Verizon's 700MHz spectrum may not be so valuable after all

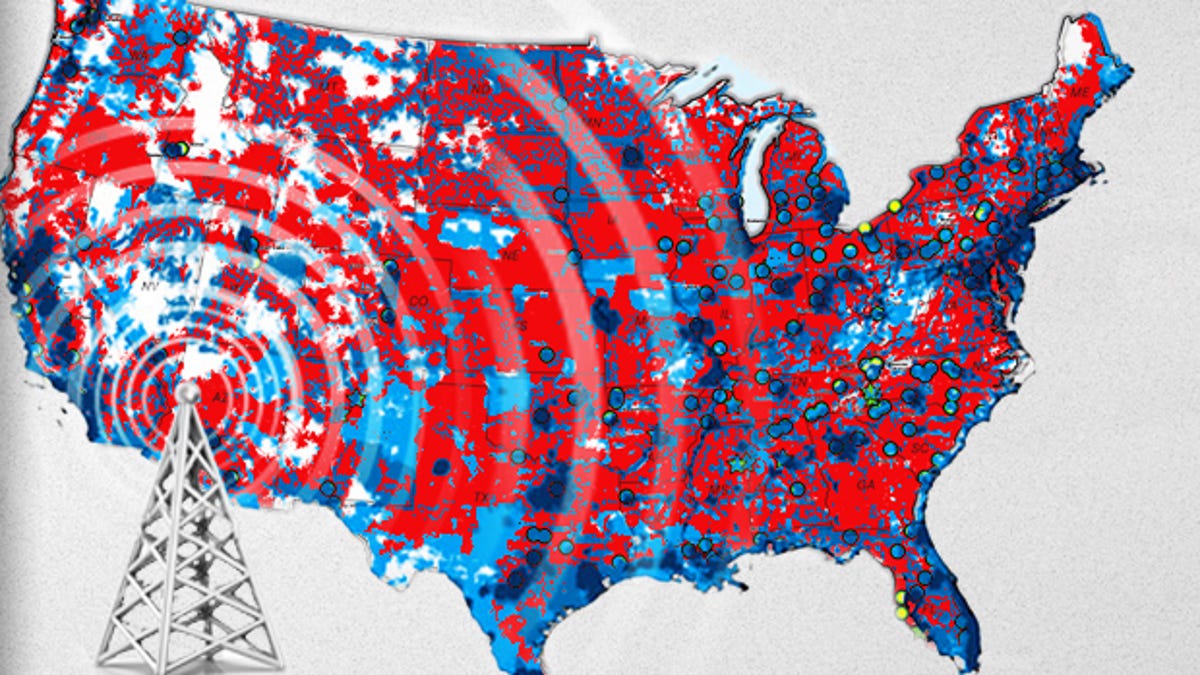

Verizon Wireless says that it plans to sell spectrum in the A and B blocks of the 700MHz frequency band, but how valuable is that spectrum to other carriers rolling out 4G LTE anyway?

Verizon Wireless won't lose much by selling some of its "high-quality" wireless spectrum, but it has much to gain if the Federal Communication Commission approves its controversial deal to buy spectrum from cable operators.

On Tuesday, Verizon said it planned to sell licenses in the A and B blocks of the 700MHz spectrum which it acquired in an FCC auction in 2008. The company said it would put the licenses up for sale, if it could get approval from regulators to buy another chunk of spectrum from a consortium of cable operators, that includes Comcast and Time Warner Cable. Verizon announced its deal with cable operators late last year. The FCC and Department of Justice are evaluating it, but smaller competitors have complained it will harm competition by allowing Verizon to control too much wireless spectrum.

At a time when the wireless industry is crying that it may run out of capacity on mobile networks if more wireless spectrum isn't freed up, Verizon's announcement that it wants to sell off some of its own spectrum was somewhat puzzling at first. Why would Verizon, which has been so diligent about managing its wireless network resources, sell seemingly valuable spectrum now, especially when it's also trying to acquire spectrum from others?

The answer is simple: Not all wireless spectrum is created equal, not even low-frequency spectrum in the 700MHz band. And because this spectrum is of lower quality, the licenses are unlikely to appeal to any of the larger nationwide carriers who need more spectrum to compete with Verizon. What this means for consumers is that Verizon is likely to get bigger and stronger, while players such as T-Mobile, Sprint, and possibly even AT&T will struggle to find more wireless spectrum to keep up with growing data demands on their networks.

700MHz spectrum rules, doesn't it?

