And, poof, the Winklevoss twins become VCs

It actually seems like a sensible career trajectory, given they're worth too much to do much else.

The latest job title for the Winklevoss twins -- the Olympian duo made famous for their role in the founding of Facebook -- should come as little surprise. What, after all, do you do when you have more money than you know what to do with and you're just 30 years old?

Naturally, you become a venture capitalist. Or, in the case of Tyler and Cameron Winklevoss, just hang out a VC shingle and become Winklevoss Capital. Remember, these Harvard alums gave up their long legal battle with Mark Zuckerberg last June and agreed to a $65 million settlement.

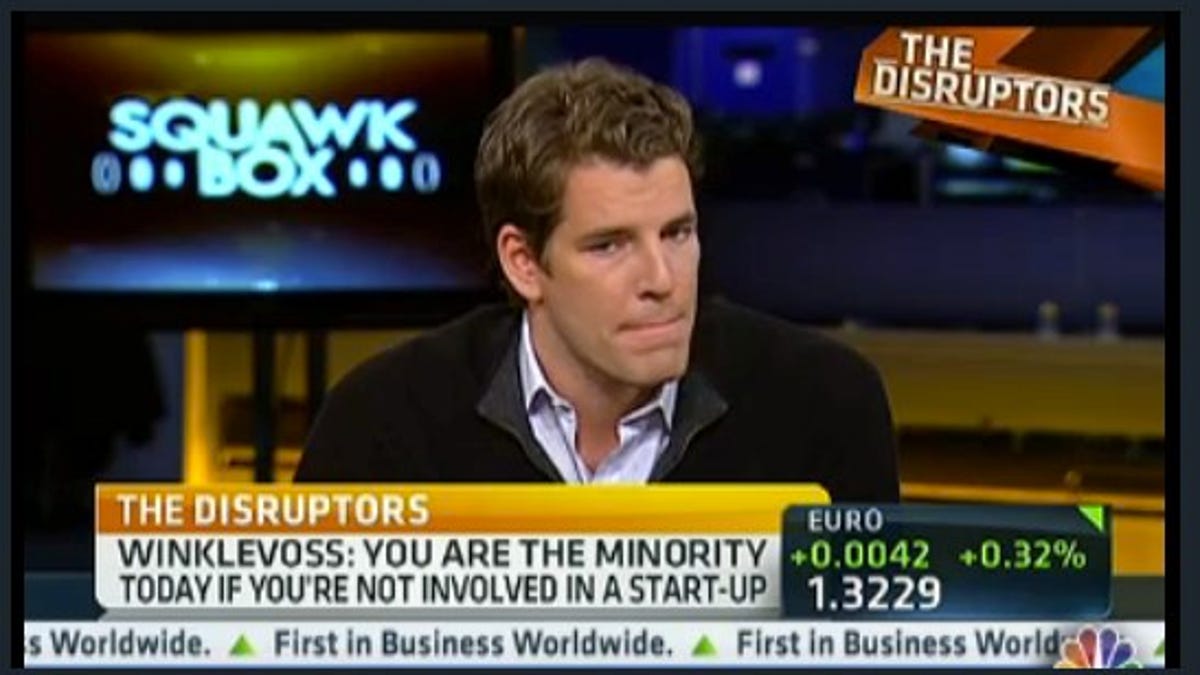

Today, the Winnklevoss twins took to CNBC's Squawk Box to explain their strategy.

The big takeaway? The twins like the cloud.

Better yet, as Tyler put it, they like "early stage disruptive startups...where we can add both capital and operational experience and work with the entrepreneurs to build their team."

How big is the fund? They won't say.

Who have they invested in? They also won't say, but they're talking to a number of startups.

If they ever felt bitter about Facebook, they're not showing it now. Why? They're stoked about the upcoming IPO. Co-host Andrew Ross Sorkin asked them about the size of their war chest, and the twins explained that they took equity in the company, though their name doesn't appear in Facebook's S-1 so it's unclear how much.

That $65 million settlement could turn into a lot more if their onetime nemesis Mark Zuckerberg does a good job.

So what's their view about the IPO? Does a $100 billion valuation -- what Facebook's bankers are gunning for -- make sense?

"You know, valuation is what people are willing to pay," said Cameron, already sounding like a VC. "At this point in time, it looks likes there's a ton of interest, so I wouldn't be surprised if it went off somewhere near there."

And that could turn into a lot of cash to sprinkle on early stage startups.