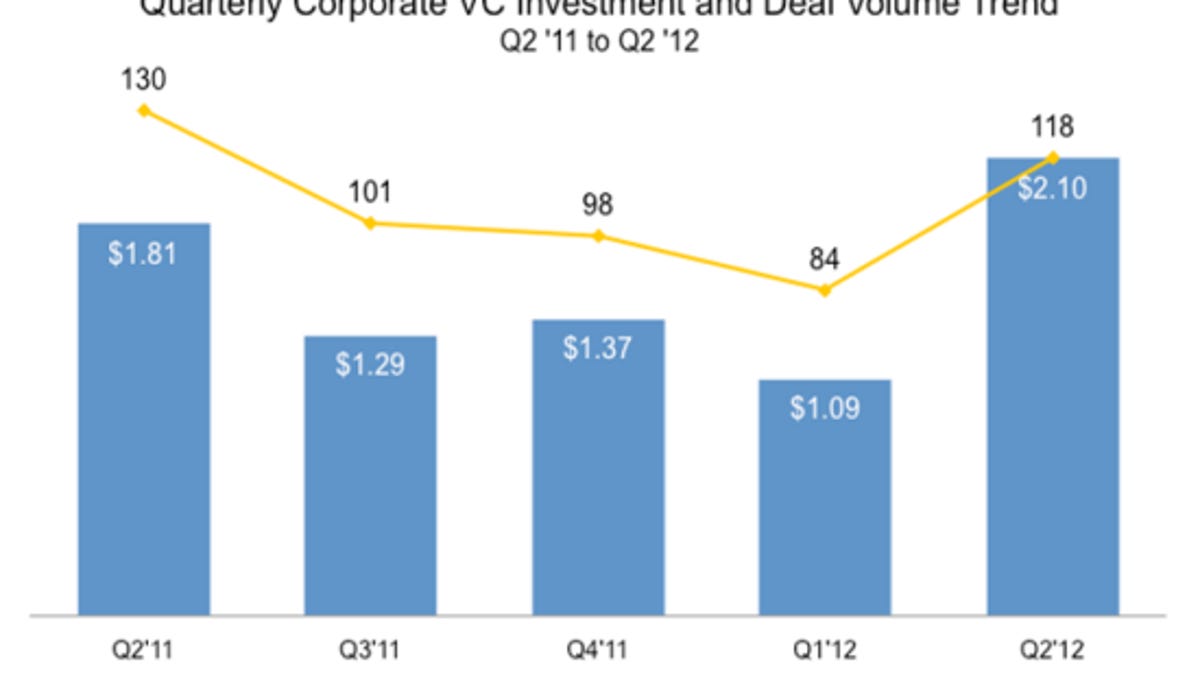

Venture capitalists offer up $2.1 billion in funding in Q2

The average corporate venture-capital funding deal during the period was $17.8 million, easily topping the first quarter's $13 million figure.

Corporate venture-capital funding was on the rise during the second quarter of 2012.

Research firm CB Insights, which provides quarterly data on VC investments, revealed today that a total of $2.1 billion was offered up to startups during the second quarter in just 118 deals. The total invested capital nearly doubled the first quarter's $1.09 billion in investments. During the second quarter of 2011, funding hit $1.81 billion.

So, where is that cash going? According to CB Insights, Facebook's $1 billion acquisition of Instagram prompted corporate venture capitalists to flock to the mobile arena, where investing there hit a five-quarter high of $146.7 million. Within the mobile sector, video, collaboration, and communication technologies proved most popular among venture capitalists.

The Internet sector also attracted venture capitalists; funding in that segment rose 60 percent compared with the first quarter of 2012. A total of 48 deals were hatched during the quarter, amounting to $513 million in funding. During the same period last year, 38 deals were signed for $508 million.

California still appears to be the place to get funding, with three-quarters of all deals coming from a corporate venture capitalist based in that state. New York and Massachusetts, which accounted for 25 percent of all deals during the second quarter of 2011, accounted for just 5 percent this time around.

One other important note from the CB Insights study: the average deal size from corporate venture capitalists came in at $17.8 million, easily topping last year's $13.9 million average deal size.