VC funding continues record pace in third quarter

Just when you thought the economy was completely trashed, we find out that venture investment continues at the highest rate in 10 years.

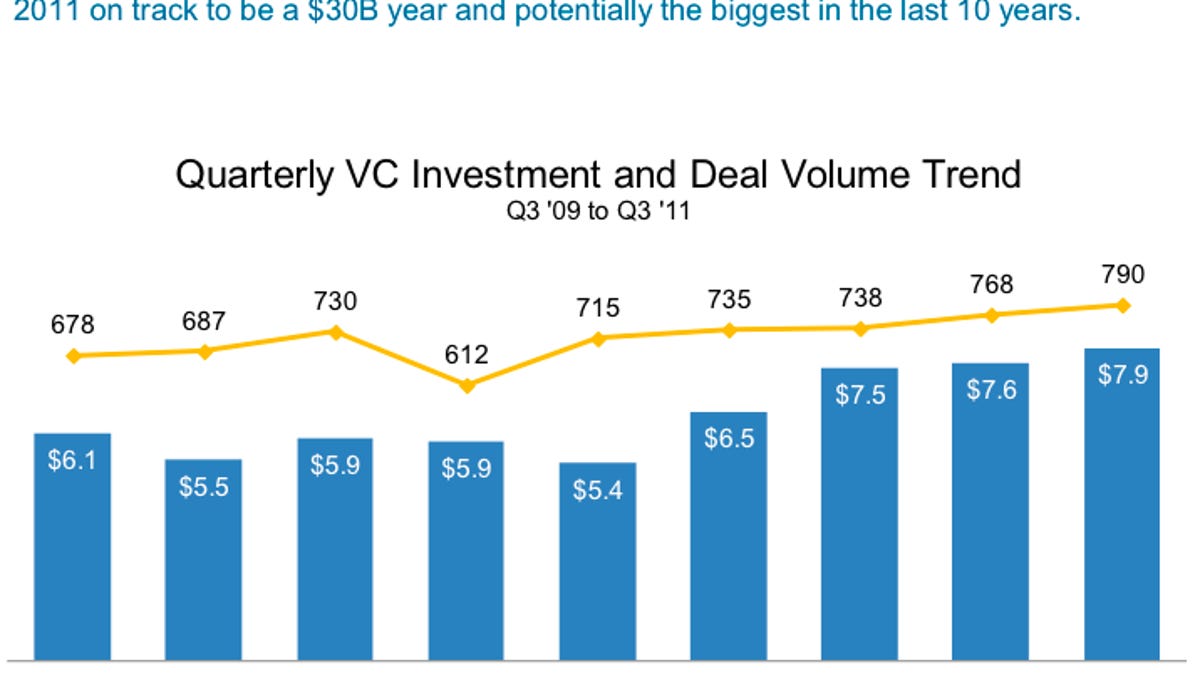

Venture investing for the third quarter of 2011 reached new heights yet again with a record $7.9 billion in funding for 790 companies according to a new report from private company research firm CB Insights.

The report released today shows that, despite market turmoil and economic uncertainty, VCs opened their wallets at a record level in the third quarter. And if this pace continues, we're on track for 2011 to see the highest levels of financing in more than a decade, potentially at $30 billion for the full year.

I discussed the new report with CB Insights CEO and founder Anand Sanwal, who predicts that some venture firms will have a tough time raising capital at some point in the future (no one knows quite when), which could lead to a change at some point--either in the rate of financing or in the number of venture firms.

Sanwal believes that the market has increasingly coalesced into two types of funding. There are the seed deals that give investors an option on future growth. So, if a seed financed company figures out its business model and/or is growing like a weed and thus exhibiting potential, it will get follow-on financing.

Then there are growth-equity types of rounds for companies that have figured out and established a business model and just needs more fuel in the tank to propel its growth. That leaves some number of companies in the middle which may be solid companies but who may be in a bit of "no man's land" when it comes to raising financing.

I agree with Sanwal that the funding environment is changing a bit. Seed stage financings have shown no shortage of slowing down, but mid-series financings, typically B and C rounds have slowed down dramatically--at least in perception if not reality.

Key points from the report:

- California continues to be the largest source of funding and deals with 39 percent, and New York taking second place with 20 percent of the total number of deals

- The Internet sector stayed consistent at 39 percent of the total number of deals for the last three quarters worth nearly $3 billion

- Seed stage investments accounted for 15 percent of the total number of deals

- Mobile deals ticked up to 13 percent of the total number of deals