Silicon Valley rougher to business than Seattle, Austin -- report

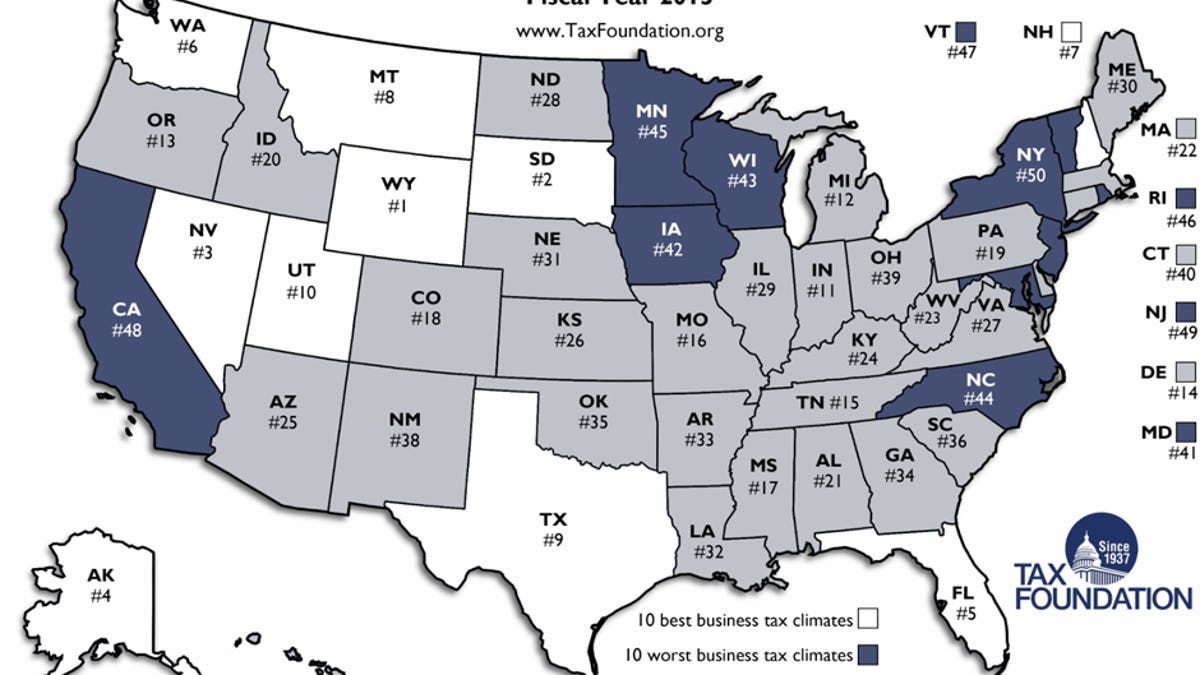

Washington and Texas, home to sizable collections of tech companies, are among the Top 10 states for businesses. California comes in a sad 48th, according to Tax Foundation analysis.

Silicon Valley's economy seems to be recovering more quickly than the rest of the nation's, with employers hiring and venture capitalists offering sunny predictions. There's even a new reality show based here.

It may not last. A new analysis of how business-friendly states are -- released today by the nonpartisan Tax Foundation -- shows that California is way at the bottom. The Golden State ranks a dismal 48 out of 50.

"States do not institute tax policy in a vacuum," said Scott Drenkard and Joseph Henchman, the study's authors. "Every change to a state's tax system makes its business tax climate more or less competitive compared to other states and makes the state more or less attractive to business."

Translation: If California remains relatively hostile to new businesses -- at least compared with friendlier states like Washington, Texas, Florida, and Nevada -- the next generation of tech companies may be located somewhere else.

There are signs it's already happening. Intel CEO Paul Otellini warned last week that California's future is bleak. "We're so close to screwing it up, it's pathetic...I worry that we have to hit the abyss before we can fix things, and I worry that the abyss will be more like Greece," Otellini said at the Intel Capital Global Summit, according to The Wall Street Journal.

T.J. Rodgers, chief executive of Cypress Semiconductor, added: "California is one of the most hostile places to do business on the face of the earth." (See CNET's 2008 interview with Rodgers.)

Intel built a new $3 billion chip manufacturing plant in Arizona, not California, because of lower tax rates. Last year, the company said it was going to invest another $5 billion there.

It's true that tax rates are only one factor business leaders weigh in deciding where to place offices, factories, or corporate headquarters (or, in the case of startups, where the founders choose to live). Climate, real estate prices, availability of workers, and so on are important too.

But over time, a business-hostile tax system can have a dramatic effect. A report released last month by the Manhattan Institute notes that the no-longer-Golden-State has lost 3.4 million residents to out-migration and has lost more people than have immigrated from other portions of the country.

"Most of the destination states favored by Californians have lower taxes," the study concludes. "States that have gained the most at California's expense are rated as having better business climates. The data suggest that many cost drivers -- taxes, regulations, the high price of housing and commercial real estate, costly electricity, union power, and high labor costs -- are prompting businesses to locate outside California, thus helping to drive the exodus."

Facebook founder Mark Zuckerberg said last year that if he had it all to do over, he would have stayed in Boston.

States in the Tax Foundation's Top 10 ranking include Washington, Texas, New Hampshire, Utah, Wyoming, and Florida. In the bottom 10: New York, New Jersey, California, Vermont, Minnesota, Maryland, Wisconsin, and Rhode Island. It calculates the rankings based primarily on the details of states' individual income taxes, sales taxes, corporate taxes, and property taxes. (California has a top individual income tax rate of 10.3 percent.)

The Tax Foundation is an independent nonprofit group that's not affiliated with a political party. It recommends simple, neutral, stable taxes and discourages deals made with specific companies -- saying that strategy rarely works well, such as when North Carolina lured Dell with $240 million of tax incentives, but the company closed the plant four years later.