Analyst to Apple: Time to stop hoarding cash

A $46 billion cash balance is more valuable to shareholders in the form of higher earnings per share or a dividend, Stanford C. Bernstein analyst says.

Perhaps $46 billion in walking-around money is too much.

So argued a notable financial analyst on Thursday, saying it's time for Apple to do something with its colossal cash reserve that's better for shareholders. In an open letter to Apple's board of directors, Sanford C. Bernstein analyst Toni Sacconaghi urged Apple to either return some cash to shareholders as a dividend or increase the value of Apple stock by repurchasing its own shares.

"In our conversations with shareholders, one common source of frustration--which is now bordering on exasperation--has been Apple's burgeoning cash balance and the company's unwillingness to return it to shareholders or discuss its vision for how the company plans to use it. Apple's cash balance is of mythic proportions--higher than the total market cap of all but 49 of the S&P 500 companies, the highest among all U.S.-listed companies and growing," Sacconaghi wrote. "We implore you to consider returning cash to your shareholders, along with a longer-term road map for how you plan to use your cash balance and why."

Apple's cash has been earning interest at an annual rate of 0.76 percent--a "value-destroying" rate compared to alternatives. Instead, Sacconaghi recommended an immediate $30 billion share repurchase plan and a 4 percent annual dividend.

Apple didn't comment for this story, but Chief Executive Steve Jobs addressed the matter at the shareholder meeting in February when pressed by shareholders on Apple's cash.

"Cash gives us tremendous security and flexibility. When you take risks, it's like jumping up in the air, and it's nice to know the ground will be there when you land," said Jobs during the meeting. "We run our company conservatively from a financial point of view because you never know what opportunity is around the corner...We're very fortunate that if we needed to acquire something we could write a check for it and not have to borrow money."

Just what to do with piles of money is a subject of some disagreement in tech circles. Traditionally, many companies have returned profits to shareholders through quarterly and annual dividends, but most high-tech companies don't bother.

For these companies, owning the stock is opportunity to sell it when it gets more valuable. Among the big names in tech who don't pay dividends are Dell, Cisco, Google, Yahoo, EMC, and Adobe Systems.

"For now, we believe that the share repurchase program, combined with ongoing strategic investments in our business and maintaining a strong cash balance, are in the best interest of our shareholders," Cisco argues to its shareholders.

But there are some traditionalists in tech. IBM paid $819 million to its shareholders in its most recent quarterly dividend. Hewlett-Packard paid $187 million, Oracle paid $251 million, and Intel $891 million. Expectation of such dividends can increase the desirability and therefore price of a company's stock.

Perhaps most interesting is Microsoft, which paid $1.125 billion in dividends to shareholders last quarter. Investors and "Microsoft millionaires" got wealthy when the company's stock surged in the 1990s, but then it leveled off. Microsoft changed course in 2004 by starting to pay a dividend--and for employee compensation, offering stock instead of stock options that carries value regardless of whether the share price rises.

Apple has transformed itself in recent years, first with iPods, then the iPhone, and now with the iPad. Lots of cash would let Apple considering bolder moves.

Might it want to buy a computer chip designer? AMD, Nvidia, ARM, and Texas Instruments each are within range. Or how about a wireless carrier? Verizon's out of reach, but Sprint Nextel's market cap is $13.3 billion. These moves are improbable, but they do illustrate the power of the war chest Apple has accumulated.

While dividends are the exception rather than the rule in the tech sector, large cash stockpiles are common. For comparison, Microsoft has $36.8 billion in cash and short-term investments. Cisco has $39.1 billion. Google has $24.5 billion.

Keeping more cash on hand can be a different matter for computing companies. While others need cash to fund operations and provide a safety net, they haven't historically had to deal with the breakneck pace of change in the tech sector, where new developments can make one technology obsolete or elevate another to critical importance in a matter of months. Having a lot of cash lets companies enter a new market rapidly through an acquisition, for example.

But $46 billion is enough to acquire an awful lot--any of 439 of the companies in the Fortune 500, factoring in a 20 percent acquisition price premium. That flexibility is nice, but it also worries shareholders evaluating Apple, Sacconaghi said.

"A return of cash to shareholders would mitigate investor fear of a potentially large, value-destroying acquisition and create financial discipline," he said.

Sacconaghi estimates that Apple will generate almost $20 billion more in cash in fiscal 2011; with that, even a $30 billion share buyback and 4 percent dividend would leave $25 billion to $30 billion on the books by the end of fiscal 2011, he calculated, "providing ample financial flexibility."