It's true that low-frequency spectrum, such as spectrum in the 700MHz band can travel long distances and penetrate walls. In fact, that's why Verizon is using the C block licenses in this same 700MHz frequency band to build its 4G LTE network. But the licenses in the A and B blocks are much different than the license Verizon has for the C block. For one, the A and B block spectrum has different characteristics that makes it incompatible with the C block spectrum. This means that Verizon would have to add another radio chip to its devices to even use this spectrum.

Secondly, because this spectrum was once used for broadcast TV, the licenses in the A block are likely to still interfere with TV channel 51, which will reduce its usefulness for LTE service.

And lastly, the licenses that Verizon owns in the A and B blocks are relatively small and they only cover small metro regions. The C block is a nationwide block of spectrum, which, because it's at low frequency, is much more useful for national coverage. In urban areas where Verizon owns the A and B block licenses, spectrum higher up the frequency scale in the AWS bands is likely to be more useful.

This is where the spectrum that Verizon hopes to get from the cable companies comes in. Because it is at a higher frequency in the AWS band, this spectrum is ideal for adding capacity in densely populated areas once Verizon fills up its current 700MHz network. Verizon already plans to use AWS spectrum it acquired previously to augment its 700MHz LTE network. And the additional 20MHz of AWS spectrum it gets from the cable companies will be added to its coffers for future growth.

But Verizon's smaller competitors, such as T-Mobile, complain that Verizon already owns a significant amount of wireless spectrum. And it fears that allowing the company to "accumulate even more spectrum on top of an already dominant position," will allow the company to "checkmate crucial avenues for growth of its smaller competitors." T-Mobile has asked the FCC to block the spectrum transfer.

On the company's quarterly conference call today, Verizon Chief Financial Officer Fran Shammo defended Verizon's spectrum policy, and its plan to sell off the A and B block of 700MHz spectrum if it's able to acquire the cable spectrum.

"Verizon Wireless has shown over time that we have been good stewards of spectrum," he said. "As a company policy we would not hoard spectrum."

Shammo explained that Verizon is simply trying to buy spectrum from cable operators that fits more appropriately with its plans for 4G LTE growth. And he said that the company is not trying to curry favor with the FCC by offering to sell some of its 700MHz spectrum licenses in exchange for getting the cable deal completed.

"We didn't decide to wake up one day and sell it because we ran into a roadblock at the FCC," he said.

Who will want Verizon's 700MHz spectrum?

Still, a closer look at the spectrum Verizon is proposing to sell reveals that the A and B block spectrum isn't likely to be of much use to many other carriers either.

Kevin Smithen, an analyst at Macquarie Capital, said in a research note that due to potential interference issues in the neighboring broadcast TV channel 51, the A block in the 700MHz band will likely only receive "minimal interest from bidders with immediate LTE spectrum needs."

And he said that other national wireless carriers are also likely to be turned off by the smaller blocks and lack of national coverage for the licenses in both the A block and the B block. For example, AT&T, which has already bought some 700MHz spectrum from Qualcomm in these blocks, could be a potential fit for these licenses. But Smithen thinks the channel size offered for the licenses is too small for AT&T, and it's more likely that they'd appeal to a smaller regional player, such as Leap Wireless.

"While 700 MHz spectrum is better suited for LTE than other bands, a 5 MHz x 5 MHz configuration or limited pop coverage on both the A and especially the B bands is not a viable LTE solution for AT&T or Verizon," he said. "We believe that a nationwide 10 MHz x 10 MHz configuration at a higher band is a more likely solution for a national carrier."

As for T-Mobile and Sprint, these operators are not using any 700MHz for their LTE deployments. So it's also unlikely that they would be interested in Verizon's spectrum.

The FCC has said that it will make its decision on whether to allow Verizon to buy the cable companies' spectrum by the middle of July. If it's approved, Verizon will start the process to sell its 700MHz spectrum. Transfer of those licenses will also have to be approved by regulators.

Verizon's Shammo said the company wouldn't offer "a fire sale" on the spectrum. And if Verizon can't get an appropriate value for the spectrum, he said the company won't sell it.

As for consumers, the growing consolidation of wireless spectrum in the hands of one or two dominant operators could mean less choice in the future as other providers are driven out of business. And it could lead to higher service prices. Verizon is already in a much stronger spectrum and network position than its competitors, and the company is one of the most expensive carriers around. As its dominance grows, will prices continue to climb? That's something that regulators are evaluating.