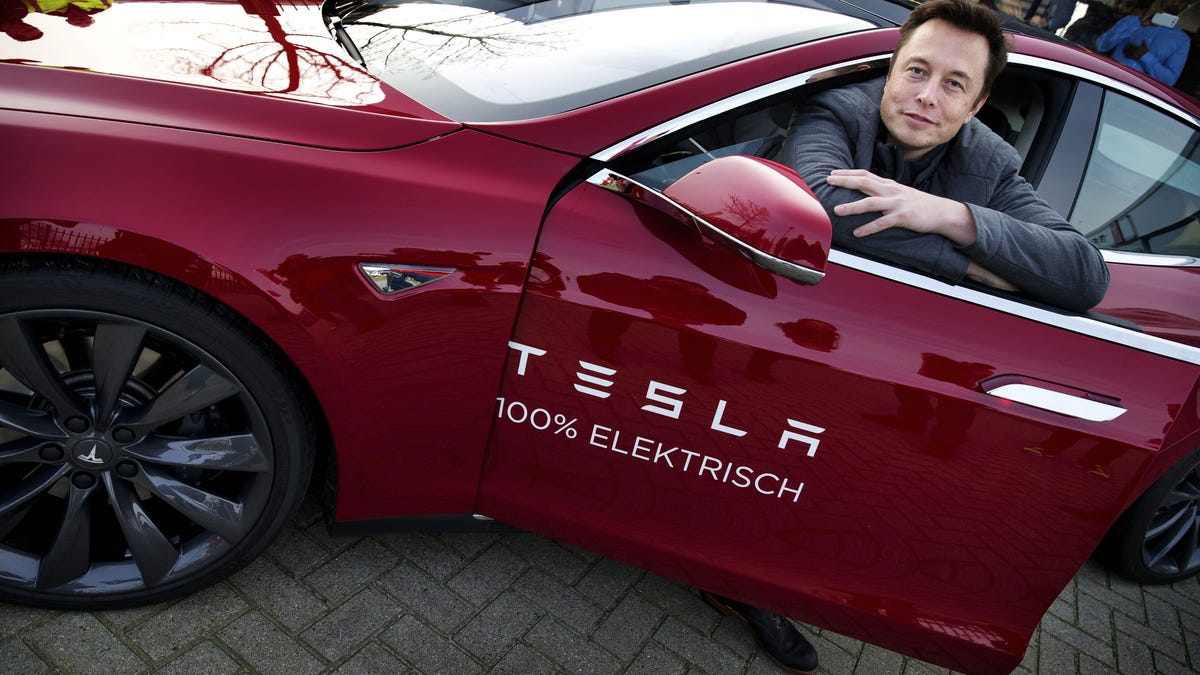

Second-guessing Elon Musk is turning into an expensive lesson

At this point in his career, Tesla's CEO must be weary of the naysayers. Perhaps Tesla's bang-up fourth quarter will finally change some critics' minds -- nah.

In the meantime, CEO Elon Musk continues to make his second-guessers learn an expensive lesson.

For months, the financial news channels have put on the air self-styled experts warning that Tesla was a house of cards -- no Netflix pun intended -- fated to collapse.

Even though Tesla's stock price quadrupled in 2013, shares pulled back on worries about the potential flammability of the Model S' batteries. Separately, Tesla announced a recall of charging equipment for a software update for roughly 29,000 charging adapters for its 2013 Model S electric cars-- the famously combative Musk taking issue with the media description, contending that the company was carrying out a "remedy" as opposed to a recall.In retrospect, those episodes will be recalled as much ado about nothing. Tesla's fiscal fourth-quarter earnings out Wednesday afternoon put paid to the notion that something's fundamentally wrong with the carmaker's prospects. Consider the following:

- Revenue climbed to $610.9 million from $294.4 million a year ago. After one-time adjustments, Tesla netted $46 million, or 33 cents a share. That beat the average analyst estimate of 21 cents a share.

- Tesla is on track to deliver 35,000 Model S vehicles in 2014, up 55 percent from 2013.

- The company expects operating margins to hit 28 percent by the fourth quarter.

- The initial Chinese deliveries of the Model S will begin this spring. Meanwhile, the Beijing store is the biggest and most active Tesla location in the world.

Tesla remains a technology story -- and a very good one at that. There's no need for hype. But the fact is that Tesla is transforming the transportation market, and none of the other auto companies have yet shown electric car technology that's quite as good. Maybe that was the reason behind the reported meeting last spring between Musk and Apple CEO Tim Cook. Don't believe rumors that this was somehow the prelude to a corporate hook-up between the companies. It's not anything of the sort.

As my colleague Dan Farber correctly noted, Musk is into moon shots, not playing second banana in somebody else's bureaucracy. Maybe Apple technology, such as iOS, Siri, or Maps, winds up getting integrated into Tesla's vehicles -- or perhaps even into extraterrestrial vehicles being built by Musk's SpaceX venture.

At this point in his career, Musk must be weary dealing with critics who refuse to buy into his vision. But they refuse to cave. For instance, CNBC recently reported that someone it described as a "major options player" is betting that Tesla stock will crater to $50 a share by next January. Meanwhile, short interest in Tesla is hovering around its 12-month high. Sooner or later, one side or the other will have to blink. Given his track record, you either possess the oracular powers of Kreskin or are simply on the wrong side of a wager to believe Musk is going to trip up anytime soon.