Yahoo and Microsoft: Is it on again?

Yahoo's board reportedly shows new willingness for another try to work out a deal with Microsoft.

Update 10:33 a.m. PDT Tuesday: Adds details of Jerry Yang's activities over the past week

And you thought a deal between Microsoft and Yahoo was over and done with?

Not so fast.

Microsoft has signaled that it is willing to sweeten its previous offer for a partial buyout of Yahoo's search business, according to one major investor who has been in contact with both parties.

Neither Microsoft nor Yahoo had immediate comment.

After the termination of discussions with Microsoft less than two weeks ago, Yahoo's board said in a statement that a sale leaving the company without an independent search business "would not be in the best interests of Yahoo stockholders."

But the source noted that several of Yahoo's nine board members, including its chairman, Roy Bostock, have since indicated a willingness to hold further discussions with Microsoft on a possible deal to sell the search operations.

"When Microsoft made its offer to acquire Yahoo's search business, Yahoo rejected the offer outright. There was no negotiating beyond the ($9 billion offer) Microsoft was offering," the source said.

After the Microsoft negotiations collapsed, Yahoo struck a search advertising outsourcing deal with Google. But that hasn't impressed shareholders. Shares of Yahoo, which traded at $23.52 the day of the Google announcement, closed at $21.45 on Monday.

Meanwhile, rumors of an impending Yahoo reorganization--a big one that could come as early as this week--continue to swirl.

Investors clamoring for change have pointed to the approximately 35 percent decline in Yahoo's share price since Microsoft's $33 per share offer to acquire all of Yahoo. Microsoft withdrew that offer in May after failing to get a "yes" from Yahoo. Shares of Yahoo are now within hailing distance of the $19 per share trading level they hovered at prior to Microsoft's unsolicited bid in February.

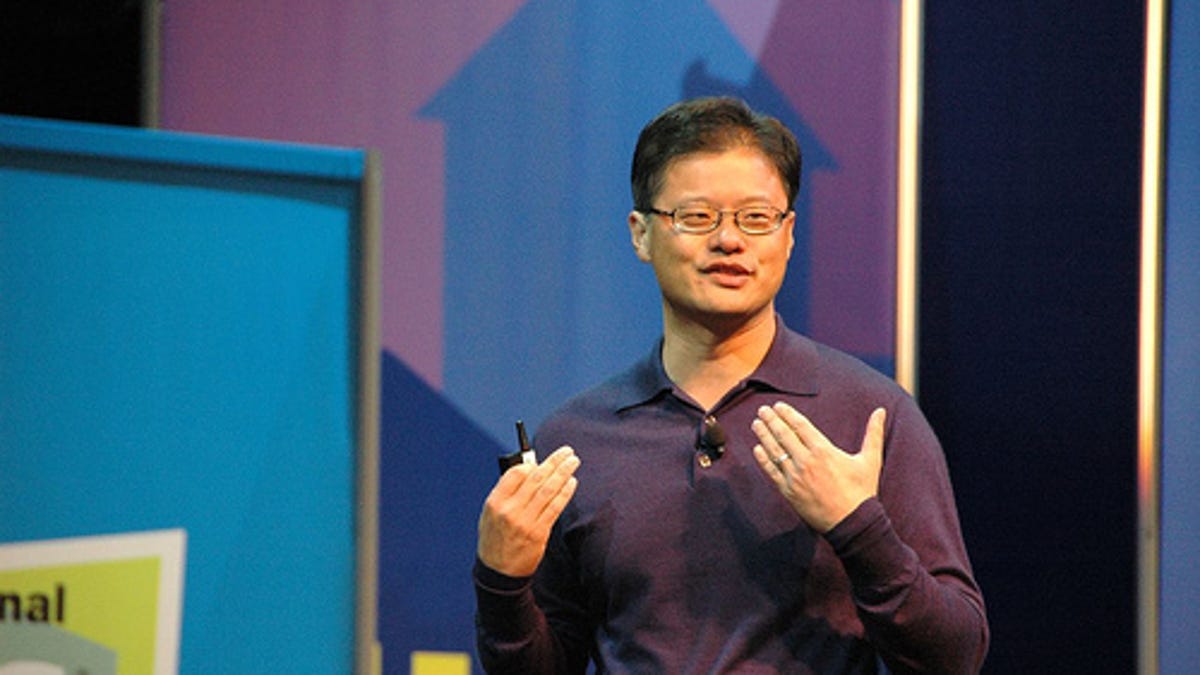

Meanwhile, the future of Yahoo's CEO and co-founder, Jerry Yang, as well as a number of the company's other directors, remains undecided. Yahoo has been stunned by a run of high-profile resignations in the last couple of weeks. And while reports surfaced about the degree of Yang's involvement in the pending re-organization of Yahoo, the CEO has been busy making the rounds on Capitol Hill to discuss the Google agreement, as well as talking about the big G to Yahoo teams from Sunnyvale to New York about the announcement. These moves come as the company's annual shareholders meeting on August 1 draws near.

The source questioned whether unrest about the stock price would force a change at the top as well. "A lot of Yahoo directors are fed up with the process of what's been happening," the source said.

Should Microsoft increase its buyout bid for just Yahoo's search assets, and if the company's investors find it appealing enough--even if Yahoo's board does not--investor activist Carl Icahn may consider keeping with his initial game plan of running a dissident slate to win control of the board.

But according to an institutional investor advisory services source, Icahn would still likely stand a better chance just running a partial slate of dissident directors for minority representation on the board--even if Microsoft makes a public statement of a sweetened offer to buy only Yahoo's search business.

"If Microsoft would make a public statement, it would make a difference to a certain extent," said the institutional investor advisory services source. "But, unless it was official like a tender offer, or unless shareholders could see the details and specific terms of the partial offer, it's hard for shareholders to know how it will benefit them."

This source noted that a mere press release saying the offer has been increased to a certain level will have even less effect, or meaning to shareholders: "I don't think Microsoft publicly announcing even the terms of a sweetened bid would be enough for Carl Icahn to run a full slate, or motivate shareholders to replace the whole board."