Apple Card: After mocking credit cards, Apple creates one

The new Apple Card exists both as a virtual and a laser-etched physical card.

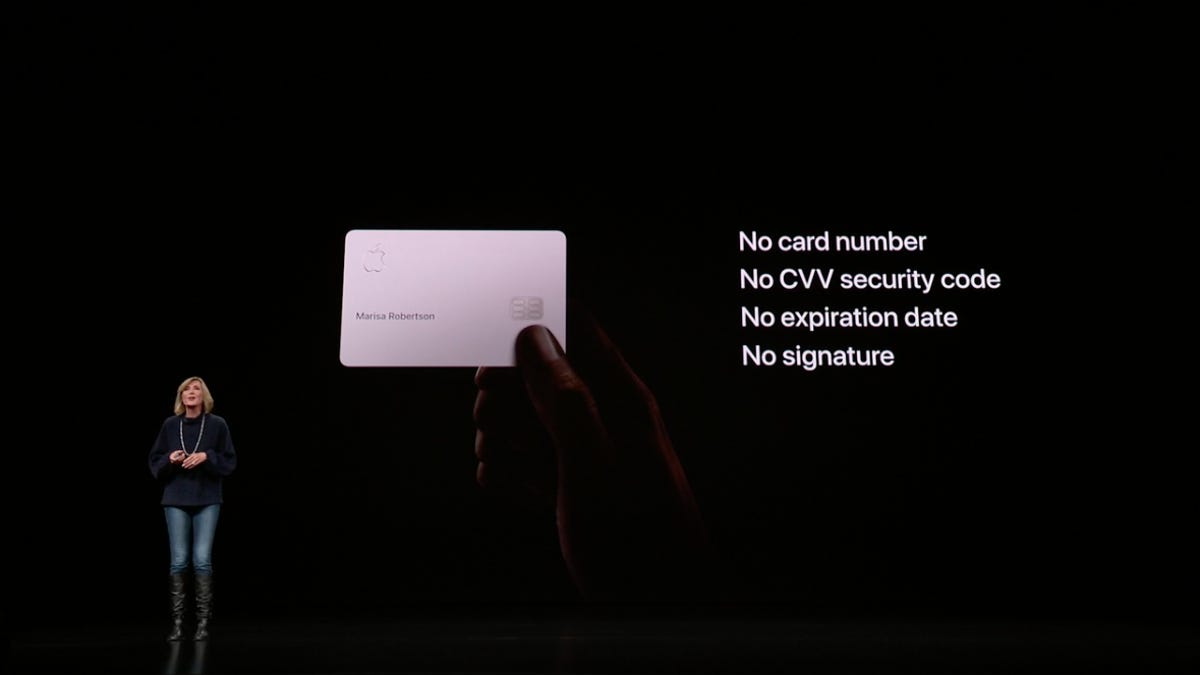

Apple Pay boss Jennifer Bailey showing off the new physical Apple Card.

It's not enough that your iPhone stores your credit card information. Apple wants to be on your physical card too. Apple on Monday introduced Apple Card, a new credit card that will live both virtually in Apple's Wallet app and in the physical world as a minimalist-designed, laser-etched titanium card. The virtual card will become available in the US this summer.

The tech giant said it sought to toss out many of the things people don't like about credit cards by doing away with late fees, annual fees and international fees, as well as penalty interest rates.

"While we all need them, there are things about the credit card experience that could be so much better," Apple CEO Tim Cook said at a press event Monday while introducing Apple Card.

Looking to turn heads in the payments world, Apple will offer cash-back rewards daily to Apple Card customers, a change from monthly rewards from most other cards. Customers will be able to get 3 percent cash back for purchases made directly with Apple, 2 percent via the virtual card and 1 percent when using the physical card.

Apple's announcement comes about four years after the company introduced Apple Pay , a service that was pitched as a way to kill off your wallet and physical credit cards, instead letting you pay with your phone.

"People have dreamed of replacing these for years," Cook said of credit cards during a 2014 press event that included the unveiling of Apple Pay. He pointed out then that cards are easy to lose and cumbersome to use.

But adoption of mobile payments like Apple Pay have been slow. Less than a third of iPhone owners have used Apple Pay at least once, according to a study by PYMNTS.com. That situation, even after years of the company pushing Apple Pay to more retailers and websites, likely caused Apple to decide it needed to do something else if it wanted to grow in payments and build up usage of its mobile wallet.

More from the Apple event

It also follows along Apple's plans to bolster the services it offers you. The company already offers a streaming music service, cloud storage and games and apps.

And that's how what was once old -- and mocked by Tim Cook -- is new again for Apple.

"Frankly, I'm underwhelmed," Ted Rossman, industry analyst at CreditCards.com, said in a statement Monday. He added that customers will likely get more cash back and without having to use Apple Pay regularly with a card like the Citi Double Cash, which offers 2 percent cash back on all purchases.

Apple teamed up with Goldman Sachs and Mastercard to release the new card, which will be accepted worldwide. The new partnership will allow Goldman to continue growing its customer base into the mainstream, after it's previously catered to businesses and wealthy clients. The bank has already introduced Marcus, a site offering online consumer banking and loans.

First published at 10:45 a.m. PT.

Updated at 12:18 p.m. PT: Adds more background throughout.