Samsung makes a lot of money from chips, but phones struggle

Despite reporting record profits, Samsung says it's seeing the effects of a "sluggish" smartphone market. Which could mean more promotions for the Galaxy S9.

The smartphone slowdown is real.

Samsung's first-quarter revenue and profits soared, but it warned of tougher times ahead in the mobile market -- including a slowdown in demand for its newest phones, the Galaxy S9 and S9 Plus.

The South Korean electronics giant on Wednesday reported a 20 percent jump in revenue and a 58 percent rise in operating profits as it benefited from strong demand for its memory chips, which are used in everything from phones to servers. Samsung also got a boost from its flagship smartphones, which hit the market in mid-March.

But Samsung warned that second-quarter profits in its mobile business should decline sequentially "due to stagnant sales of flagship models amid weak demand and an increase in marketing expenses." It warned that its display business -- which counts Apple among its customers -- will struggle, at least in the June quarter. And it said while memory chip demand has been strong in servers, flash memory sales are being hurt by a smartphone slowdown.

While the memory business should remain strong in the second quarter, Samsung warned that "generating overall earnings growth across the company will be a challenge due to weakness in the display panel segment and a decline in profitability in the mobile business amid rising competition in the high-end segment."

To boost Galaxy S9 and S9 Plus sales, Samsung plans to expand its "experiential stores," work closer with partners and continue promotional programs such as trade-ins. That could mean a lot of upcoming discounts on Samsung's flashy new devices. The company also said it will launch a new flagship model -- presumably the Note 9 -- in the second half of the year and will keep investing in its Bixby voice assistant "to provide a seamless multi-device experience for consumers."

The smartphone market has been slowing down in recent quarters. It's become harder for handset vendors to make huge changes in their devices and differentiate from one another. Prices for the latest and greatest phones have actually increased at the same time US carriers have gotten rid of subsidies. All of that's meant people are waiting longer to upgrade. Smartphone sales fell for the first time ever in the fourth quarter, according to market researcher Gartner.

Samsung and its main rival, Apple, haven't been immune. Apple, which reports its quarterly results next week, is expected to report weak demand for the iPhone X. That's also impacting Samsung, which supplies the smartphone's OLED displays.

But Samsung, which introduced its Galaxy S9 and S9 Plus earlier than normal to get a sales boost, may not feel the impact of a mobile slowdown as much as Apple. Apple generates about two-thirds of its revenue from the iPhone, and it's believed the bulk of its profit also comes from the smartphone. Samsung's mobile and components business both comprise nearly half of its sales, but the majority of its profit -- in the case of the first quarter, about 75 percent -- comes from its chip business.

"The reality is that the diversified Samsung conglomerate has massively reduced its dependency to smartphones -- contrary to Apple," Forrester analyst Frank Gillett said. "The main business driver is the component business with memory chips -- and new opportunities related to software, connected devices and AI/IOT platforms."

