Best Buy feels Amazon squeeze, to close 50 big-box stores

The retailer's fiscal fourth-quarter sales fall well below expectations. Is Best Buy becoming a showroom for online retailers like Amazon?

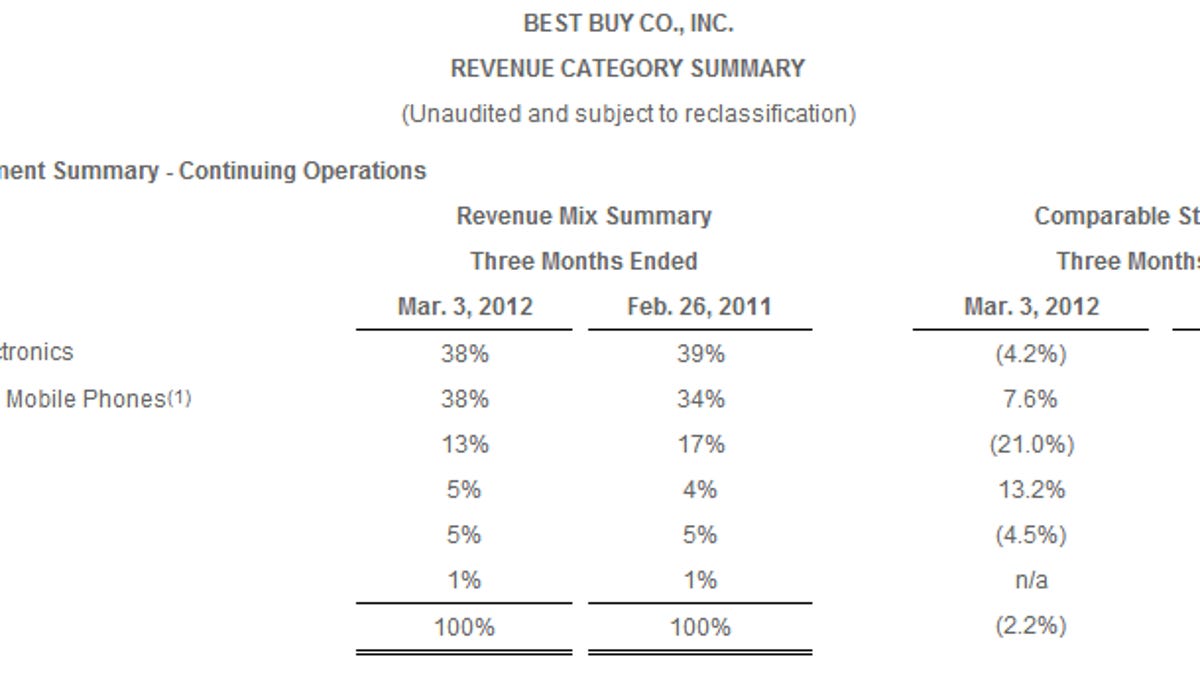

Excluding those charges, Best Buy reported a non-GAAP profit of $2.47 a share. Wall Street was expecting earnings of $2.16 a share on revenue of $17.23 billion for the quarter that ended March 3. As for the fiscal 2013 outlook, Best Buy projected earnings of $2.85 a share to $3.25 a share. Non-GAAP earnings will be $3.50 to $3.80 a share. Wall Street was looking for $3.69.

Best Buy's problem: Amazon. Best Buy has been trying to grow its e-commerce business to compete better, but the big-box approach to selling consumer electronics isn't what it used to be. That reality has Best Buy thinking small.

The company outlined the following moves:

- It will cut $800 million in costs by fiscal 2015.

- Close 50 big-box stores this fiscal year.

- Open 100 Best Buy Mobile and small stores this year.

- Boost online revenue by 15 percent.

- And Best Buy will change its employee compensation model to revolve around customer service and business goals.

Best Buy CEO Brian Dunn said that the company is looking to "provide a better shopping environment for our customers across multiple channels while increasing points of presence."

On a conference call with analysts, Dunn said:

Over the last three years, the industry experienced little innovation and many of the large traditional consumer electronics categories such as television, PCs and gaming. At the same time, consumers have enjoyed greater price transparency and ease of costs shopping. As a result, we knew we had to accelerate our cost reduction efforts, adjust our sales mix and significantly improve on the experience we were delivering for our customers. All of this in the most uncertain consumer and economic environment we've ever experienced.The challenge for Best Buy is simple: It can't be the showroom for electronic sales online. To differentiate, Best Buy will have to focus on service.

To bolster service, Best Buy said it will boost its loyalty programs and provide free shipping and access to "major sales events" and offer no-hassle returns and price matching. Best Buy is even throwing in a free house call from its Geek Squad for its Reward Zone Silver loyalty card members.

Will it work? Perhaps. Analysts going into Best Buy's earnings report noted a few big issues. First, Best Buy's products sales are shifting to Apple products, which have lower profit margins. And then there's Amazon. "The company is gradually becoming a physical showroom for online retailers, and the prevalence of smartphones makes comparison shopping increasingly easy," said Wedbush Securities analyst Michael Pachter.