RIAA's sales numbers: A closer look

The music industry is betting big on cloud music and subscription services, but sales figures indicate that consumers will be a tough sell.

Cloud-music services have received a lot of attention over the past year and are supposed to represent the next phase in music retail. But looking at music sales from the past five years, it may be hard to understand why.

Supporters have said that cloud music services will generate a big chunk of revenue through subscription fees. The problem is that subscription-music services have been a problem for a while and the public still hasn't shown any indication that it's willing to pay to store and access music.

Last week, Nielsen SoundScan reported that overall music sales rose 1 percent during the first half of the year, the first time that's happened since 2004. Yesterday, I took at look at what might be driving the increase and to help illustrate the story, I acquired sales statistics from the Recording Industry Association of America.

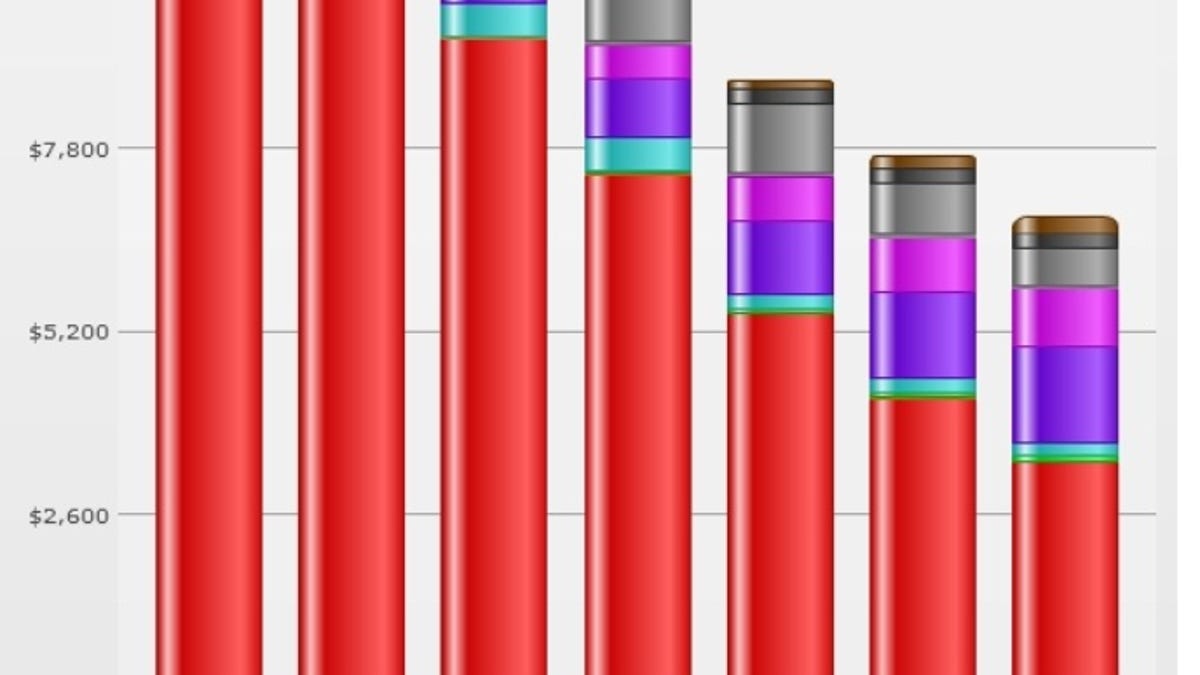

Look at the graphic above and notice the subscription area (dark gray color) that begins to appear in 2005. That year, total revenues from subscription came to $149 million. Sales grew to $234 million but started to fall in 2007.

In 2008, subscription revenues dipped to $221 million and last year came in at $200 million. That represents a 14 percent decline since the high in 2007.

Though the companies that accounted for the revenue weren't named, presumably some of the money came from well-known subscription services such as Rhapsody, the now defunct Yahoo Music Unlimited (shut down subscription in 2008), and the revamped Napster.

Critics have argued that enabling people to store songs on a company's server and access their music libraries from any device that connects to the Web is little more than a value-added proposition, a convenience that won't entice consumers to dig deeper into their wallets. Supporters, however, predict that consumers' embrace of smart phones provides a real opportunity for growth in subscription.

Smartphone are used as much for consuming media as they are for making calls, but they don't have the ability to store all the apps, music, movies, and other content that consumers own. The cloud is the natural always-on reserve, say supporters.

Another interesting area is the rise and fall of the "mobile category." This does not include sales from mobile devices (those are accounted for in the digital album and single categories just like sales done via a PC). The mobile area was created to account for ringtones, ringbacks, and the like. The category was worth $421 million in 2005 and more than $1 billion in 2007 but was down to $526 million last year.

Related links

• Could an iTunes subscription service save the record biz?

• Nielsen SoundScan: Album sales inching up

• Subscription music's future, Part 1

Web and satellite radio services, such as Pandora, Slacker, Live365, and XM Sirius are part of the group that contributes to digital performance royalties. That's the copper-colored area that was nothing but a tiny sliver in 2005 ($20.4 million) and is now generating $249 million. Not huge, but the growth has been steady.

Another interesting revelation the chart offers is how much the music business is diversified. No doubt, the industry has shrunk. But look at yesterday's graphic and the years 1996 to 2003. There's a lot of red there, the color representing CD sales. Last year's line looks a lot more multicolored. Sales of digital albums ($828 million) and singles ($1.3 billion) make up a much larger share of overall revenues and they are growing.

For a long time, techies chided the top labels for sticking to their dying model, but it looks like managers are trying to adapt.