Three reasons Facebook has to go public

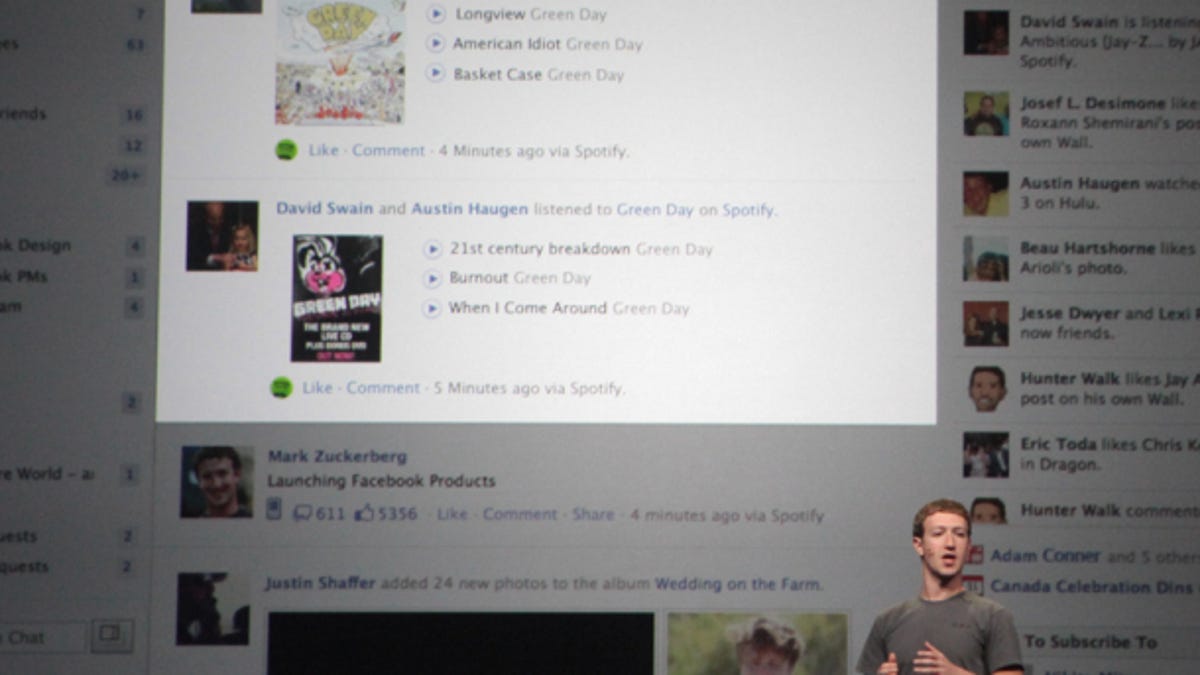

Founder Mark Zuckerberg can't hold off going public any longer--and that should be great for the company.

Make no mistake: Mark Zuckerberg doesn't want to go public.

It's no secret that Zuckerberg has tried to keep Facebook private as long as possible, believing--rightly or wrongly--that that's the best way to stay nimble and build the business. But at this point, Zuck's got little choice. Facebook has become too big, it has too many shareholders, and so it's on track to go public this spring, eight years after Zuckerberg started Facebook in his Harvard dorm room.

A couple of months ago, the 27-year-old Zuckerberg assembled his top management team to talk about the IPO game plan, according to a person familiar with the situation. And now there's reportedly a heated competition on Wall Street between banks eager to take the lead role arranging the sale of what will likely be the biggest tech IPO in history. The company could file its S-1 this week.

So why now?

That darn SEC rule

The key reason Facebook is going public is because of an antiquated Securities and Exchange Commission rule from 1964 that says that any private company with more than 500 "shareholders of record" must adhere to the same financial disclosure requirements that public companies do. That means filing detailed quarterly and yearly financial reports, and dealing with all the scrutiny that comes with a powerful company opening its books.

