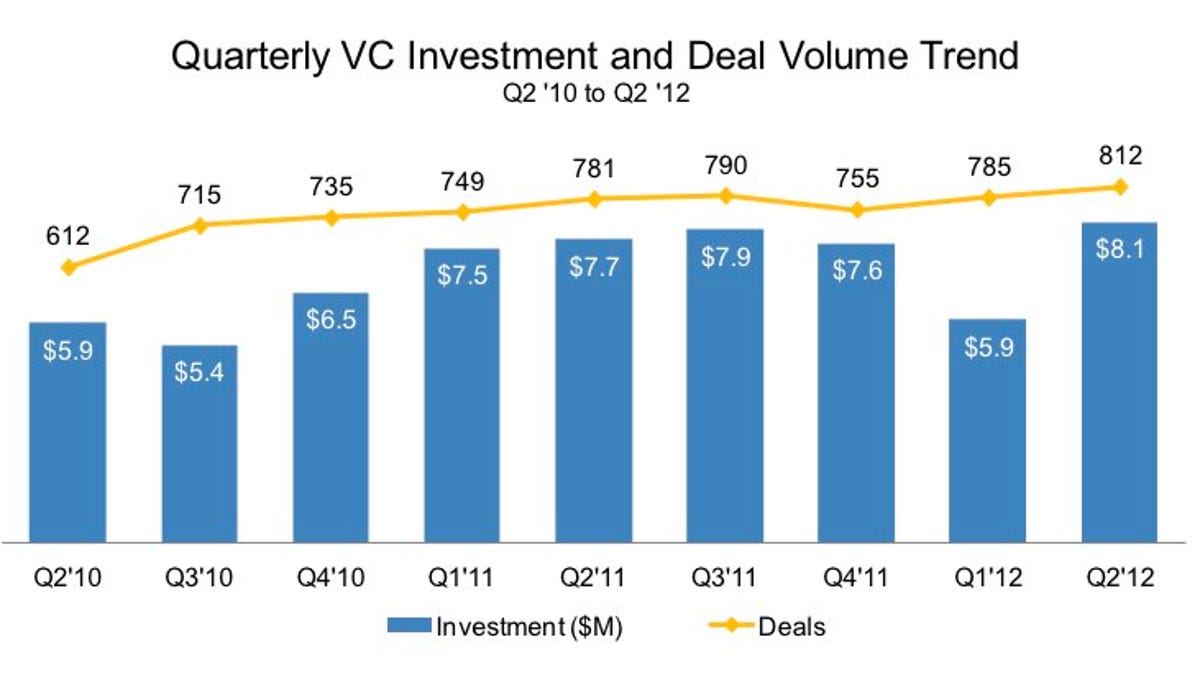

VC funding hits $8.1B, highest point since dot-com days

A new study from CB Insights reveals that 812 companies received funding during the second quarter, representing a 3 percent increase over the prior quarter.

Venture capitalists are ready and willing to spend cash, a new study from research firm CB Insights has found.

During the second quarter, $8.1 billion in cash was doled out to 812 companies, according to CB Insights. The figure is the "highest funding and deal totals since the dot-com days," according to CB Insights. The $8.1 billion represents a 37 percent gain on the first quarter, when VCs handed out $5.9 billion in cash, and a 5 percent gain on the second quarter of 2011's $7.7 billion in spending.

CB Insights believes Facebook's $1 billion acquisition of Instagram might have prompted such high spending. The company says that the mobile sector saw 102 deals -- its highest figure ever. In addition, companies operating in the mobile sector with a photo or video focus nabbed nearly 30 percent of the funding.

On the Web, meanwhile, social services failed to attract the kind of investor attention that they once did, and gave up the lead to education technology, e-commerce, and enterprise technology, according to CB Insights. All told, venture capitalists handed out $3.1 billion in cash across 371 deals to Web companies, making it the biggest investment quarter for that sector since last year.

CB Insights also found that seed funding, which provides cash to early-stage companies, has been on the rise, and accounted for 31 percent of all Internet deals and 34 percent of mobile commitments. All told, over 20 percent of the deals were seed investments.

One other tidbit from the CB Insights study: 45 percent of all VC deals were inked by California-based venture-capital firms. New York came in second place with 10 percent of all deals, followed by Massachusetts with 9 percent.