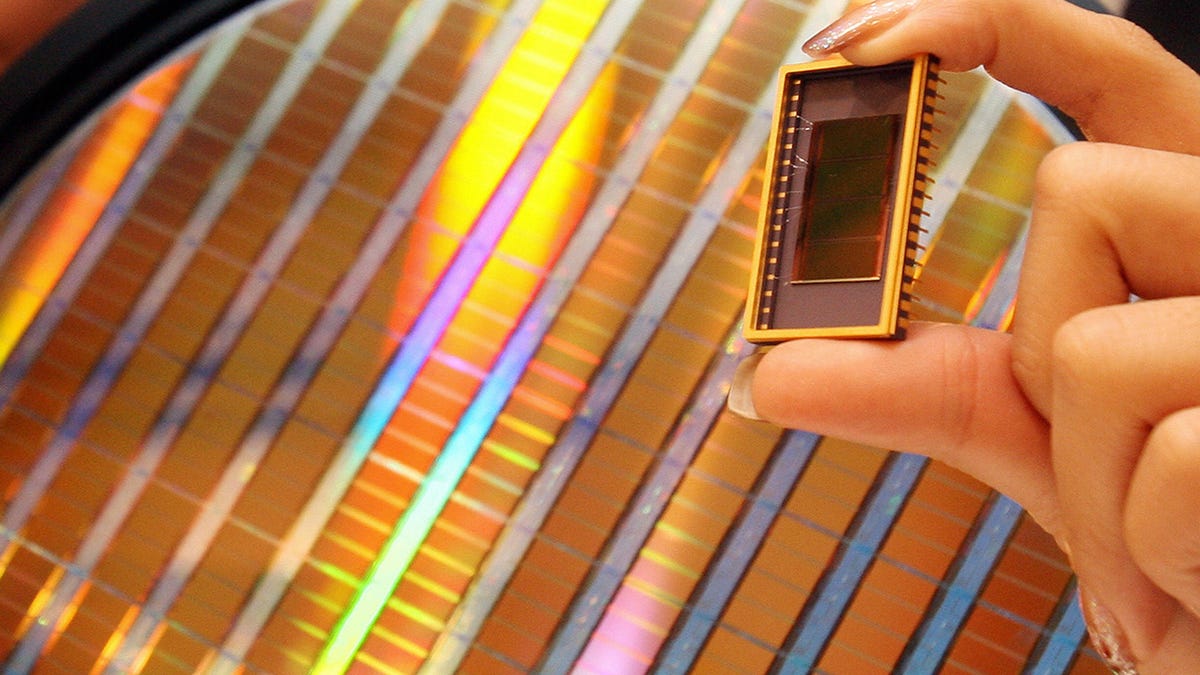

Chip boost

Samsung is best known as the world's biggest phone and TV maker, but it also sells more memory chips than any other company on the planet. That has boosted Samsung's results even as the TV market stagnates and the mobile market matures. Last year, Samsung became the world's biggest semiconductor maker in terms of revenue, beating out the long-term leader Intel.

This quarter, Samsung's memory business revenue soared 43 percent to 17.3 trillion won ($16 billion). Its overall semiconductor business sales jumped 33 percent to 20.8 trillion won.

Samsung said the operations benefited from strong demand for memory chips in servers and graphics products. Its overall semiconductor business got a boost from strong demand for semiconductors used in smartphones and crypto-currency mining.

Along with flash memory and DRAM, Samsung builds processors that act as the brains of devices, and it manufactures displays and various other components. It not only uses components it builds in its own devices but also sells them to customers like Apple.

It's Apple that had some analysts worried ahead of Samsung's results. The iPhone X uses OLED displays from Samsung, and many market watchers believe Apple hasn't sold as many units as hoped.

Samsung on Wednesday said profits in its display business were hurt by slow demand for flexible OLED panels and higher competition between rigid OLED and more traditional LCD displays. (Flexible OLED displays let smartphone makers curve the screens of their devices, such as the Galaxy S9). It warned demand should remain weak for OLED in the second quarter.

The OLED business should rebound in the second half of the year, though, Samsung said. That's likely because of expected new iPhones from Apple that will use the technology.

Mobile slowdown

Samsung's newest phones, the Galaxy S9 and S9 Plus, included relatively minor tweaks from their predecessors, but they helped drive a big jump in the company's mobile business in the first quarter. Sales climbed 23 percent from the same period a year ago to 22.5 trillion won ($20.8 billion).

"The early launch of the Galaxy S9 and solid sales of the Galaxy S8 smartphones resulted in considerable growth in earnings," Samsung said.

But the similarity of Galaxy S9 and S9 Plus to their year-old predecessors could be hurting demand for the newer devices. Research firm Canalys estimated Samsung shipped just over 8 million Galaxy S9 and S9 Plus units in the first four weeks after launch, about level with last year's Galaxy S8 sales but falling short of 2016's Galaxy S7.

"The novelty of premium smartphones is wearing off," Canalys analyst TuanAnh Nguyen said.

Overall, Samsung reported revenue of 60.6 trillion won ($50.6 billion) and an operating profit of 15.6 trillion won ($14.4 billion). Earlier this month, the company said it expected its sales to jump to 60 trillion won ($55 billion). It also said its operating profit likely soared 58 percent to 15.6 trillion won ($14.7 billion).

Cambridge Analytica: Everything you need to know about Facebook's data mining scandal.

Tech Enabled: CNET chronicles tech's role in providing new kinds of accessibility.