Buying back $30 billion in stock would reduce shares outstanding by 13 percent, boosting earnings per share accordingly, he said.

Sacconaghi concluded with an exhortation toward better transparency: "Perhaps most importantly, we encourage Apple to engage in an ongoing dialogue and be more transparent with shareholders about cash usage. As board members, you are legal stewards of shareholders' interests, and our conversations with shareholders suggest that they have not been fully heard on this issue."

The full text of the letter is as follows:

Dear Apple Board,

Over the last five years, Apple has done an extraordinary job in (1) creating breakthrough products such as the iPhone and iPad; (2) innovating on its existing product line; and (3) fostering a loyal and growing customer-base. Most importantly for shareholders, these actions have translated into earnings growing a stunning 10-fold, resulting in Apple's shares appreciating 487 percent over the last five years (2nd highest among all S&P 500 companies), while total returns on the broader market were -1 percent (see Exhibit 1). Moreover, the company has exercised exemplary fiscal discipline throughout this growth phase--both in controlling expenses (see Exhibit 2) and avoiding costly acquisitions; for all of these outcomes its shareholders are doubtlessly grateful.

However, in our conversations with shareholders, one common source of frustration--which is now bordering on exasperation--has been Apple's burgeoning cash balance and the company's unwillingness to return it to shareholders or discuss its vision for how the company plans to use it. Apple's cash balance is of mythic proportions--higher than the total market cap of all but 49 of the S&P 500 companies (see Exhibit 3), the highest among all US listed companies (see Exhibit 4) and growing--FCF has been $14.3B over the last 4 quarters and we expect the company to generate nearly $20 billion in FY 11. We implore you to consider returning cash to your shareholders, along with a longer-term road map for how you plan to use your cash balance and why.

A return of cash to investors makes sense for several reasons:

• Current cash levels are excessive relative to what Apple requires to run its operations. We estimate that--at most--pple requires $10B in cash on hand to run its ongoing operations. Given its negative cash conversion cycle and strong cash flow, it may require much less, but we do appreciate the fact that the company had outstanding off-balance sheet third-party manufacturing commitments and component purchase commitments of $6.2B at the end of FQ3 10 which its cash balance may help guarantee/fund; however, even if we assume that Apple does need $10B to operate the company, that still leaves $36B of excess cash.

• Prevailing returns on cash are very low, destroying shareholder value. Apple earned 0.76 percent interest on its cash reserves vs. an implied expected return of ~11 percent on the stock--this large negative spread on cash indicates that holding onto excess cash is eroding shareholder value. Moreover, several academic studies point to a high correlation between return of cash and long term shareholder returns.

• A return of cash would create financial discipline and alleviate investor concerns about a potentially imprudent acquisition. Apple's burgeoning cash balance creates the perception that the company may spend it on large acquisition(s) that shareholders believe might be value-destroying longer-term. While we acknowledge that Apple has been disciplined in this regard, with a history of making relatively small acquisitions for talent and technology only, this investor concern is longer-term and based on what has historically transpired at other companies. A return of cash and/or a transparent policy around use of cash would help alleviate this investor concern and ensure financial discipline on current and future management teams at the company.

• A return of cash to shareholders could attract a new class of investors. While Apple is widely owned today, there are investment managers with mandates that they invest only in dividend-paying stocks. Additionally, some investors are ideologically opposed to investing in companies that lack a clear policy on cash usage. Furthermore, several investors have told us that they discount Apple's large cash balance when valuing the company given that return of cash is neither imminent nor certain.

• Dividends or share repurchases could potentially lead to multiple expansion and/or higher EPS. Given that 20 percent of Apple's market cap is currently invested in cash at low interest rates, it is harmful to shareholder returns. Return of a portion of this cash along with the articulation of a clear cash-usage policy would likely lead to a multiple expansion as shareholders' expectations of having a claim on the excess cash becomes more clear. Moreover, if Apple chose to use some of its cash to buy back stock it would translate into higher earnings per share (EPS).

Three broad options exist for a return of cash: (1) a one time dividend; (2) ongoing dividends, and (3) share repurchases. We believe that investors' bias--even in the face of changing tax laws--is for Apple to institute a regular dividend coupled with buybacks, but we would encourage Apple to engage and poll its investor base and potential shareholders to more systematically gauge sentiment. The majority view among shareholders we have spoken with is that a one-time dividend would be least desirable.