Facebook has of course been keenly aware of this, and it has often taken steps to keep the SEC at bay. When Facebook raised $450 million from Goldman Sachs a year ago, for instance, valuing the company at $50 billion, Goldman structured the deal in such away so that all shareholders would count as one--leading David Kirkpatrick, author of "The Facebook Effect," to predict that the deal might buy Zuckerberg more time before having to go public.

The social-networking company has been at work on Capitol Hill as well. It's been lobbying Congress on behalf of a bill--now before the Senate--that, among other changes, ups the number of shareholders of record to 2,000, according to John Coffee, a Columbia Law School professor who last fall testified before the Senate Banking Committee about this issue.

Even so, Facebook passed the 500 number at the end of 2011, and so any change to the rule is too little, too late. The company could adhere to stricter disclosure rules without selling shares to the public, but that's just not practical.

"Technically speaking, they could stay private," said a Silicon Valley venture capitalist who spoke under the condition of anonymity and is familiar with the situation at Facebook. "But you have all of the burdens with none of the upside."

Employees will breathe a sigh of relief

One big upside is that many employees can start cashing out, and the newfound wealth of a successful Facebook IPO would be widespread enough that it should be easy to spot.

People work at tech startups work for mediocre salaries and stock options that they hope someday will turn into BMWs and houses. That path hasn't been so clear at Facebook, however, because the company has given out different types of non-cash compensation at different times and changed its rules across the years.

The first 200 or so employees were given standard stock options, according to a person familiar with the company's compensation. Those options are like most awarded at private tech companies: They vest over time and turn into stock that employees can exercise (that is, sell), more or less when they decide to.

But in 2007, Facebook started issuing what's called "restricted stock units," sometimes referred to as phantom stock. It even received a waiver from the SEC to ensure that these wouldn't count towards the 500 shareholder-of-record limit. Restricted stock units convert into common stock only after the company goes public; the company IPOs and the employee gets stock based on the market value, minus the taxes.

That's OK, but options are better. For one thing, early Facebook employees--the ones who received options--have been able to sell some of their holdings, and plenty have done just that. They've used SharesPost or SecondMarket, companies that have emerged to make markets in private stock. Facebook has consistently been SecondMarket's most actively traded stock, and the most active sellers are former employees.

There's a good reason for that. In 2010, Facebook banned employees from selling their stock, citing legal concerns around insider-trading rules. So, in an odd twist, the only way for early employees to cash out their vested stock options has been to leave the company.

"Even if you are vested, the only way to sell is to quit," said Kirkpatrick, who had access to Zuckerberg and his top people while researching his book. "That's what a number of senior people have done."

Given that, going public is important to help Facebook keep good people, although some newly rich always bolt (as happened at Google). It should also cheer up those with restricted stock units, which plenty of Facebookers have privately griped about.

Facebook didn't respond to requests for comment.

Face it, Zuck: You'll be more powerful as a public company

People like to say that public companies aren't able to move on a dime, to take big risks outside the scrutiny of Wall Street. But I don't buy it. Apple under the late Steve Jobs should be the model for Zuckerberg. Jobs consistently made products--think the iPhone, or the iPad--that lesser leaders wouldn't have dared make because they would have feared cannibalizing money makers (the iPod and laptops in the Apple example) and pissing off Wall Street.

Zuckerberg, too, can make bold bets, especially given that the company is reportedly planning to sell just 10 percent of the company to the public. He and his team will still be very much in control.

Moreover, Facebook would suddenly see its pile of cash balloon by $10 billion. That's important, given that the consumer Internet has in some ways become a battle of titans--Google, Facebook, Apple, Amazon, Microsoft--all of which are sitting on mountains of cash.

Facebook has been buying up lots of smaller companies with cash--sometimes for the product, sometimes for the engineers--and a sudden cash infusion would let Zuckerberg pick up the speed on that front. But empowered with cash and stock, Zuckerberg could also think bigger and, if needed, start making Google-sized acquisitions.

Risky? You bet. But far more possible as a public company.

Ultimately, whether Facebook continues to thrive isn't about whether or not it's public. It's about how good Zuckerberg is as a leader. And that's what the world will be watching as his already large public profile gets even larger.