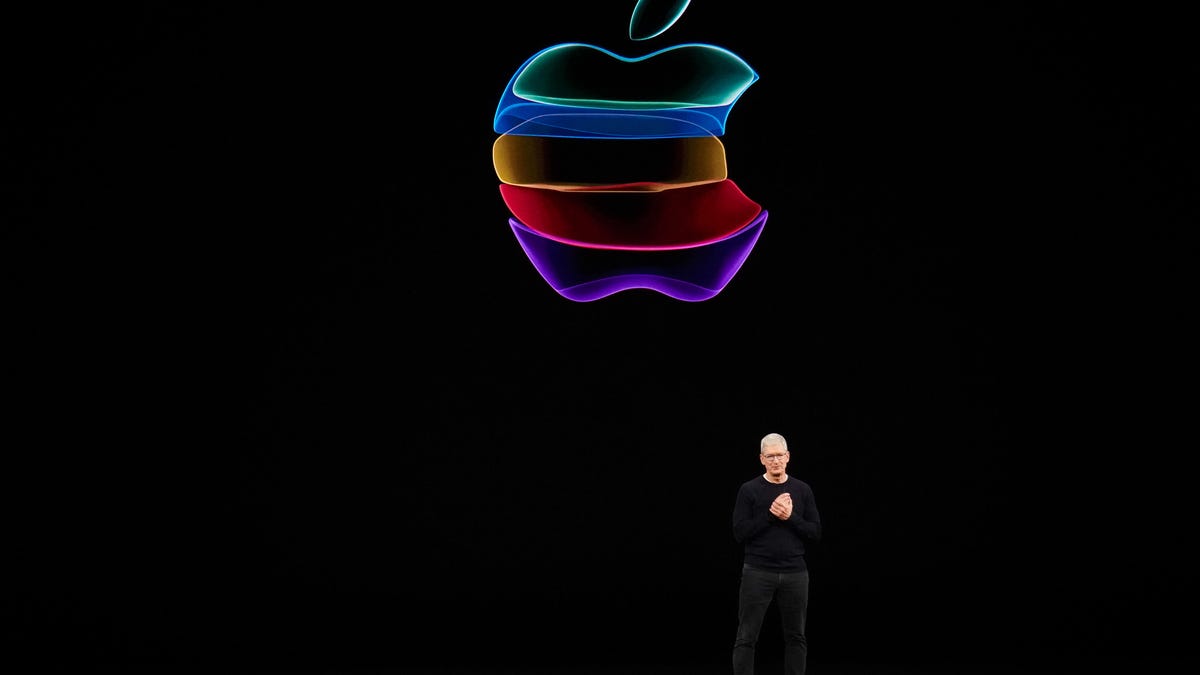

Apple CEO Tim Cook has been moving the company into new areas like services and wearables.

Apple on Tuesday reported an all-time record quarter for revenue and earnings -- and it's partly thanks to its newest AirPods and its services business.

The company credited its services and wearables lines, as well as its newest iPhones , for the performance. Both sales and earnings in the three months ended Dec. 28 were well above Wall Street forecasts. Apple also provided a revenue forecast for the current quarter, which ends in March, that's better than analysts' projections.

"We are thrilled to report Apple's highest quarterly revenue ever, fueled by strong demand for our iPhone 11 and iPhone 11 Pro models, and all-time records for services and wearables," Apple CEO Tim Cook said in a press release. He noted that there are now over 1.5 billion Apple devices actively used around the world, up from 1.4 billion at the end of fiscal 2018.

The period marks a sharp turnaround for Apple. A year ago, Cook warned that Apple's fiscal 2019 first-quarter revenue would be weaker than previously expected because of lower demand in China. The warning from Apple, one of the most valuable and profitable companies in the world, was a rare occurrence, the sort of heads-up that hadn't happened in at least 15 years.

Since that year-ago warning, Apple's stock has more than doubled, and the company has regained much of its lost luster. Its newest iPhones from September have proved popular with buyers. (Apple no longer breaks out unit sales of its devices, so it's unclear just how popular they've been.) While the iPhone remains Apple's biggest moneymaker, the company has been steadily diversifying its operations into new services and products. That includes the $4.99-per-month Apple TV Plus service that went live Nov. 1 and Apple's AirPods Pro, which were hard to find during the key holiday shopping season.

Apple's AirPods have become hugely popular since the wireless earbuds first hit the market in December 2016. The latest model, AirPods Pro, went on sale in October for $249, $90 more than the original version.

"As a result of Apple disclosing virtually nothing about their financials, we believe AirPods are probably the most underappreciated part of Apple's business today," Bernstein analyst Toni Sacconaghi noted ahead of Apple's earnings release. He believes AirPods generated about $6 billion in revenue in 2019, nearly double 2018's level.

Soaring iPhones, services and wearables

Apple doesn't break out unit sales for its devices anymore, but it said overall iPhone revenue climbed 7.6% to $55.96 billion. The December quarter marks the first full period of sales for Apple's newest iPhones, the 11, 11 Pro and 11 Pro Max. The fiscal first quarter is Apple's biggest of the year, thanks to the new phones .