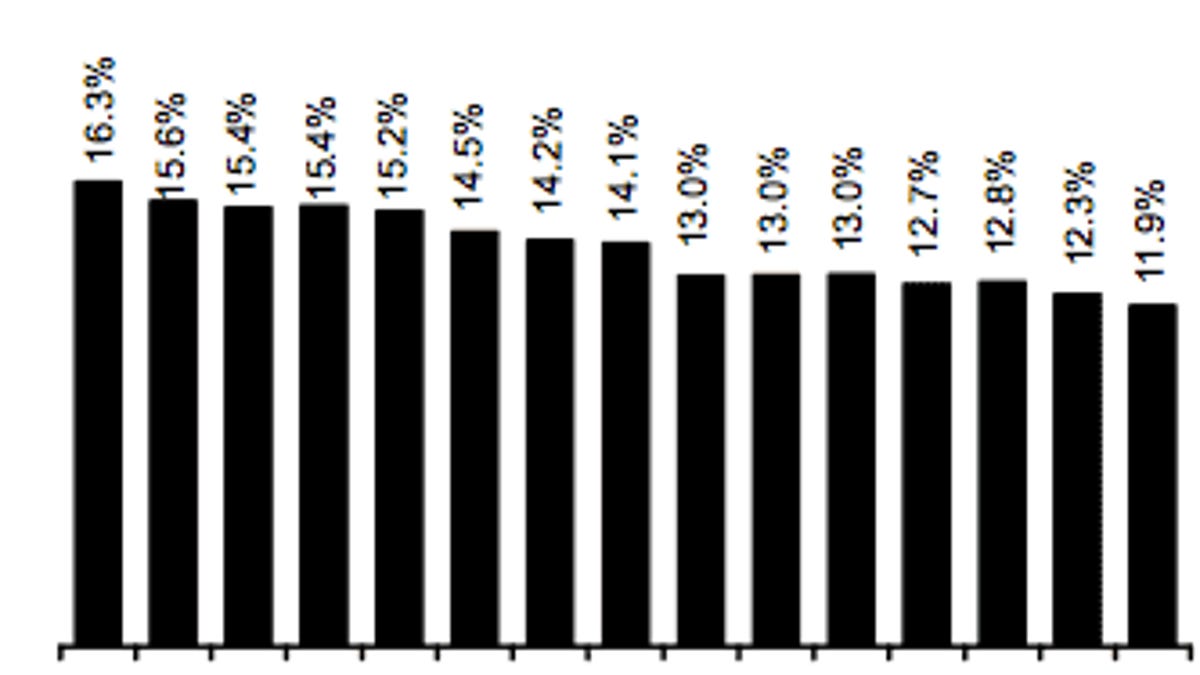

Our analysis indicates that a 4 percent dividend would have consumed about 65 percent of Apple's trailing four-quarter free cash flow, leaving $4.5+ billion in excess cash for corporate needs, acquisitions and share repurchases. Even if Apple's earnings multiple expanded by 50 percent, a 4 percent dividend would amount to an estimated 71 percent of cash generated in FY 11, leaving $5+ billion in excess cash, above and beyond your existing cash balance of $46 billion. We note that a 4 percent dividend yield would not be unprecedented among technology companies; we think Apple should be a leader in returning cash to its shareholders and a 4 percent dividend yield would rank it among the top 10 technology companies (see Exhibit 5). Exhibit 6 provides expected cash flow payout ratios on alternative dividend rates.

A $30 billion share repurchase (65 percent of your current cash balance) would lower Apple's shares outstanding by 13 percent, effectively boosting EPS by a similar amount. Apple could consider ongoing repurchases in the open market, or an accelerated share repurchase (ASR), which has been used recently by other large cap tech companies, including HP and IBM (see Exhibit 7). Exhibit 8 provides a sensitivity analysis of the size of buyback vs. share count reduction, based on Apple's current stock price.

Given Apple's powerful cash generation, arguably both a dividend and share repurchase could be done in parallel. Using our assumptions of a 4 percent annual dividend and $30B immediate buyback, Apple would still retain an estimated $25--$30 billion in cash on its balance sheet at the end of FY11, providing ample financial flexibility.

Perhaps most importantly, we encourage Apple to engage in an ongoing dialogue and be more transparent with shareholders about cash usage. As Board members, you are legal stewards of shareholders' interests, and our conversations with shareholders suggest that they have not been fully heard on this issue.

This story was updated at 12:19 p.m. PDT with additional context.