"iPhone 11 was our top-selling model every week of the December quarter and the three new models were our three most popular iPhones," Cook said Tuesday during a call with analysts.

Apple's services revenue soared 17% to $12.7 billion, largely thanks to the App Store. On New Year's Day, customers spent $386 million in the App Store, Cook said, up 20% from the previous year. He noted that Apple TV Plus was "off to a rousing start" but didn't give details about subscribers.

"We see great promise for these recently launched services, and we're optimistic about what we have in the pipeline for each of them," Cook said.

Sales from Apple's wearables, home and accessories business jumped 37% to $10 billion. The wearables business alone is the size of a Fortune 150 company, Cook said. "Demand for AirPods continues to be phenomenal," he said, and Apple Watch recorded all-time record revenue in the first quarter. That came despite supply shortages for the AirPods Pro and Apple Watch Series 3 , which indicates Apple's two-year-old smartwatch may have been the most popular model during the holiday season.

Mac and iPad sales both declined from the previous year.

China risk

Apple is seeing some impact from the coronavirus sweeping across the globe, Cook said. The company has suppliers in the Wuhan region of China, where the coronavirus first emerged. Apple has alternative sources for those components, Cook said, and it's "working on mitigation plans to make up any expected production loss."

What's less clear is how the coronavirus will impact suppliers in other parts of China, he said. The Chinese government extended the New Year holiday break from the end of January to Feb. 10, which will delay the startup in Apple supplier factories, Cook said.

"The situation is emerging, and we're still gathering lots of data points and monitoring it very closely," Cook said during an earnings call with analysts. He noted that as of last week, Apple had limited employee travel to impacted areas to only "business critical situations."

A never-before-seen virus first detected in the Chinese city of Wuhan has claimed over 100 lives and infected over 4,500 Chinese citizens with a pneumonia-like illness, according to China's National Health Commission. The virus, known as 2019-nCoV, was first reported to the World Health Organization on Dec. 31 and has been under investigation since. Chinese scientists have linked the disease to a family of viruses known as coronaviruses, which include the deadly SARS and Middle East respiratory syndrome. The virus since has spread to Europe, Australia and the US.

Apple closed one store in China because of the coronavirus, and "a number" of its retail partners have also closed their retail locations, Cook said. "Many of the stores that remain open have also reduced operating hours," Cook said, and the company is taking extra precautions for its staff and customers. It's frequently deep cleaning its stores and conducting temperature checks for retail workers to make sure they remain healthy.

"While our sales within the Wuhan area itself are small, retail traffic has also been impacted outside of this area across the country in the last few days," Cook said.

Apple factored the possible supplier and retail traffic impact into its revenue guidance for the March quarter, which -- at $63 billion to $67 billion -- is a bigger range than what it normally provides. Even with the possible impact, Apple's projection is higher than the $62.45 billion expected by analysts.

China has become one of Apple's most important markets over the past several years. In the fiscal first quarter, which ended Dec. 28, Apple's revenue from Greater China rose 3.1% to $13.6 billion. It lagged behind the Americas and Europe, but sales in some product areas soared during the period.

Apple saw double-digit growth for its iPhone business in Mainland China in the first quarter, Cook said, a turnaround from sluggishness Apple had experienced in recent quarters. It also had double-digit growth in its services business in China, which includes its App Store, and "extremely strong double-digit" growth for its wearables business, which includes the Apple Watch and AirPods, Cook said.

While Apple sells a lot of its gadgets in China, it's also tied to the country in another key way: Apple designs its phones in the US, but the devices, like many other electronics, are assembled in China. Many of its employees travel frequently between the region and Apple's Cupertino, California, headquarters, and a slowdown in production in China could mean a shortage of iPhones and other Apple devices across the globe.

"We're closely following the development of the coronavirus," Cook said Tuesday. "We're donating to groups that are working to contain the outbreak. We are working closely with our Apple team members and partners in the affected areas, and our thoughts are with all of those affected across the region."

Apple's Q1

Overall, Apple reported net income of $22.2 billion, or $4.99 a share, up from $19.97 billion, or $4.18, a share a year ago. Analysts expected Apple to report fiscal first-quarter earnings of $4.55 a share, according to a poll by Yahoo Finance.

The company also reported revenue of $91.82 billion, up 8.9% from the previous year and above the $88.5 billion expected by analysts.

Analysts expect 2020's iPhones, likely launching in September, to help the new, super-fast 5G wireless networks become mainstream. And Apple could introduce an updated version of its petite iPhone SE as soon as the March quarter. It also likely will keep pushing with its services business, especially Apple TV Plus, which is free for a year for people who buy a new Apple device.

Apple shares closed Tuesday at $317.69, up 2.8% from the previous day. The amount gave Apple a market value of $1.39 trillion. Shares rose another 2.3% in after-hours trading to $324.90.

"We believe by the end of 2021 Apple has potential to be the first $2 trillion valuation given the 5G tailwinds and services momentum potential over the coming years," Wedbush analyst Daniel Ives noted.

Originally published Jan. 28, 1:44 p.m. PT.

Updates, 2:25 and 3:20 p.m.: Adds comments from conference call and details about the coronavirus.